VeChain announces $1 million grant as VET price eyes comeback

- VeChain Foundation announced a $1 million grant program for an eNFT ecosystem.

- This grant aims to leverage NFT in a large-scale setup, helping enterprises combat issues like tracking and counterfeiting.

- VET price looks bullish as it approaches a wide area of demand that could help provide stable ground for the next leg up.

VeChain Foundation unveiled a massive grant program to further its real-world adoption and impact. VET price has recently tapped a demand zone and looks ready for blast-off.

eNFT, game-changer in blockchain mass adoption

VeChain Foundation announced on April 28 their allocation of $1 million to developers and projects that can bring value to the enterprise NFT (eNFT) ecosystem and its derivatives.

With DeFi and NFT sectors booming, VeChain believes that this grant will help further the adoption of its native token VET and its recent introduction of the VeThor (VTHO) token.

The blog details,

To build such an ecosystem, we need as many applications and projects as we can get, including NFT marketplaces, token bridges, DeFi applications, open source tools and more. The compounding effect of more tools will exponentially increase the development progress of the eNFT ecosystem.

Additionally, the grant program does not restrict the developers to NFT but allows them to expand to other aspects like DeFi applications, token bridges and cross-chain tools.

VET price primed for higher high

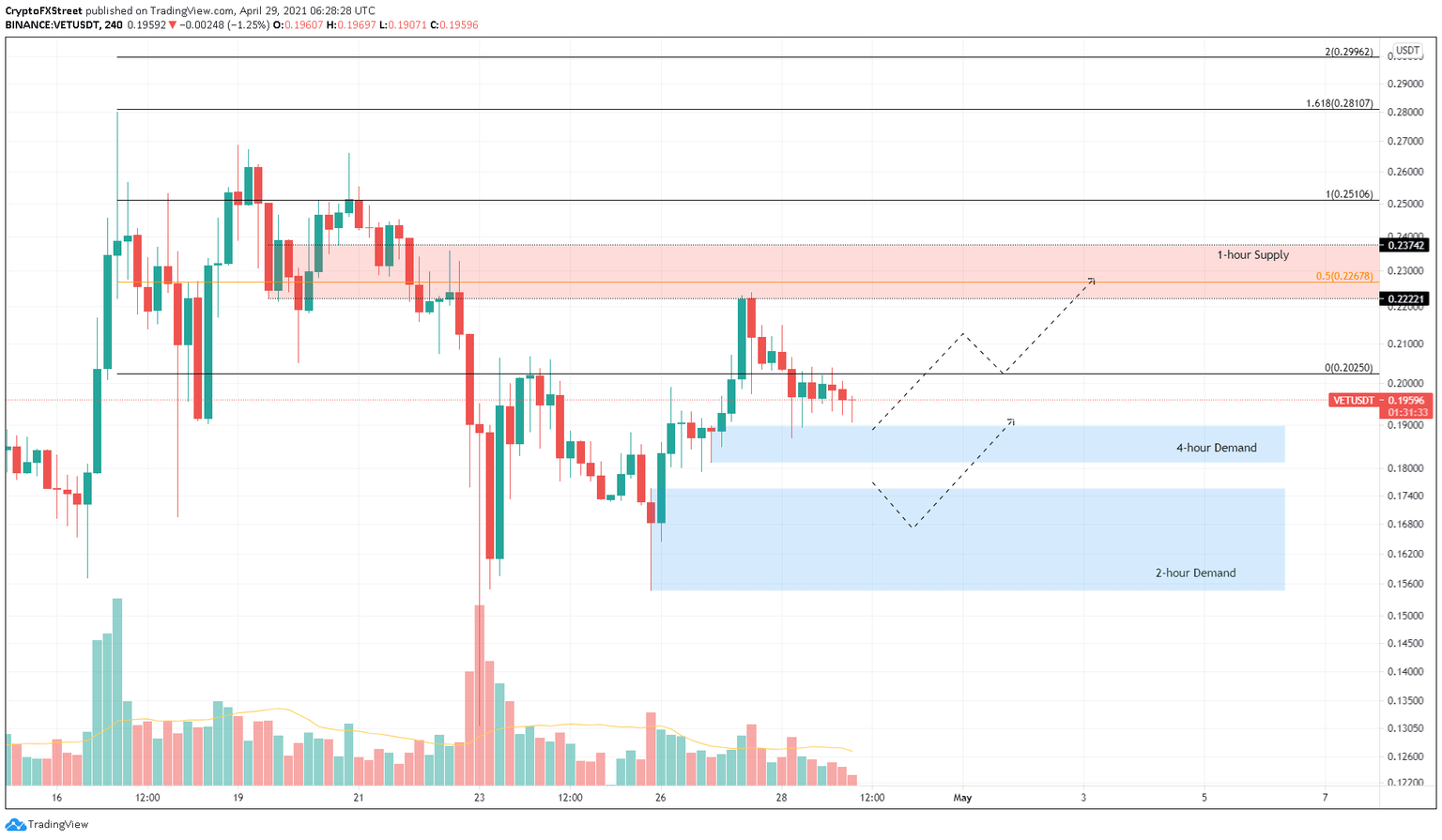

VeChain price has broken the short-term market structure by setting up a higher high on April 27. Since then, VET has retraced nearly 16% to a 4-hour demand zone that extends from $0.190 to $0.198.

Over the past 24 hours, the buyers in the area have prevented VeChain price from sliding lower, indicating a buyer interest. Hence, a bounce from this barrier to the swing top at $0.251 is the path that the bulls might take.

However, the recent swing high at $0.224 might dampen the buying pressure. Thus, it is crucial to breach past the higher high to retest $0.251.

VET/USDT 4-hour chart

While the 4-hour demand zone seems like a viable barrier to bounce from, a potential spike in selling pressure could easily overthrow it. A breakdown of the $0.186 level will invalidate the bullish thesis and kick-start a sell-off toward the 2-hour support area stretching from $0.154 to $0.175.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.