Polygon’s MATIC price could even fool top-tier traders, here’s why

- MATIC price has yet to show a bullish countertrend rally since breaching the parallel trend channel.

- Polygon price has fallen in free-fall fashion, a typical catalyst for a long range-bound consolidations.

- Invalidation of the bearish downslide is a breach above $0.73.

MATIC Price has two scenarios in place. Traders/investors should consider other digital currencies and let the technicals of MATIC play out further.

MATIC price is in an in-between zone.

MATIC price has fallen in nearly a straight shot since January’s all-time high at $2.92. The bulls were likely expecting a countertrend rally to ensue by now as the scaling-solution token has fallen below the breached parallel trend channel. Unfortunately, classical-style trading methodologies like trend channel retests have not worked on this market yet.

Polygon’s MATIC price continues to fall “penny from Eiffel” style to no avail as the bears have the $0.45 level cornered. The bulls have yet to hurdle through the previous 2-week opening candle, nor have they printed a bullish candle of equal or more value to the largest candle within the bearish decline. If market conditions persist, the bears could target $0.20 with little to no resistance.

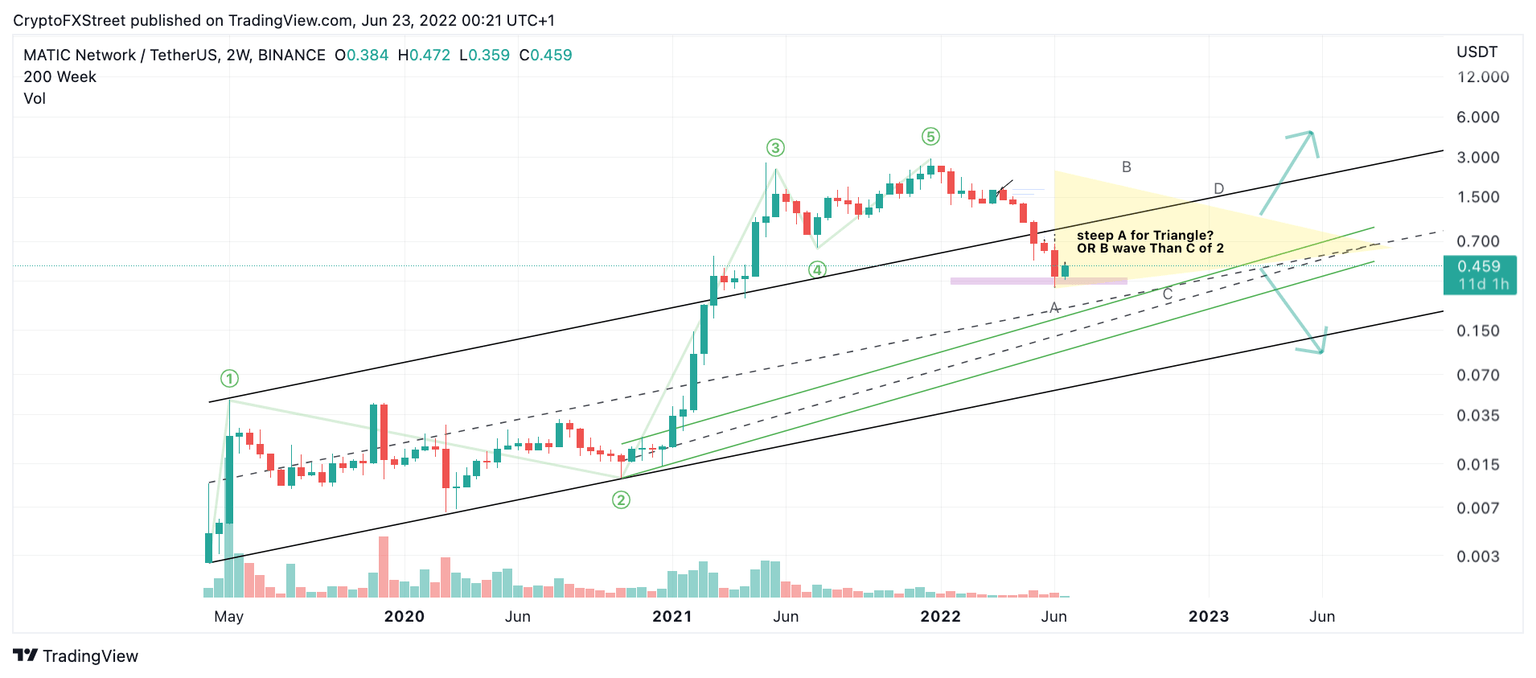

MATIC/USDT 2-Week Chart

There is however, the tapering volume pattern, which suggests the long-term count for Polygon price is still bullish. Still, deciphering the next 4-6 weeks out will be challenging, even for the best academic Elliot Wave practitioners out there.

To keep it simple, forget about the academics for now and trade a different chart. In a few weeks, MATIC price will depict more evidence of where it wants to go. The steep decline will either be a part of a corrective structure or the first macro wave of the bear market. Both scenarios can only be confirmed in retrospect.

In the short term, a break above $0.73 could end the current downtrend for traders looking to take a risk. If the bulls breach this level, a rally towards $$1.20 could occur, resulting in a 150% increase from the current MATIC price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.