This is why traders need to be careful trading Polygon’s MATIC price

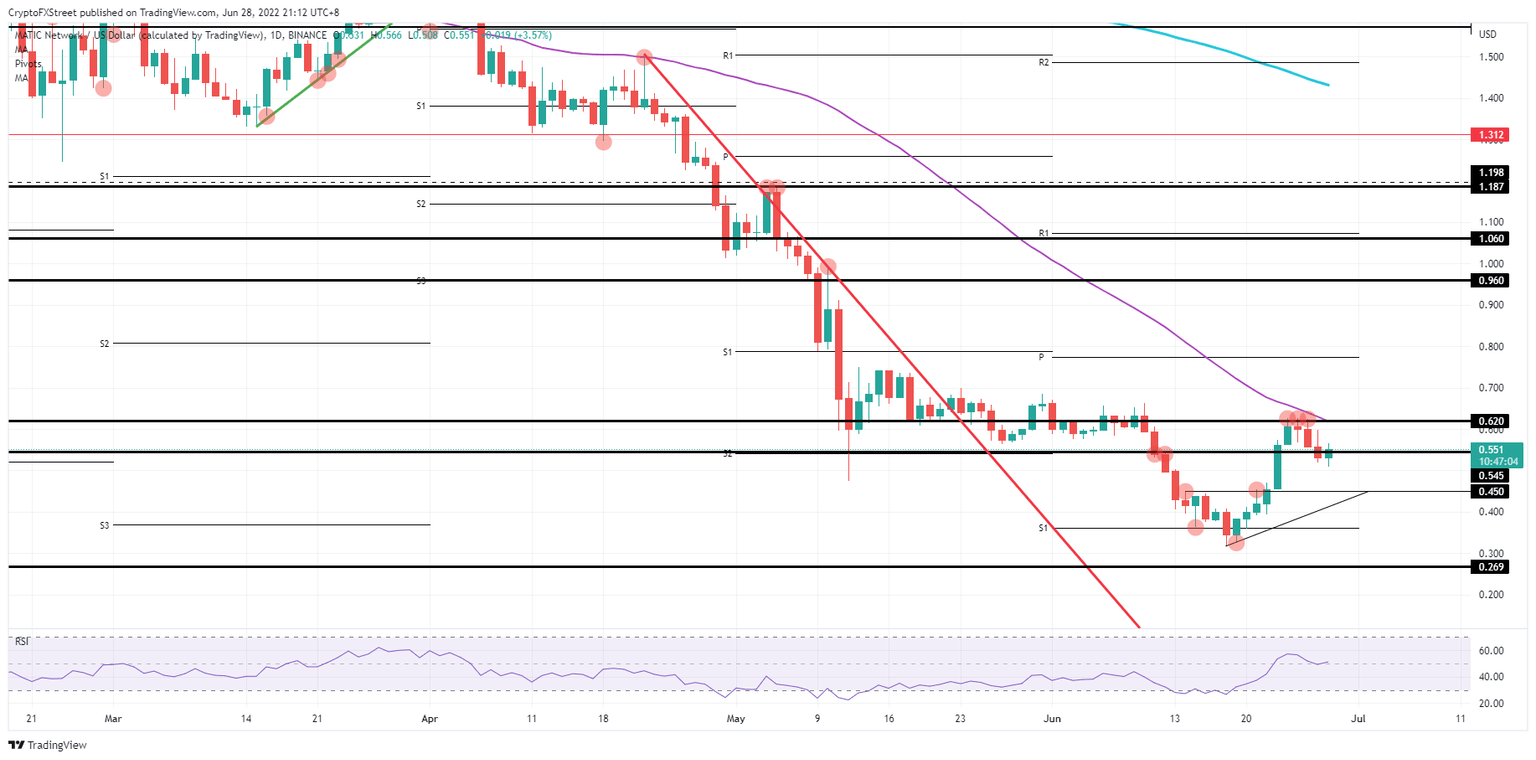

- Polygon price is flip-flopping between a wedge and a fade after receiving a firm rejection to the topside.

- MATIC could quickly drop another 16% before finding support to bounce off.

- Expect a further decline, as a stronger dollar could be back anytime now.

Polygon (MATIC) traders must have no fun at all seeing the shortness of the relief rally and the soft patch that looked to be underway for the summer. Instead, for MATIC bulls it must almost feel like the holiday flight got cancelled, and the swimming pool has a dead rat floating in it, after the firm rejection from the pivotal level at $0.620. Expect the fade to continue and see MATIC price drop another 16% to 25% in the wake of looking for support.

Polygon’s MATIC price set to drop 20%

Polygon traders lacked conviction in joining the small rally created in the soft patch when equity markets started to rally and the dollar got busy making its suitcase for the summer. Traders were surprised when – not the 55-day Simple Moving Average but the pivotal level at $0.620 put a cap on any further moves to the upside. Ad to that, $0.513 did not hold as support, and it looks like its relevance has ended.

MATIC traders are thus forced to look at lower levels, with $0.450 coming to mind, a smaller level to have marked up as it did its part in the breakout trade earlier last week. Should that level not hold well, there is still the tilted supportive line around $0.410 which do the trick. In the meantime, the Relative Strength Index (RSI) will have dipped below 50 and neared the oversold area, limiting further downturns.

MATIC/USD daily chart

Should the dollar give way more and, for example, start to trade back above 1.08 or 1.10, cryptocurrencies would have a field day. The $0.620 level would get sliced easily, and likely see MATIC price action rally at a gruesome pace towards $0.960 to start flirting with $1.00. Such a move would pare back all incurred losses from May until now, and even make investors think of a positive close for the year for MATIC if the trend continues.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.