These are the challenges that Polygon’s MATIC price can face in July

- Polygon price action sees pressure coming from both sides.

- MATIC price could see its trend over the weekend defined by a close either above or below a pivotal level.

- Expect to see a medium-term breakout as price action starts trading in a narrow way.

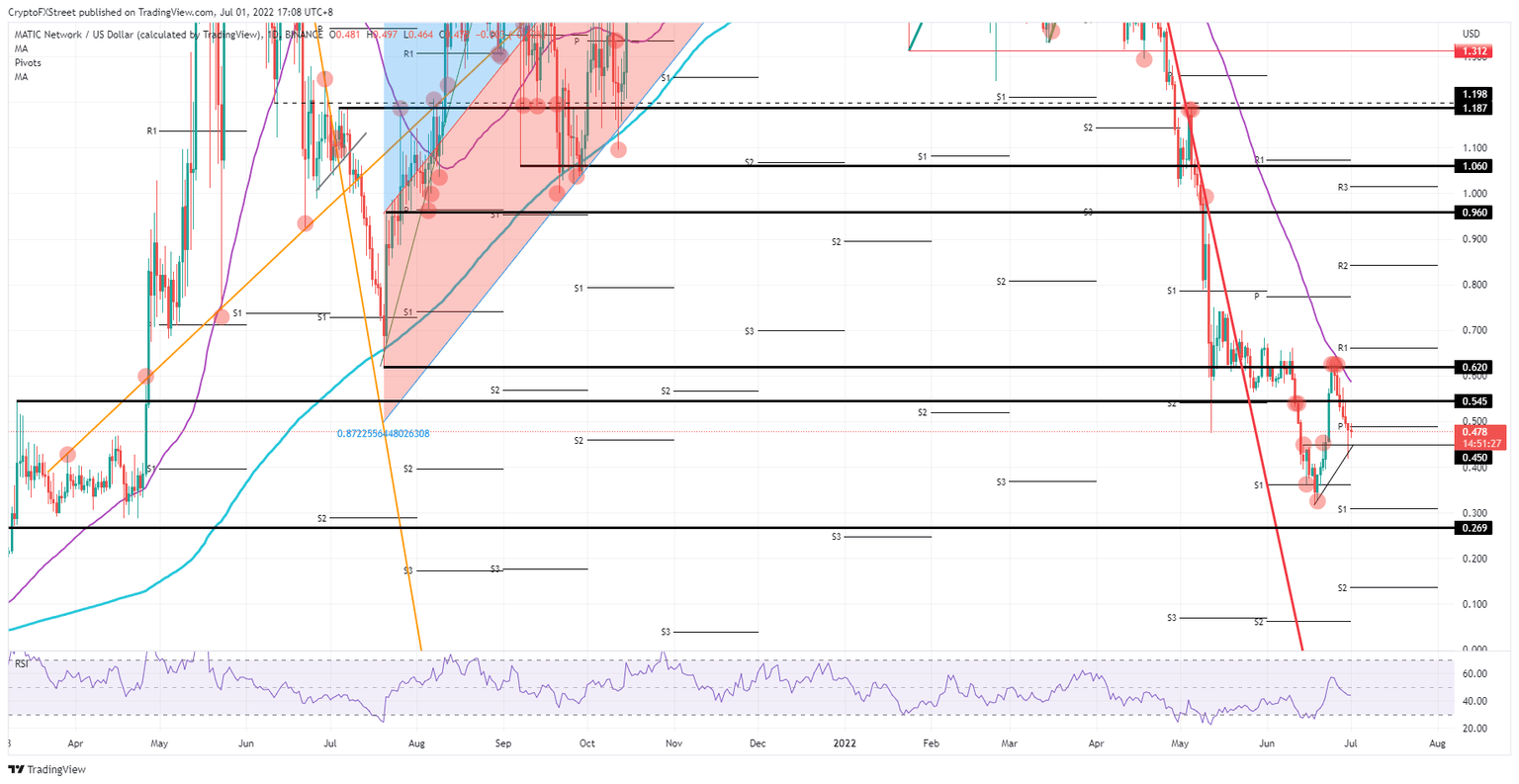

Polygon (MATIC) price is seeing both bulls and bears approaching each other as price action makes lower higher and higher lows since mid-June. As a new month starts, the new monthly pivot level gets repriced almost right in the middle of today’s price action in the ASIA PAC and European session. It will be key to see near the closing bell this evening if MATIC closes above or below the pivotal level to determine which initial trend to be formed in July.

MATIC price caught between a rock and a hard place

Polygon price is trending in a squeeze from both sides as price action consolidates with bears and bulls nearing each other. That fact is also represented in the Relative Strength Index (RSI), which has been trading above 50, after coming out of oversold. Thus far, all looks good in this price equilibrium, although the start of a new month reprices the crucial monthly pivot levels and sets the mid-pivot almost in the centre of today’s price action, making it a crucial element to determine where price action will close this evening.

MATIC price is expected to close below the monthly pivot for July as the current market narrative is still quite bearish, and equity markets have started another leg lower these past few days. Expect a break below $0.450 and a slide towards $0.300 with the new monthly S1 support positioned before $0.269 to catch any price falls beforehand. This means roughly a 35% negative result and a possible new low for this year.

MATIC/USD daily chart

As mentioned above, the daily close for today could be above the fresh monthly pivot, and in that case, it will mean that going into the weekend, a rally could unfold towards $0.545 as volume dies down a little bit and moves could get stretched quicker as fewer market participants will be present. Even a $0.620 would not be impossible, although the 55-day Simple Moving Average could be proven again to be the one hurdle to break the rally, as it has in the past.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.