VeChain Price Prediction: VET coils up for 23% upswing

- VeChain price is pulling back to a stable support barrier to find a footing for its next leg.

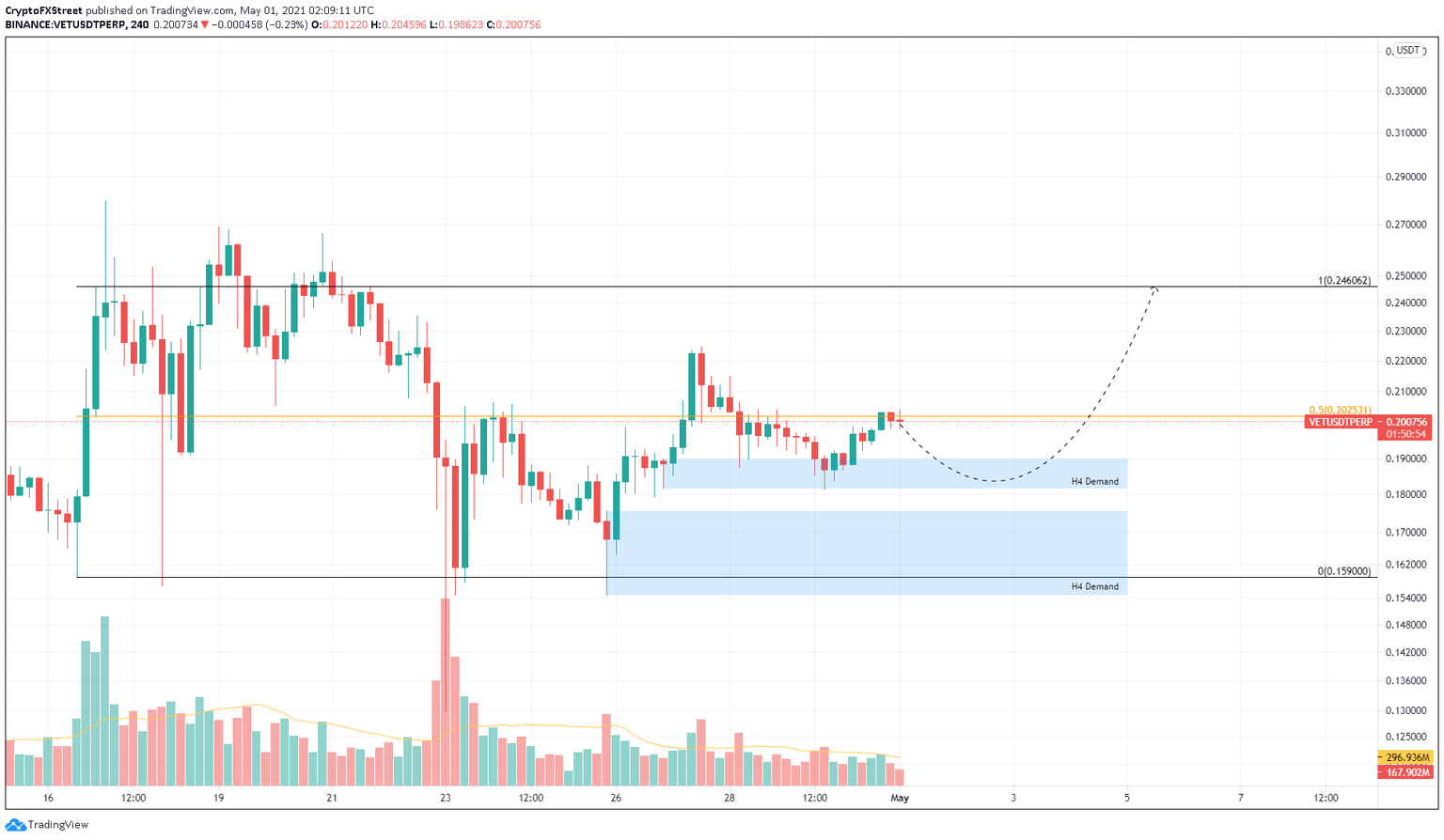

- This move might take VET into the immediate demand barrier that extends from $0.181 to $0.190.

- Although unlikely, a breakdown of the $0.163 support barrier would invalidate the bullish thesis.

VeChain price broke a smaller market structure on its recent ascent. On its upcoming rally, the bulls might push to retest the local top.

VeChain price primed for higher highs

On the 4-hour chart, VeChain price a brief spike above the 50% Fibonacci retracement level in the last leg up. Since this point, VET has dipped lower, creating a higher low. Now, VeChain price could bounce off the immediate demand zone that ranges from $0.181 to $0.190 or simply head higher.

The bulls are aiming to retest the upper boundary at $0.246 in their next rally, which is roughly a 23% climb.

However, this ascent could face resistance around the previous swing high at $0.222. Therefore, VET buyers need to have a substantial volume breakout to have any chances of retesting $0.246.

If the sellers overwhelm the buying pressure, the second demand level’s upper trend line at $0.175 could be tested. Such a move will not kill the optimistic narrative if VeChain price manages to recover quickly.

VET/USDT 4-hour chart

While the bullish scenario seems logical, investors should note that a potential spike in selling pressure or a flash-crash that breaches the $0.163 support barrier would invalidate the upswing thesis.

Under these conditions, VeChain price could slide to $0.159.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.