ThorChain Price Prediction: RUNE bulls prepare to reclaim $5.50

- ThorChain price is planning to extend the gains after a full swing V-shaped recovery.

- RUNE could make a 15% climb to $5.50, levels last tested on January 4 with technical and on-chain tailwinds.

- Bitcoin and altcoin revival courses could drive the altcoin to recoup some of the ground lost in 2024.

- The bullish thesis will be invalidated upon a break and close below the 50% retracement level of $4.34.

ThorChain (RUNE) price is trading with a bullish bias, completing a full swing V-shaped recovery after the steep dip in the first four days of February. It comes amid an altcoin revival recourse, inspired by Bitcoin (BTC) price breaking past the $45,000 psychological level.

Also Read: THORChain price eyes 10% rally as RUNE bulls make a comeback

ThorChain likely to climb 15% soon

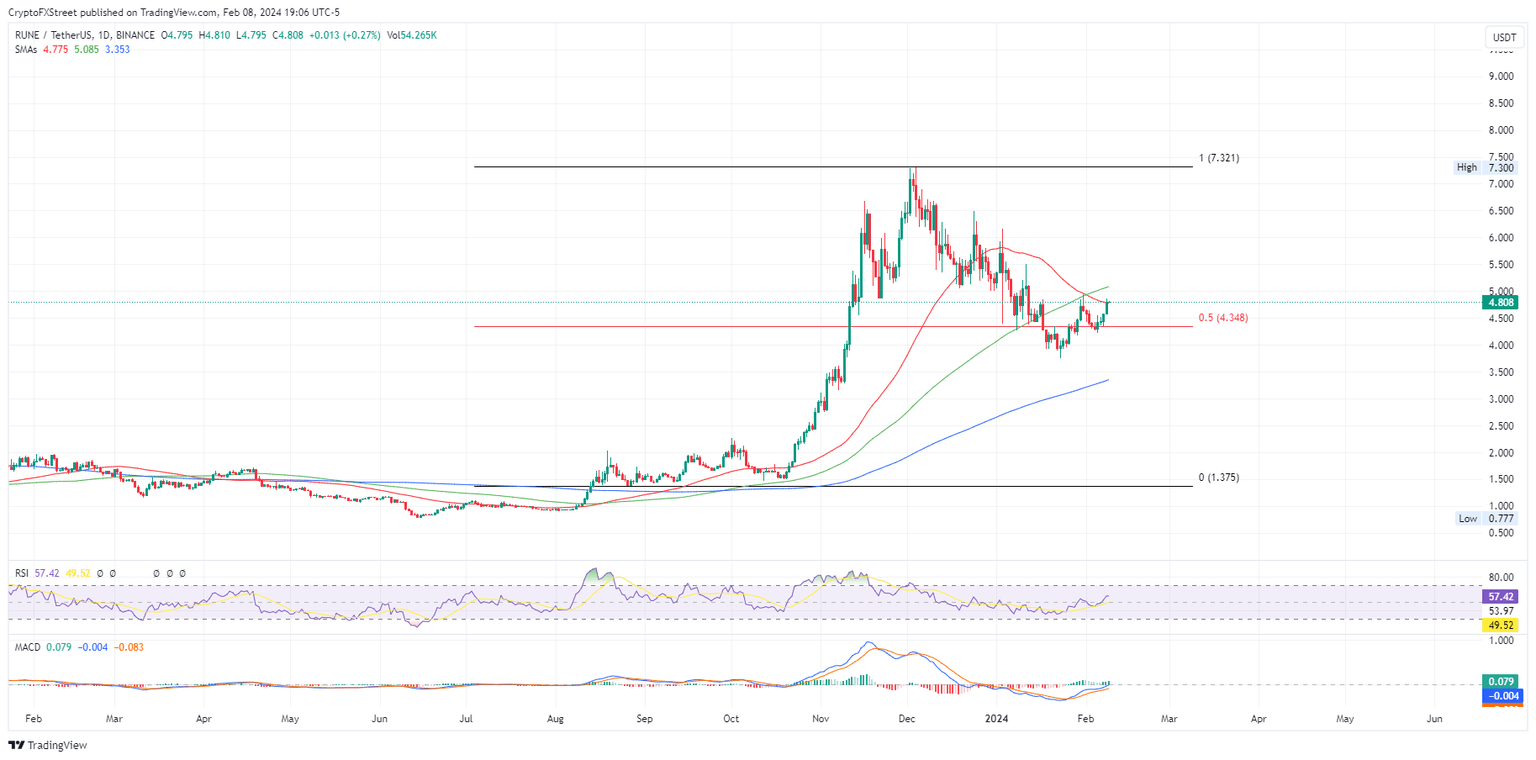

ThorChain (RUNE) price could extend the gains after a 10% climb that began when RUNE price pivoted around the 50% Fibonacci level of $4.34.

Multiple technical indicators and on-chain metrics support the bullish outlook. The Relative Strength Indicator (RSI) is moving up, a sign of rising momentum. Its position above 50 suggests a strong price strength, and a stance below 70 showing there is more room to the north before RUNE is considered overbought.

Also, the Moving Average Convergence Divergence (MACD) indicator is moving above its signal line (orange band) edging toward positive territory. This hints at a possible bullish cycle incoming. The histogram bars of the MACD are flashing green, indicating a strong presence of bulls in the RUNE market.

Increased buying pressure could see ThorChain price shatter resistance due to the 50-day Simple Moving Average (SMA) at $4.77 followed by the 100-day SMA at $5.08.

Overcoming these blockades would clear the path for RUNE to make a 15% climb to hit $5.50, levels last seen on January 4. In a highly bullish case, the gain could see the altcoin hit the $6.00 psychological level.

RUNE/USDT 1-day chart

On-chain metrics supporting ThorChain bullish outlook

Several metrics from Santiment support the bullish thesis. For starters, the percentage of stablecoin total supply held by whales with more than $5 million is increasing. This points to growing intention to buy RUNE. The sentiment is corroborated by the soaring Tether (USDT) stablecoin market capitalization, also suggesting traders are leaning towards buying.

RUNE Santiment: Percentage of stablecoin total supply held by whales with more than $5 million, USDT market cap

Also, the social dominance and social volume metrics are recording significant upticks, suggesting an increasing number of RUNE mentions on crypto-related social media. These accentuate the bullish thesis.

On the flipside, early profit booking could cut the rally short, sending ThorChain price back to the 50% Fibonacci level of $4.38. A break and close below this level would invalidate the bullish thesis.

In the dire case, the slump could send ThorChain price to the 200-day SMA at $3.35.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B03.20.56%2C%252009%2520Feb%2C%25202024%5D-638430374865485122.png&w=1536&q=95)

%2520%5B03.19.21%2C%252009%2520Feb%2C%25202024%5D-638430375454968259.png&w=1536&q=95)