VeChain Price Forecast: VET could slide 16% if this critical demand barrier is broken

- VeChain price might initially crash to $0.075 if it fails to produce a decisive close above $0.093.

- If bulls manage to slice through $0.075, it would confirm a bearish outlook and prompt a 16% sell-off toward $0.063.

- However, if VET bulls reclaim $0.093, an 18% upswing seems likely.

The VeChain price could tumble lower if the bulls fail to climb above a crucial supply barrier.

VeChain price at an inflection point

The VeChain price has been on a massive bull run for almost five months, resulting in 20x returns. Now, this run-up could be facing extinction as it approaches a make-or-break point.

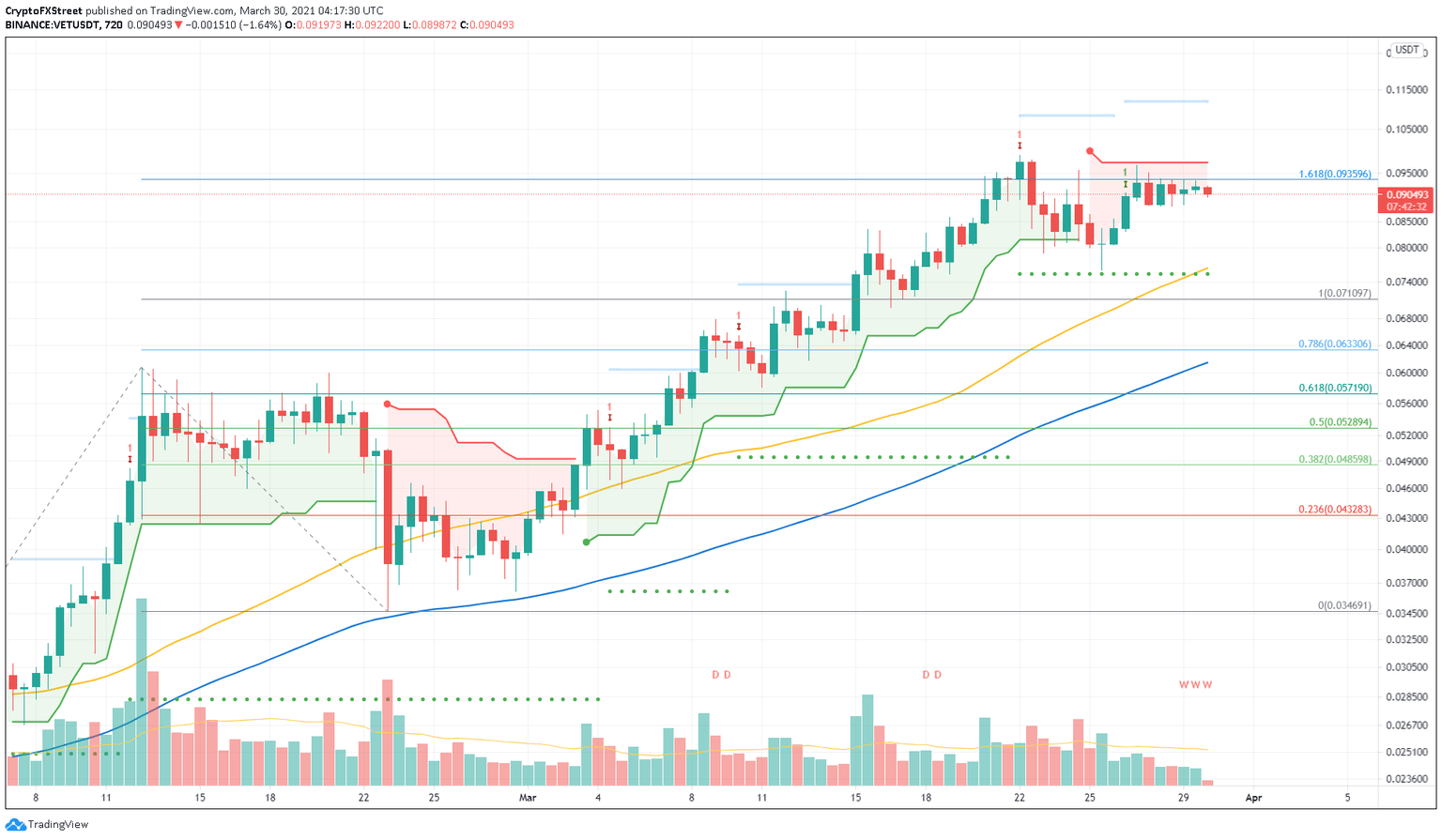

VET has failed to pierce the 161.8% Fibonacci extension level at $0.093 for more than a week. This move reveals excessive profit-booking. A spike in selling pressure here could trigger a 16% sell-off toward the Momentum Reversal Indicator’s (MRI) State Trend Support at $0.075.

Interestingly, this level coincides with the 50 Simple Moving Average (SMA) on the 12-hour chart. Hence, this level is crucial in determining the fate of VET price.

If this demand barrier crumbles due to any reason, it would be fatal for VeChain price. A 16% crash to $0.063 coinciding with the 78.6% Fibonacci retracement level is possible if VET manages to close below $0.075.

Adding credence to this bearish outlook is the SuperTrend indicator’s sell signal that flashed on March 25.

VET/USDT 12-hour chart

A bullish scenario could evolve around two levels, $0.093 and $0.075. If the bulls push the VeChain price to form a decisive close above $0.093, aka the 161.8% Fibonacci extension level, an 18% upswing to $0.11 seems likely.

On the other hand, a bounce from the State Trend Support at $0.075 is also a plausible scenario. In such a case, VET price could see its price climb toward $0.093.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.