VeChain Price Prediction: VET prepares for 26% advance

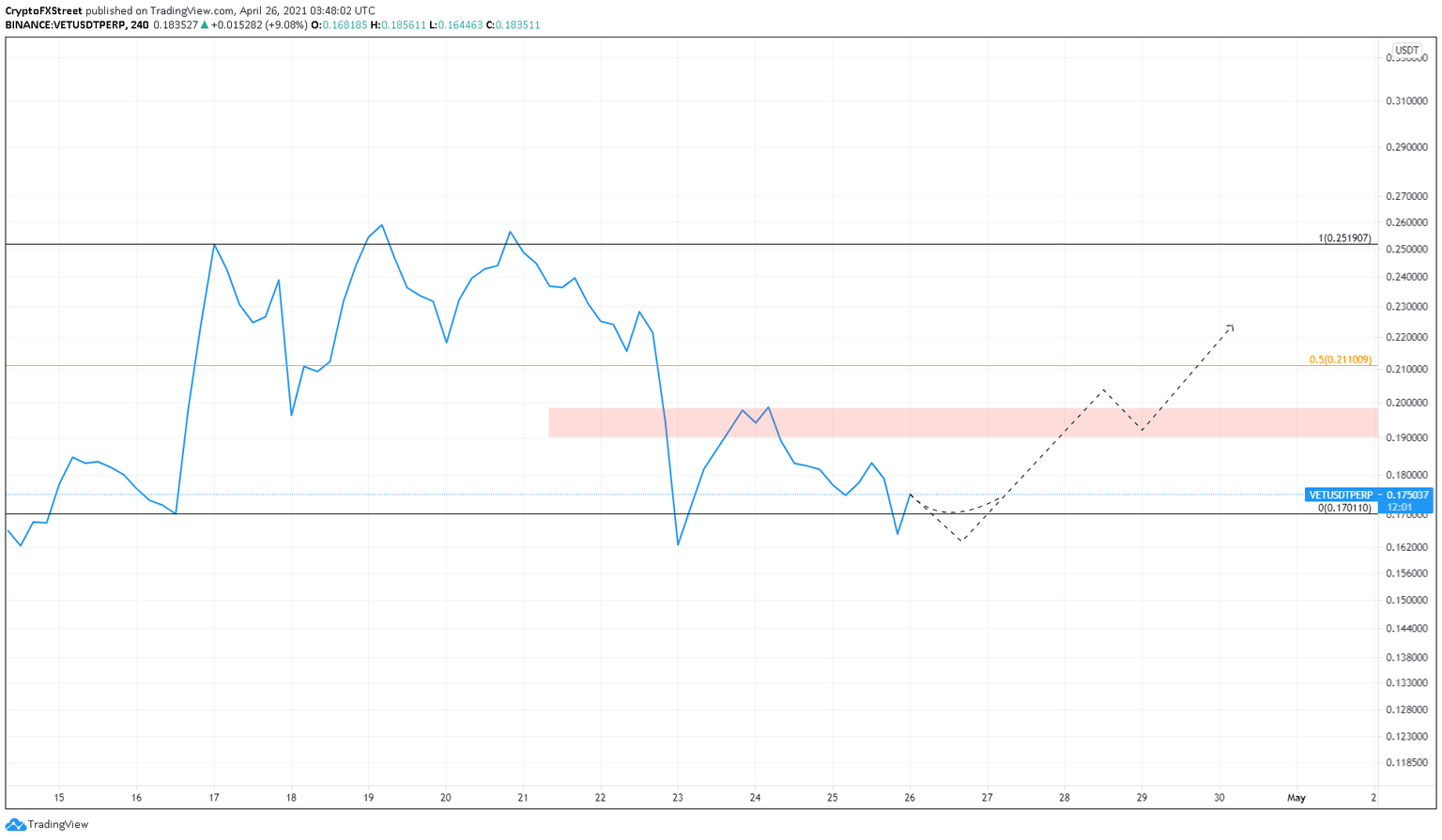

- VeChain price is testing the lower range at $0.170, anticipating a bounce to $0.251.

- A supply zone that extends from $0.190 to $0.198 could deter this upswing.

- Therefore, a decisive close above this area will confirm a 25% ascent.

VeChain price is range-bound, eyeing a quick upswing but could face hindrance near the immediate resistance area.

VeChain price at crossroads

VeChain price found support at $0.170 before creating a local top around $0.251 on April 17. Although VET has deviated a few ticks away from these swing points, it has respected the boundaries.

Like many altcoins, VET has also created a range where it moves sideways, showing no directional bias. Such clockwork-like movement can be attributed to the Bitcoin price crashes witnessed over the last two weeks.

After sliding nearly 36% from the local top and bouncing twice from the lower trend line, VeChain price eyes a reversal to $0.251. While this 26% ride to the upside seems possible, a supply zone that extends from $0.190 to $0.198 might deter the bulls from advancing.

However, a decisive close above $0.198 might propel VeChain price to $0.251, with a pitstop around the 50% Fibonacci retracement level at $0.211.

VET/USDT 4-hour chart

If the bulls fail to breach the said area of interest, a retracement to $0.170 seems likely. However, a 4-hour candlestick close below $0.162 will signal invalidation of the bullish thesis.

In such a scenario, investors can expect VeChain price to slide 11% to $0.143.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.