- The current downturn is consistent with the previous uptrend but generates the same anxiety as a full bearish market.

- Statements by Trump administration officials cast doubts on a war against cryptocurrencies.

- XRP corrects significantly and puts its typical dose of pessimism into the XRP holders.

During the space race, at the height of the Cold War, trips to the moon were the culmination of psychological warfare. And one of the most critical moments was when the lunar modules entered the dark side of the moon. There was no communication between the ship and the base on Earth. If anything happened, you would never know. It was a matter of faith that everything would work out.

The crypto market is now on the dark side of the moon.

The process of regression and consolidation is still ongoing. Today's significant falls confirm that yesterday's gains were part of the same contraction process that began over the weekend.

Among the Top 10 cryptocurrencies, only XTZ remains green (+4.34%)

The CME futures market publishes its volume figures. Last Tuesday, February 18th, the market reached 23000 futures contracts with a notional value of 1.1 billion. The trading volume of this Bitcoin futures platform shows a linear increase over the last three months.

Next Friday, February 26th is the deadline for the US SEC to issue its report on the Wilshire Phoenix Bitcoin ETF.

Jake Chervinsky, General Counsel of the Ethereum-based Defi Compound platform, said:

"this is the only Bitcoin ETF proposal pending, as Bitwise & VanEck are taking a break.”

“I guess there won't be any ETFs in 2020,” he added.

A recent survey launched by Crypto universe analyst "PlanB" asked, “What threat do you consider most relevant to the Crypto ecosystem in the short term?” Based on more than 6000 respondents, more than 50% consider US Treasury Secretary Steve Mnuchin a threat after his recent comments against Bitcoin and other minor crypto-assets.

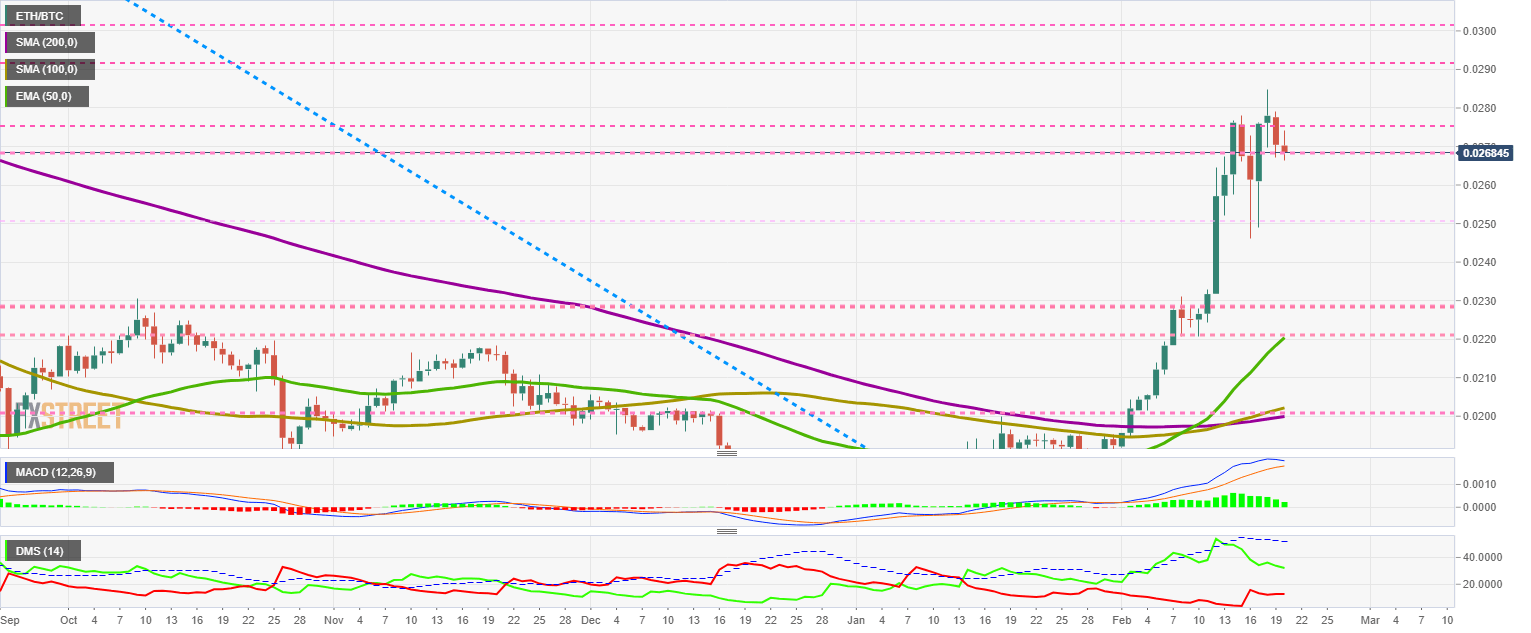

ETH/BTC Daily Chart

The ETH/BTC pair moves downwards following the tone of the day. For now, the technical impact is limited and remains above the “clean” zone between 0.023 and 0.027.

Above the current price, the first resistance level is at 0.0275, then the second at 0.029 and the third one at 0.030.

Below the current price, the first support level is at 0.025, then the second at 0.023 and the third one at 0.022.

The MACD on the daily chart shows a complete loss of the bullish profile. The MACD on the daily chart shows a total loss of the bullish trend profile.

The DMI on the daily chart shows the bulls are descending smoothly. The bears are not reacting to the bullish momentum and are not convinced to take the lead this time either.

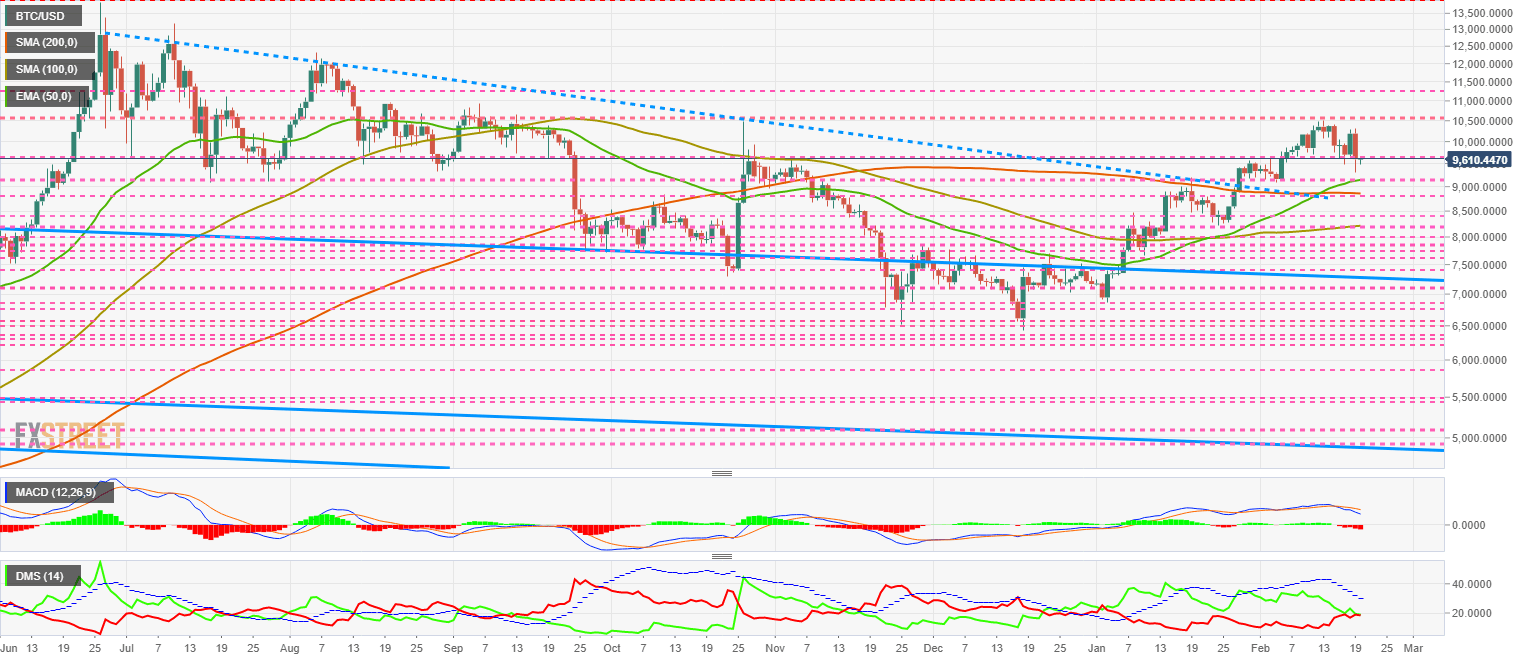

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $9610 and moving below the usual range of the last two weeks. The EMA50 and the SMA200 are already running above the long-term downward trend line, very positive data for the medium and long term.

Above the current price, the first resistance level is at $9650, then the second at $10500 and the third one at $11250.

Below the current price, the first support level is at $9250, then the second at $8750 and the third one at $8250.

The MACD on the daily chart shows that the bearish cross is moving without a momentum boost.

The DMI on the daily chart clearly shows the current situation. The bulls are still leading the way in controlling the BTC/USD pair, but with the bears so close that the change in leadership could occur in a few hours.

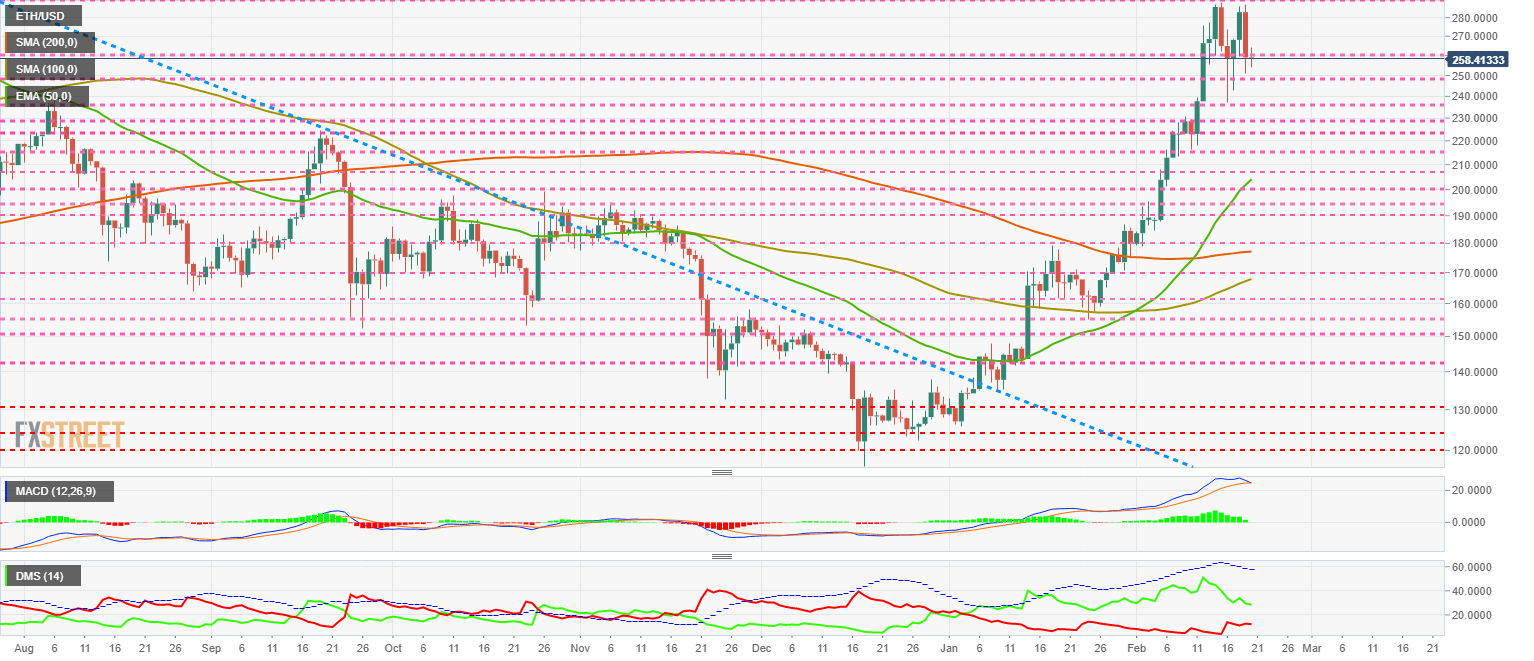

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $258 price level and is currently losing critical support at $260. The major moving averages are far below the price level, so a drop to the $220/$210 level can happen.

Above the current price, the first resistance level is at $260, then the second at $290 and the third one at $308.

Below the current price, the first support level is at $250, then the second at $240 and the third one at $230.

The MACD on the daily chart shows an incipient bearish cross that seems inevitable today. An upward bounce is possible but in a final form and with little development.

The DMI on the daily chart shows the bulls retaining a good lead over the bears. The trend profile on the sell-side is bullish, so we may see an attempt to take the lead in the ETH/USD pair in the coming days.

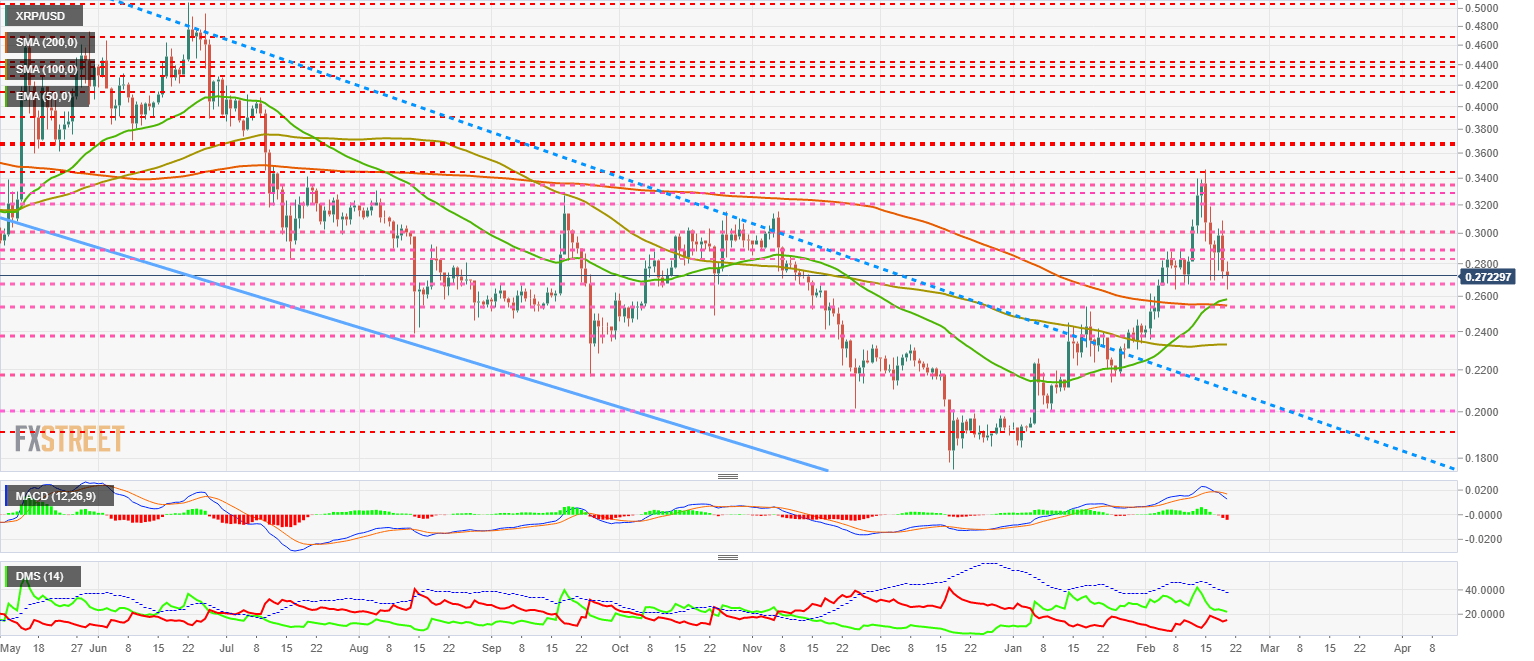

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.272.

Above the current price, the first resistance level is at the price level of $0.282, then the second at $0.288 and the third one at $0.30.

Below the current price, the first level of support is at the price level of $0.27, then the second at $0.255 and the third one at $0.24.

The MACD on the daily chart shows an active bearish cross profile. The MACD on the daily chart shows an active bearish cross profile. Short-term development may accelerate the decline, looking for support at $0.26.

The DMI on the daily chart shows bulls leading XRP/USD with a slight advantage over the bears.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?