Uniswap Price Prediction: UNI is on the verge of a drop to $3 as support fails to hold

- Uniswap price could push lower toward $3 before the next leg up.

- A significant support area around the current price could limit Uniswap's losses.

On Sunday, November 15, Uniswap price climbed to the highest level it has been over the past two months. But as a new weekly trading session, it reversed its direction, losing more than 7%. Despite the significant losses incurred, UNI price sits on top of stable support that may keep falling prices at bay.

Significant bearish sign spotted on Uniswap's 1-day chart

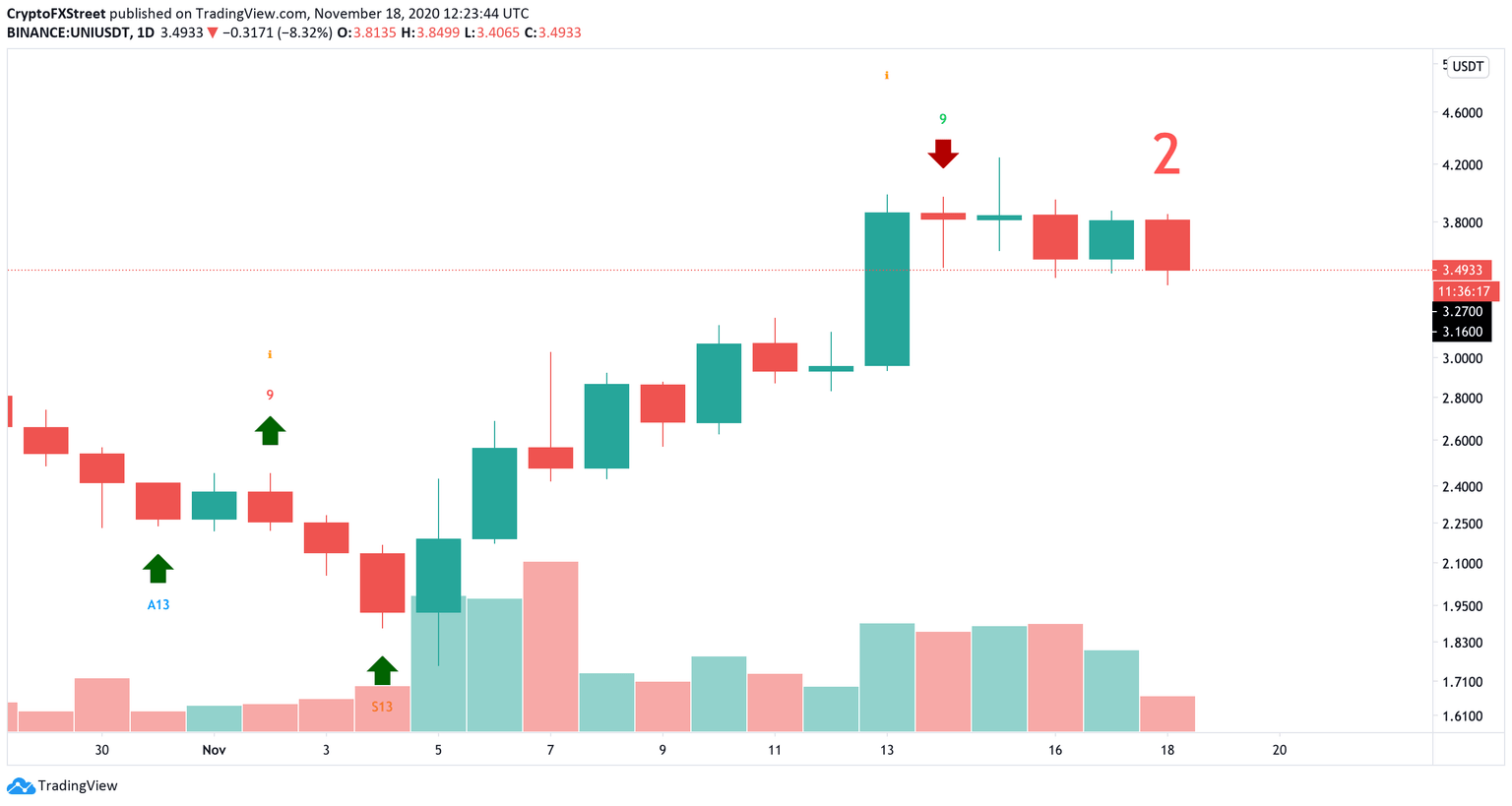

The TD Sequential indicator presented a sell signal on Uniswap's 1-day chart, signaling that the two-week-old uptrend was getting exhausted and prices were poised to retreat. The bearish formation seems to have been validated as UNI is on the second day of a potential four-day correction before the uptrend could regather its bullish momentum.

Nonetheless, on-chain metrics show stiff support underneath this DeFi token.

UNI/USDT 1-day chart

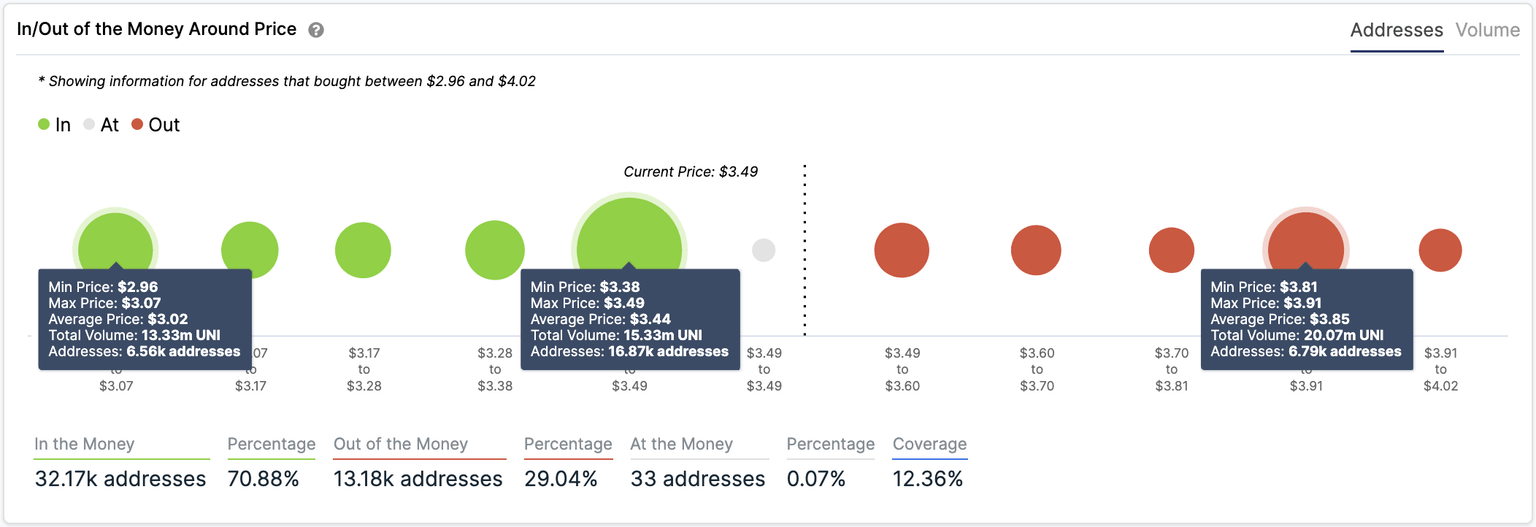

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals Uniswap sits on top of a massive demand barrier. More than 15 million UNI had been bought by nearly 17,000 addresses between $3.38 and $3.49, making this area a possible last stop for the ongoing downward correction.

But if bears manage to drag the price below that region, the next target could be seen around $3, where 6,500 addresses acquired more than 13 million UNI.

Areas of Interest Per IntoTheBlock's IOMAP

On the flip side, bouncing off the $3.44 support level could lead to an upswing towards $3.85 since there is little to no resistance in between. Only a candlestick close above this supply wall will help invalidate the TD setup's bearish outlook and lead to greener pastures. But as long as it holds, the pessimistic scenario will prevail.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.