UNI Price Analysis: Uniswap at risk of a dead-cat-bounce as market sentiment sours

- Uniswap price jumps nearly 2% in the ASIA PAC trading session on Thursday.

- UNI might be jumping, but the risk of a firm rejection lies ahead.

- With current market sentiment negative, expect to see every pop higher being met with a sell-off.

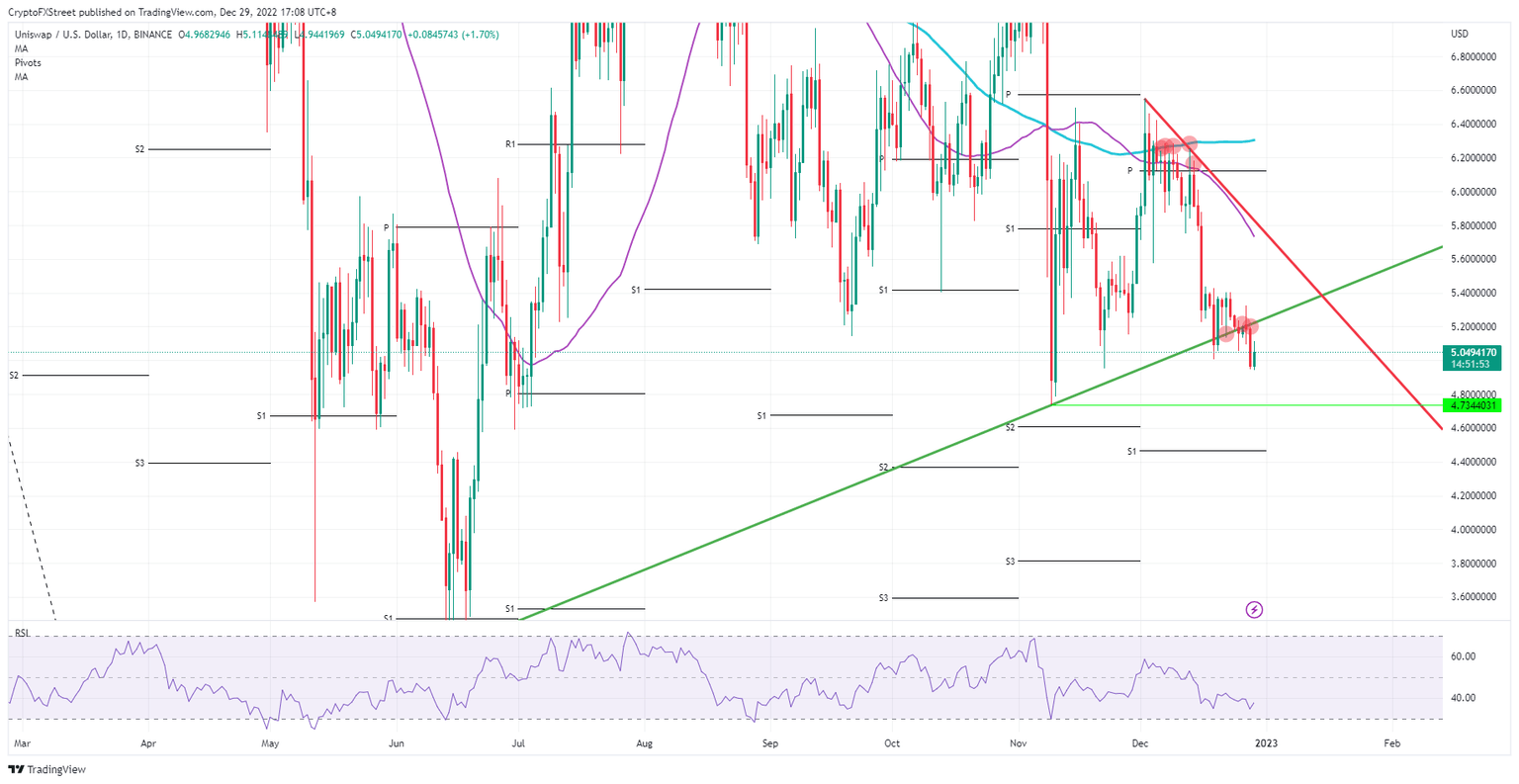

Uniswap (UNI) price action jumps nearly 2% in the ASIA PAC and European trading session on Thursday as bulls are buying the dip after the bearish breakout from Wednesday. UNI price action broke lower, out of the pennant formation it was in for most of December. Although this rally looks promising, the current backdrop is too bearish to see this rally mean anything substantial, and rather has the broad strokes of a dead-cat-bounce that would see price action eventually drop towards $4.73.

Uniswap is still at risk of tanking by at least 6%

Uniswap price is recovering a portion of the 4% decline it incurred on Wednesday near the US closing bell. US equities tanked yet again as a big sector rotation is underway. After nearly a month of declines, big winners in the equity space are Healthcare, Utilities and Household Packaging. This points to traders preparing for a firm recession as those sectors will always be needed, even during a recession, while Luxury Goods, Tech stocks and Banks tank on the back of a risk-off mode.

UNI is thus a bit of an outlier this morning as it is rallying against most of its peers and should come with a warning label. Certainly, from a technical point of view, the bounce at the $0.497 level does not hold any real technical relevance or historic pivotal value. Instead, look for a selling point into the rally near a rejection at the green ascending trend line, at $5.20, with price action set to drop lower towards $4.73.

UNI/USD daily chart

If bulls can only break back above the green ascending trend line, traders should consider taking on any long positions in UNI. With the re-entry of the pennant, the take profit level is clearly defined at $5.75 with a double cap in the form of the 55-day Simple Moving Average (SMA) and the red descending trend line. That would still mean a nice 9% profit increase on the back of that trade.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.