- XRP squeezes up for the first time since June.

- Bitcoin fulfills a pattern already seen in 2017.

- Ethereum continues to rise and faces significant levels of resistance.

The arrangements for a possible Altcoins season continue with the fantastic bullish development that Ethereum is showing.

Yesterday it pierced the 50-period exponential moving average with ease and relentlessly headed towards the $200 level.

By contrast, Bitcoin continues to get stuck below the main moving averages and gives the sense that the current situation will need a jolt to get out of it.

The market expects the resolution to this bottleneck convinced that without Bitcoin's participation it will be difficult to consolidate gains in the Altcoin niche. But recent history does not support this theory.

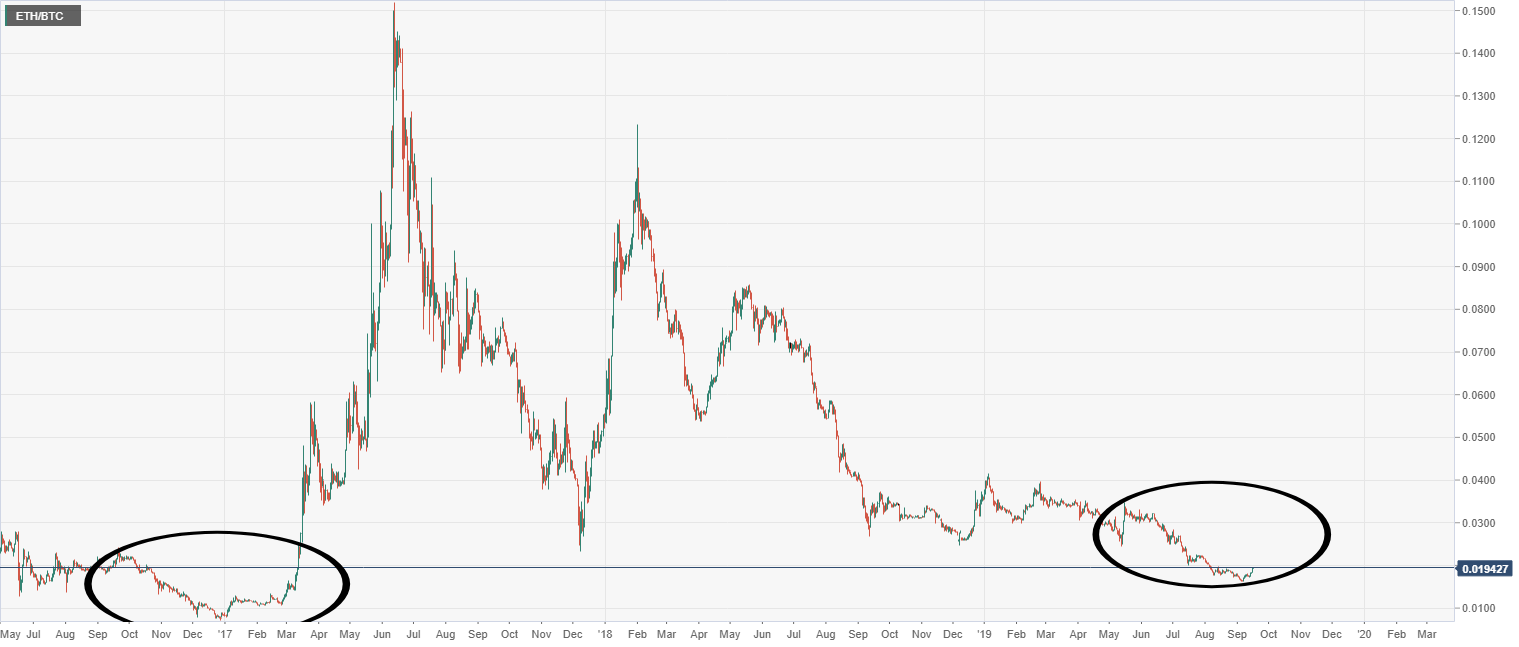

In December 2016 the technical situation of the ETH/BTC pair was similar to the current one. After a few months of a bad Ethereum behavior against Bitcoin, the pair flipped over and regained the exponential moving average of 50 periods.

After this conquest, there were two months of consolidation, Ethereum performed much better than Bitcoin, a process that culminated with Bitcoin over $19,000 and Ethereum over $1,300.

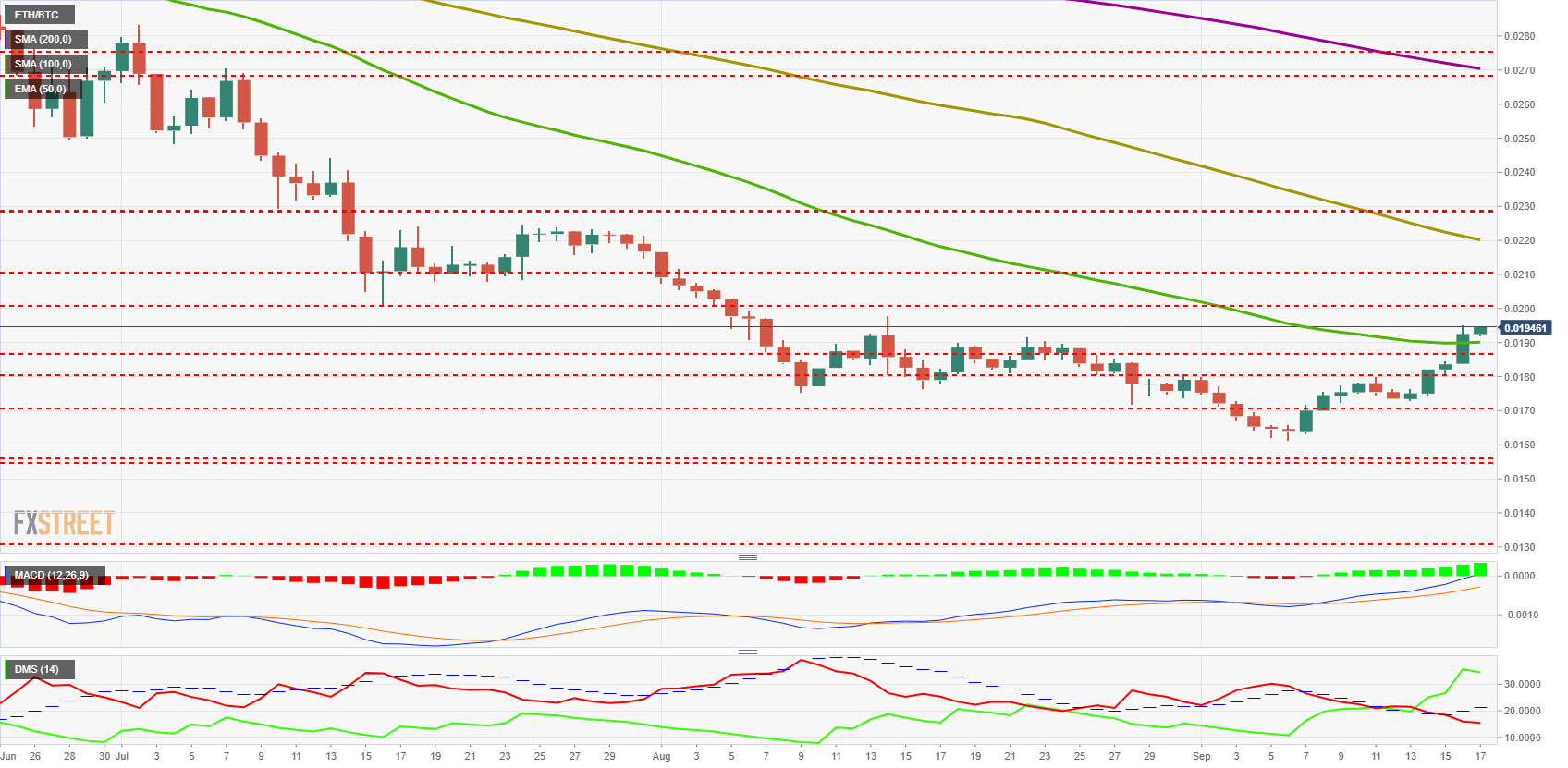

ETH/BTC Daily Chart

The ETH/BTC is currently trading at the price level of 0.01946 and lends itself to breaking yesterday's high.

Above the current price, the first resistance level is at 0.020, then the second at 0.21 and the third one at 0.22. The ideal scenario would be to overcome these three price levels and consolidate them, which would allow moving averages to be set to rise in a short space of time.

Below the current price, the first support level is at 0.019, then the second at 0.0186 and the third one at 0.018.

The MACD on the daily chart crosses the neutral level upwards with the fast average, which will drag the slow average and confirm a transition to the bullish side of the ETH/BTC pair. The bullish slope and opening between the lines are improving, increasing the chances of a continuation of the bullish trend.

The DMI on the daily chart shows the bulls losing some momentum while the bears continue to lose strength, albeit at a slower pace. The structure is strongly bullish in the short term.

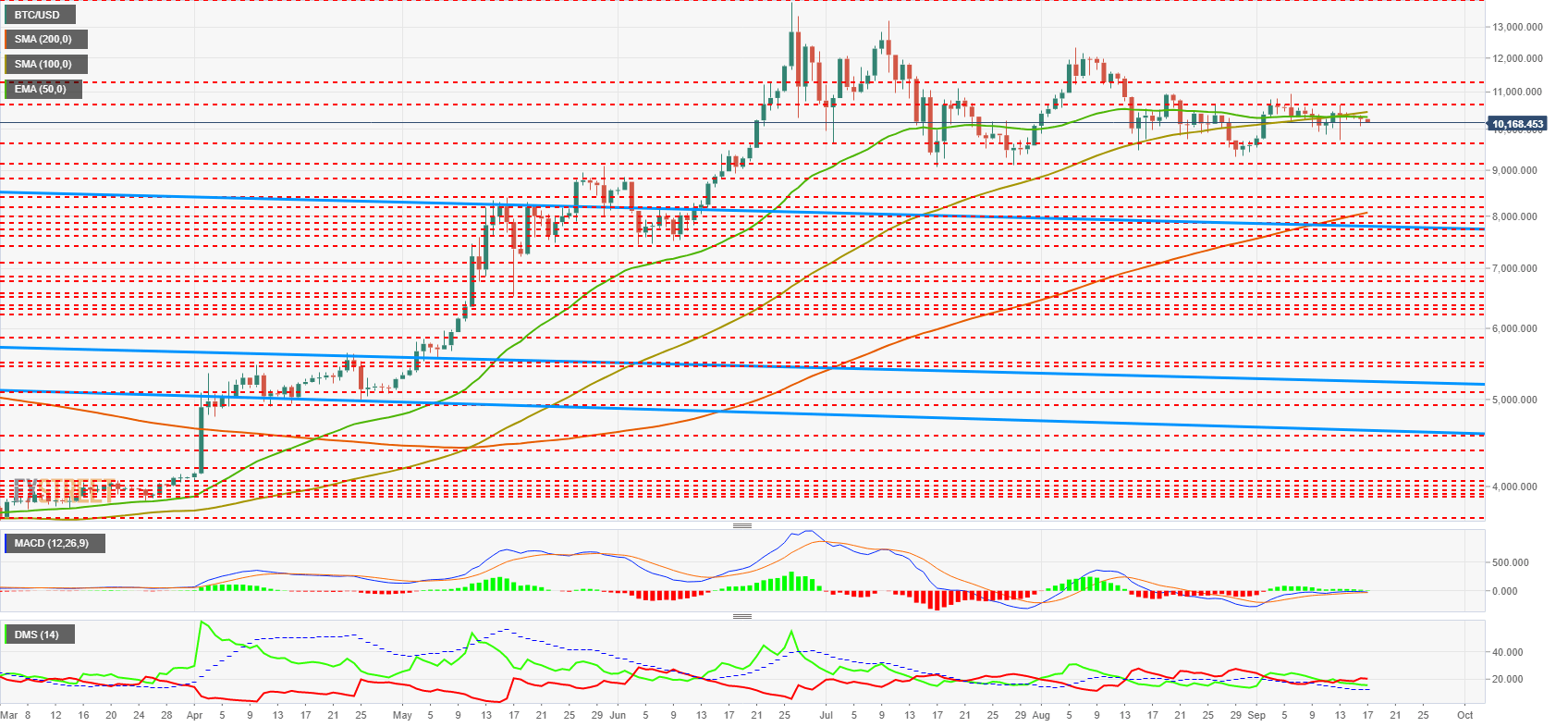

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the $10,169 price level. The 50-period exponential average and the 100-period simple average blocks it upside development.

The chart structure is not favorable in the short term, as the 200-period moving average still moves around $8,000, and it will take several days for everything to set up in bullish mode again.

Above the current price, the first resistance level is at $10,300, then the second at $10,650 and the third one at $11,300.

Below the current price, the first support level is at $9,650, then the second at $9,150 and the third one at $8,800.

The MACD on the daily chart reliably shows the price situation. The moving averages that make up this indicator are pushing against level 0 with no option to overcome this barrier.

The DMI on the daily chart shows us how the bears maintain control of the pair with little advantage over the bulls. The ADX line goes to minimum levels not seen since the end of 2018.

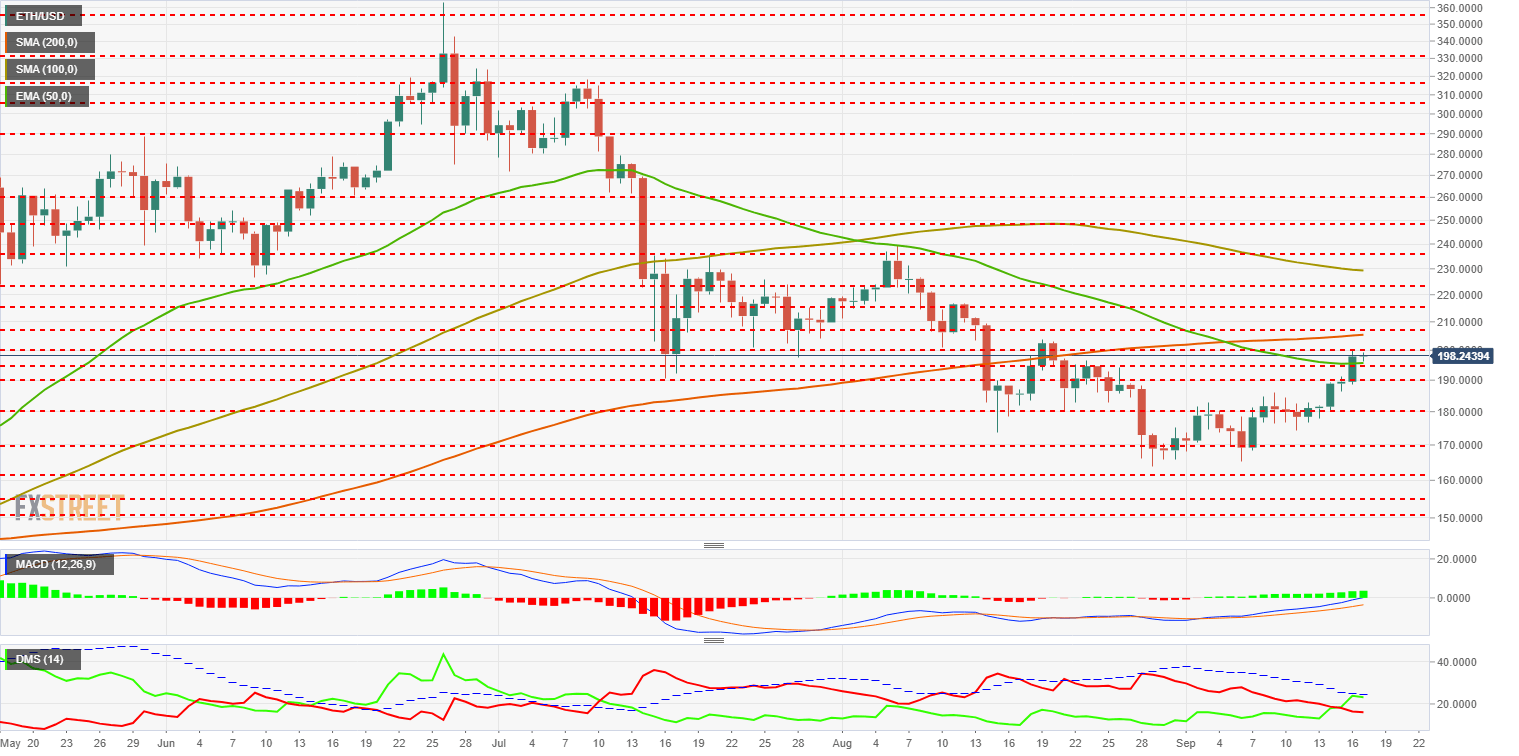

ETH/USD Daily Chart

The ETH/USD is currently trading at $198.24 and is openly declaring its intention to move above the $200 level today.

The chart structure is potentially very bullish, although some difficulties are announced in the short term as we will see below.

Above the current price, the first resistance level is at $200, then the second at $208 and the third one at $215.

Below the current price, the first support level is at $195, then the second at $190 and the third one at $180.

The MACD on the daily chart is trying to cross upwards the zero level of the indicator. This type of transit usually slows the current trend.

The DMI on the daily chart shows how yesterday the bulls failed to cross the ADX line upwards. Until this cross occurs, the bullish trend will be minimal. Bears continue to fall but may try to regain leadership in the face of bullfighting problems.

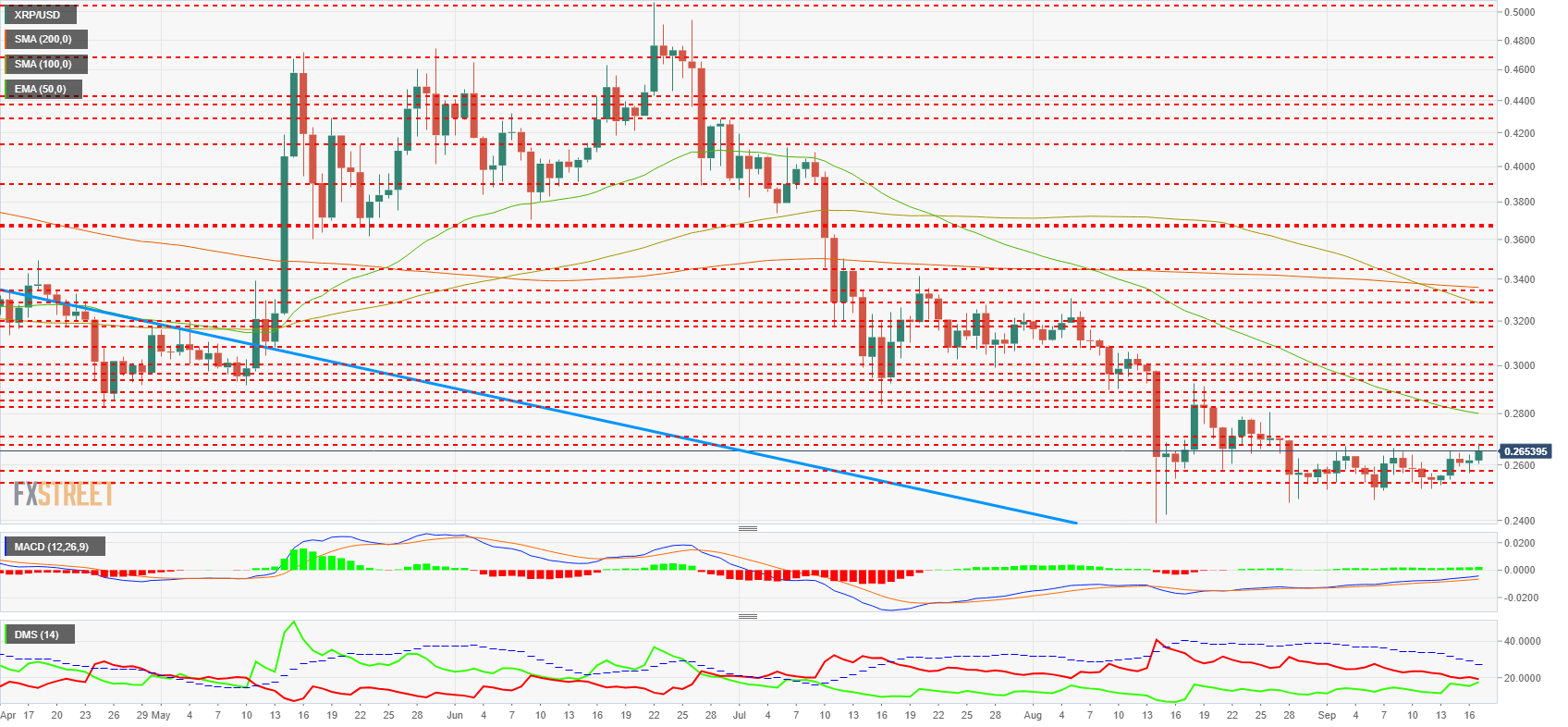

XRP/USD Daily Chart

The XRP/USD is currently trading at the $0.265 price level and is heading towards its third attempt so far this month to breach the price congestion resistance level at $0.267.

The chart structure of the XRP/USD is favorable in the short term, a situation that has not occurred since the beginning of August.

Above the current price, the first resistance level is at $0.271, then the second at $0.28 and the third one at $0.283.

The MACD on the daily chart improves substantially from yesterday. The bullish slope is increasing, and the opening between the lines is also growing. It is a positive setup but an insufficient improvement for the time being.

The DMI on the daily chart clearly shows the situation. Bulls are trying to take leadership that they haven't had since late June. The bears continue to lose strength but remain slightly above the 20 levels.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?