Uniswap Price Prediction: UNI on-chain metrics spell doom despite the improving technical picture

- Uniswap holds above the ascending channel’s lower boundary support on the daily chart.

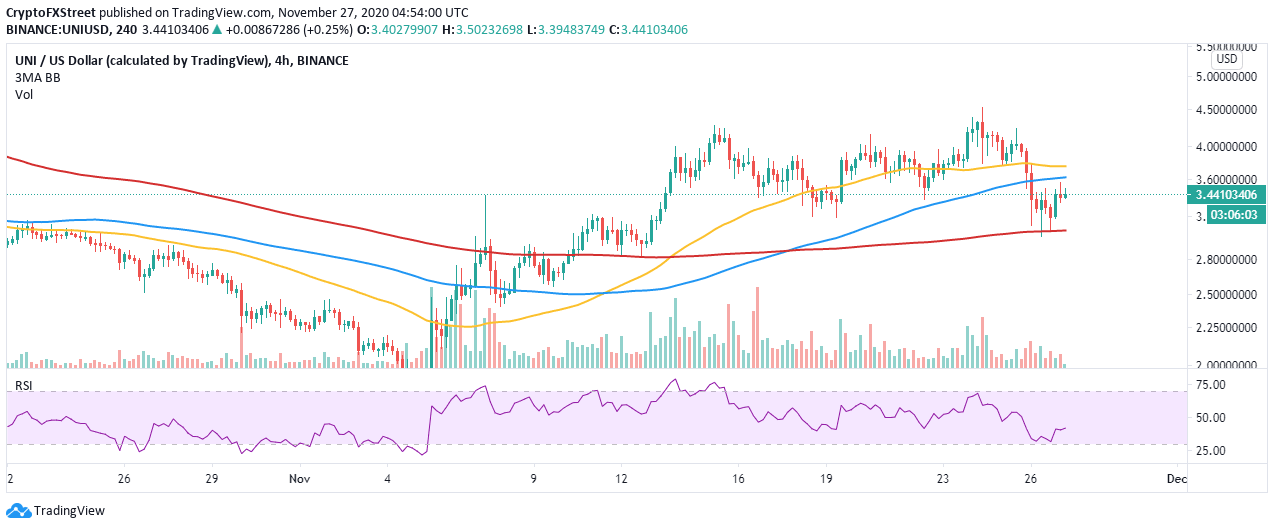

- UNI/USD might resume the uptrend if the price closed the day above the 50 SMA and 100 SMA on the 4-hour chart.

- A slump in network growth suggests that recovery could take a while before materializing.

Uniswap received a beating from the bears just like most of the cryptocurrencies in the market on Thursday. Investors rushed to take profit as prices tanked. UNI seems poised for recovery from a technical perspective, but on-chain metrics paint a contrary picture.

Uniswap jumpstarts the uptrend

Following the 37.7% loss from the highs achieved in November, Uniswap has recovered from the newly established support at $2.9. The decentralized finance (DeFi) token is trading at $3.4 at the time of writing while holding above the ascending parallel channel’s lower boundary support.

On the upside, resistance is anticipated at the channel’s middle boundary, likely to delay the breakout eying $4.5. In case of another correction from the prevailing market value, UNI may seek refuge at the 100-day SMA. The buyer congestion could also be strong enough to attract immense buying volume to restart the uptrend.

UNI/USD daily chart

The Relative Strength Index on the 4-hour chart has reinforced the bullish optimism after rebounding from the oversold area. A consistent uptrend towards the midline and the overbought region will signal more buyers to join the market, thereby creating enough volume to sustain the anticipated bullish price action.

Some delay is expected at the 50 SMA and the 100 SMA, but if broken, the price may rally quickly to $4.5. Holding above the 200 SMA may also protect the uptrend by ensuring stability is retained.

UNI/USD 4-hour chart

Santiment, a leading provider of on-chain metrics, shows a significant drop in Uniswap’s network growth. This metric tracks the number of new addresses joining the protocol daily. It is used to illustrate user adoption in the period and foretell if the cryptocurrency project is gaining momentum.

Uniswap network growth

In the last seven days, the number of new addresses decreased significantly. The addresses topped 2,300 on November 17 but slumped to 1,146 by November 26, representing a 50% decline. The downtrend in network growth is a red flag for price growth in the short term. In other words, UNI may take longer to recover from the dip.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B08.05.08%2C%252027%2520Nov%2C%25202020%5D-637420511246912465.png&w=1536&q=95)