VeChain Price Forecast: VET prepares for 30% lift-off to record highs

- The VeChain price has been consolidating in a bullish pennant formation, eyeing a 30% bull run.

- A decisive close above $0.094 will signal a breakout and the start of a new uptrend.

- If the sellers push VET below the 61.8% Fibonacci retracement level at $0.087, it will invalidate the bullish outlook.

The VeChain price shows signs of breaking out of the consolidation pattern, hinting that the buyers are eager.

VeChain price on the verge of breakout

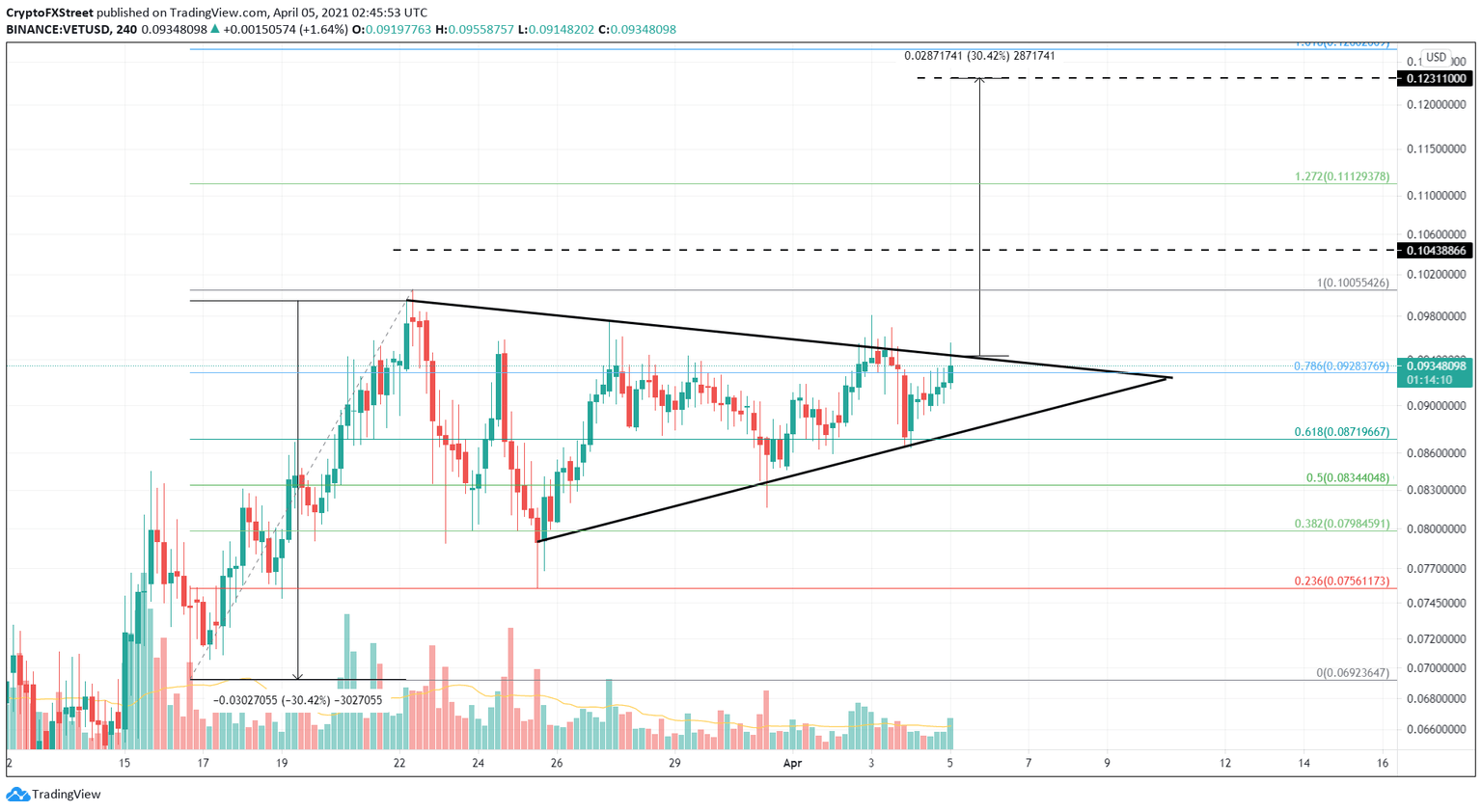

The VeChain price is traversing inside a bullish pennant formation as it slid into a consolidation phase after surging nearly 43% starting from March 16. The initial spike in VET created the flag pole, but the subsequent price action that set up a series of higher lower highs and higher lows resulted in a pennant.

The technical formation projects a 30% upswing to $0.123, determined by adding the flag pole’s height to the breakout point at $0.094.

A decisive close above the said area on the 4-hour chart confirms the start of a new uptrend. A secondary confirmation will arrive after the VeChain price surges through its previous all-time high at $0.10.

Beyond this level, the supply barrier at $0.104 will deter any upward trajectory. So it is essential that VET bulls conquer these levels, which will affirm the buyers’ potential. This move will create a foothold for VeChain buyers and allow them to propel the cryptocurrency toward the intended target at $0.123.

VET/USD 4-hour chart

While a bullish breakout seems like a no-brainer, a spike in selling pressure that pushes the VeChain price below the pennant’s lower trend line could jeopardize the bullish outlook.

A decisive close below the stable demand barrier at $0.087 coinciding with the 61.8% Fibonacci retracement level will invalidate the bullish outlook.

If this were to happen, the Vechain price could drop 5% toward the 50% Fibonacci retracement level at $0.083.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.