Solana Price Prediction: A true bull run vs another suckers’ rally

- Solana price has recovered 7% of market value amidst the most recent downtrend.

- SOL price does not show RSI divergence to securely call the bottom of the current mudslide.

- Invalidation of the downtrend is a breach above $40.28.

Solana price shows applaudable retaliation since the early September sell-off. This analysis uses RSI and Fibonacci to consider the directional move.

Solana price is at work

Solana price is fighting back against the bearish onslaught witnessed during the first trading week of September. The bulls have recovered 7% of losses experienced this week, producing applaudable momentum on smaller time frames. Still, despite the optimistic retaliation, traders should apply caution as the floor underneath the current price action looks unstable.

Solana price currently auctions at $33.13. The bulls have successfully closed above the 8-exponential moving average on smaller time frames and now seek to reconquer the 21-day simple moving average near the $33 zone.

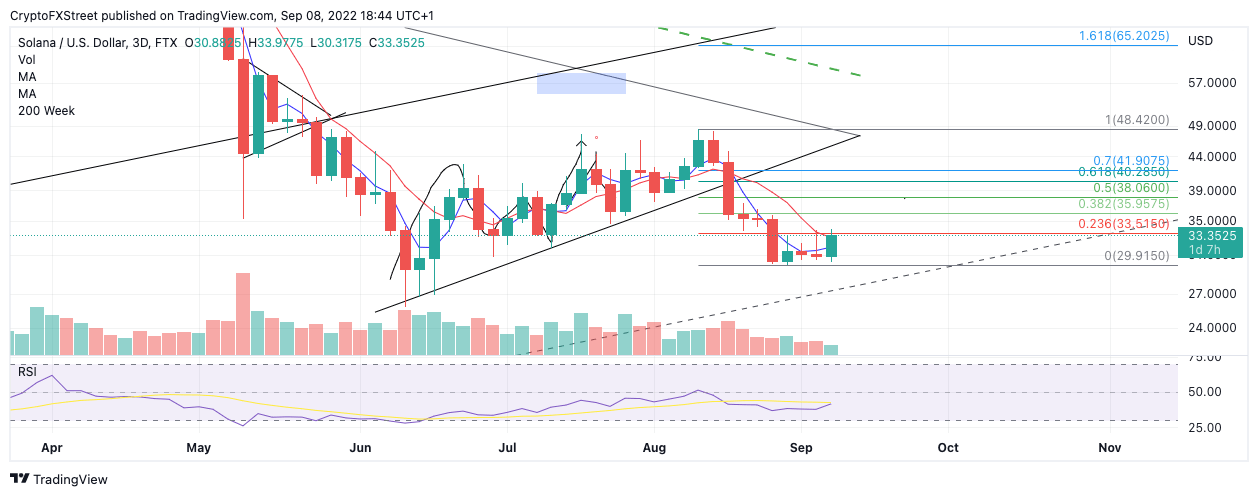

SOL USD 3 Day Chart

A Fibonacci Retracement indicator surrounding the summertime high at $48.42 and the newfound September low at $29 shows the current uptrend move as just a 23.6% upswing. Based on Fibonacci Retracement theory, 23.6% is usually not a strong indication of resistance. If a short-term bottom is in, the Solana price could rally higher towards the 38.2% and 50% retracement levels before high-cap bears flex their muscles again.

Unfortunately, there is one key missing ingredient to suggest the bottom of the downtrend is secure. The Relative Strength Index does not show any divergence to confound a counter-trend idea. Thus placing a bullish entry is still advised.

Traders should keep Solana on their watch lists in hopes that the bottom signal will occur. Until then, leaning into the downtrend or staying out of the market entirely could be the better option. The next bearish target lies at the median line of a historical ascending trend channel that has provided support since early 2020. A decline in this barrier could result in an 18% drop from the current Solana price. Invalidation could be a spike above the 61.8% Fibonacci level at $40.28.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.