This is how low ApeCoin price needs to go before a new uptrend begins

- ApeCoin price is still reeling from new all-time lows.

- Recovery in progress needs confirmation and conviction.

- Downside movement remains the most likely direction until ApeCion can breakout above key Ichimoku resistance levels.

ApeCoin price action is getting somewhat of a reprieve from the massive selling pressure that has affected the entire cryptocurrency market. However, signs of waning participation near critical resistance levels may halt any further upside momentum.

ApeCoin price faces its strongest resistance level

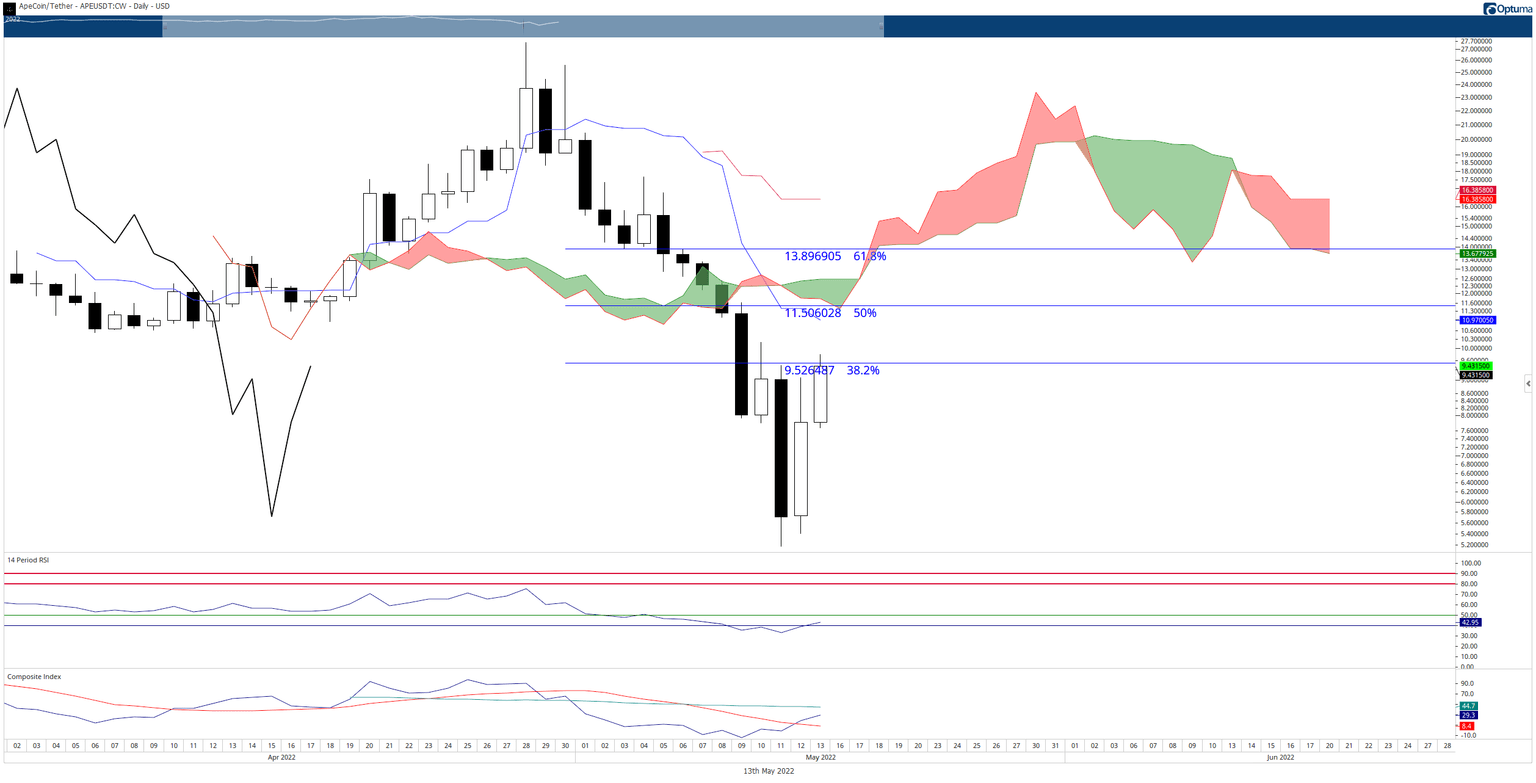

ApeCoin price action, from an Ichimoku perspective, remains in a very clear bearish downtrend. It remains in an Ideal Bearish Ichimoku Breakout and is technically displaying the first pullback since breaking down below the Ichimoku Cloud.

Between the $11 and $12.75 ApeCoin price, bulls will have to contend with the strongest resistance currently on the daily Ichimoku chart. Between $11 and $12.75 are the following resistance levels:

- The daily Tenkan-Sen at $11

- The 50% Fibonacci retracement at $11.50

- Bottom of the Ichimoku Cloud (Senkou Span A) at $11.68

- The top of the Ichimoku Cloud (Senkou Span B) at $12.75

APE/USDT Daily Ichimoku Kinko Hyo Chart

If ApeCoin price can close at or above $12.75, then the path to a new uptrend becomes significantly easier. However, a Kumo Twist on May 15 could point to a minor swing high and could terminate any further upside potential for ApeCion price.

Additionally, even if ApeCoin price closes above $12.75, an Ideal Bullish Ichimoku Breakout will not be confirmed. For an Ideal Bullish Ichimoku Breakout – which signals a prolonged bullish expansion phase – APE must close above the Kijun-Sen, and the Chikou Span must be in open space. That will not occur until ApeCoin price has a daily close at or above $23.85 – essentially a new all-time highest daily close.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.