This double scenario for the Solana price could generate a nice profit or a ton of pain

- Solana price coils within the 8-day exponential and 21-day simple moving averages.

- SOL price was rejected from a key Fibonacci level.

- A double scenario is underway, and critical levels have been identified.

Solana is bearing the brunt of the post-US CPI sell-off. Since August, the centralized smart contract token has been on a steep trend. The bulls prompted their first retaliation since September 7, but the CPI announcement on Tuesday has caused a shattering wound to all cryptocurrencies in the ecosystem.

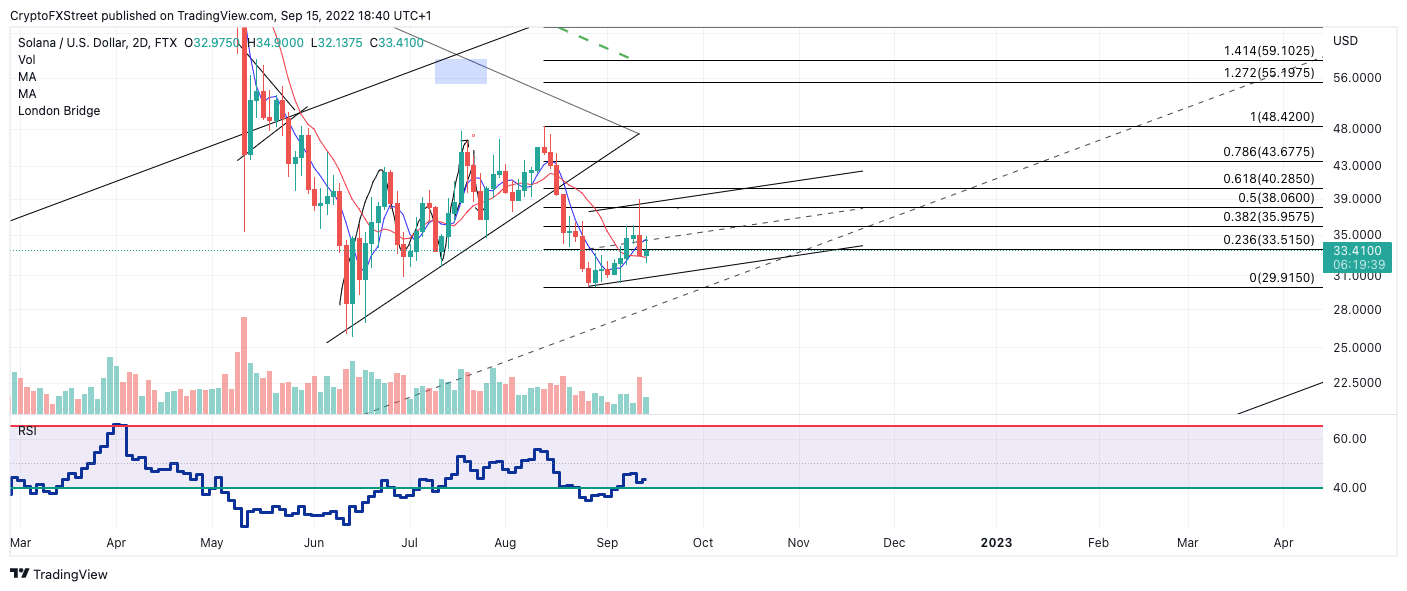

Solana price currently auctions at $33 as the bulls and bears negotiate between the 8-day exponential and 21-day simple moving averages. Compressing the two moving averages around the price is a common occurrence that happens before sharp volatile moves. Traders should be cautious about the direction the Solana price will head next.

SOL USDT

The directional bias could lean in favor of the bears as a recent 50% Fibonacci level (based on the August high at $48.42 and recent swing low at $29.91) rejected the bulls at the $38 area while printing an uptick in bearish volume.

A breach of the swing at $29.91 could prompt a further decline of equal value to the August downtrend. Such a move would result in a 40% decline.

On the contrary, a daily close above $35 could send SOL price towards the 61.8% Fib level of the mentioned downward move at $40. The bullish move would result in a 20% increase from the current Solana price.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.