Trade Ethereum for free on Binance: World’s largest exchange waves fees for a month

- Binance offered free Ethereum trading to customers using BUSD, for a month.

- The world’s largest exchange by volume has announced the initiative ahead of a massive event in Ethereum, the Merge.

- Ethereum price prepares for a rally to $1,607, recovering from the recent downtrend.

Binance is waiving fees for a whole month for customers trading the Ethereum-BUSD pair on its exchange platform. The world’s largest exchange makes 90% of its revenue from trading fees. Free trading on the exchange platform is therefore a watershed moment for ETH holders.

Also read: Ethereum price: This mega event will lay the foundation for the Ethereum Merge

Binance ramps up efforts to increase market share

The world’s largest cryptocurrency exchange by volume waived fees for a month for customers trading Ethereum BUSD pair. The free trade initiative was launched ahead of a milestone event for Ethereum holders, the Merge. The transition from proof-of-work consensus mechanism to proof-of-stake is key to Ethereum holders. Therefore, the free trade announcement for the ETH-BUSD pair is a part of the exchange’s push to grab higher market share.

Binance recently ramped up its efforts to drive in house currency BUSD’s adoption and to attract traders to its platform. The Merge is expected to vastly shrink Ethereum’s carbon footprint, enhance the security of the altcoin’s blockchain and fuel a bullish narrative among ETH holders.

Changpeng Zhao, the CEO of Binance revealed that 90 percent of Binance’s overall revenues are derived from trading fees. This fluctuates with the changes in the price of Bitcoin and other cryptocurrencies, according to Zhao.

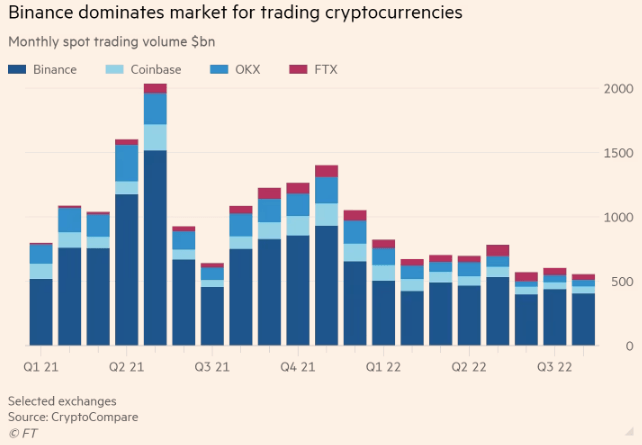

Over the summer, Binance has offered several no-fee trades in Bitcoin pairs with the Euro and the Pound. Based on data from CryptoCompare, this initiative resulted in an 8% increase in the market capitalization of the stablecoin BUSD. Increase in the stablecoin’s adoption and utility, drove its value higher. Binance dominates the crypto trading market, when compared to leading exchanges like Coinbase, OKX and FTX.

Binance dominates crypto trading

Binance continues to have strong reserves and while the exchange will miss out on some fees, this approach to free trading has been seen in traditional finance in the past. Peter Habermacher, CEO and co-founder of Aaro Capital was quoted as saying,

Temporarily giving up on fees on their main trading pairs can be seen as a concession towards attracting more flow in the current low trading volume environment, which [Binance] will benefit from indirectly through increased traffic in other trading pairs and other product lines and offerings.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.