Terra Luna Classic price to retrace 10% as LUNC bulls hit a brick wall

- Terra LUNA Classic price could flip sentiment after a bullish ASIA-PAC trading session.

- LUNC is set to drop another leg lower as the US trading week begins.

- Expect to see volatile moves this Monday with a possible leg lower toward $0.000012000.

Terra LUNA Classic (LUNC) price is all over the place after price action jumped roughly 8% during the ASIA-PAC trading session on Monday as markets are in panic mode. Unfortunately, bulls cannot bank on the early move upwards as bulls are facing a rough technical area. With bears set to kick the bulls in the gut, another slide lower and back to the level from Sunday looks like the most plausible outcome for this Monday.

Terra LUNA Classic opens up the risk with a volatile Monday trading day

Terra LUNA price saw bids coming in hard and heavy as traders seized the bullish momentum during the ASIA-PAC session. Altcoins were able to jump on the back of several reassuring comments that Silicon Valley Bank and Signature Bank depositors are not at risk of losing money. Sentiment changed 180 degrees as the European trading session came into play with contagion risks, which could again mean more troubles for the crypto industry.

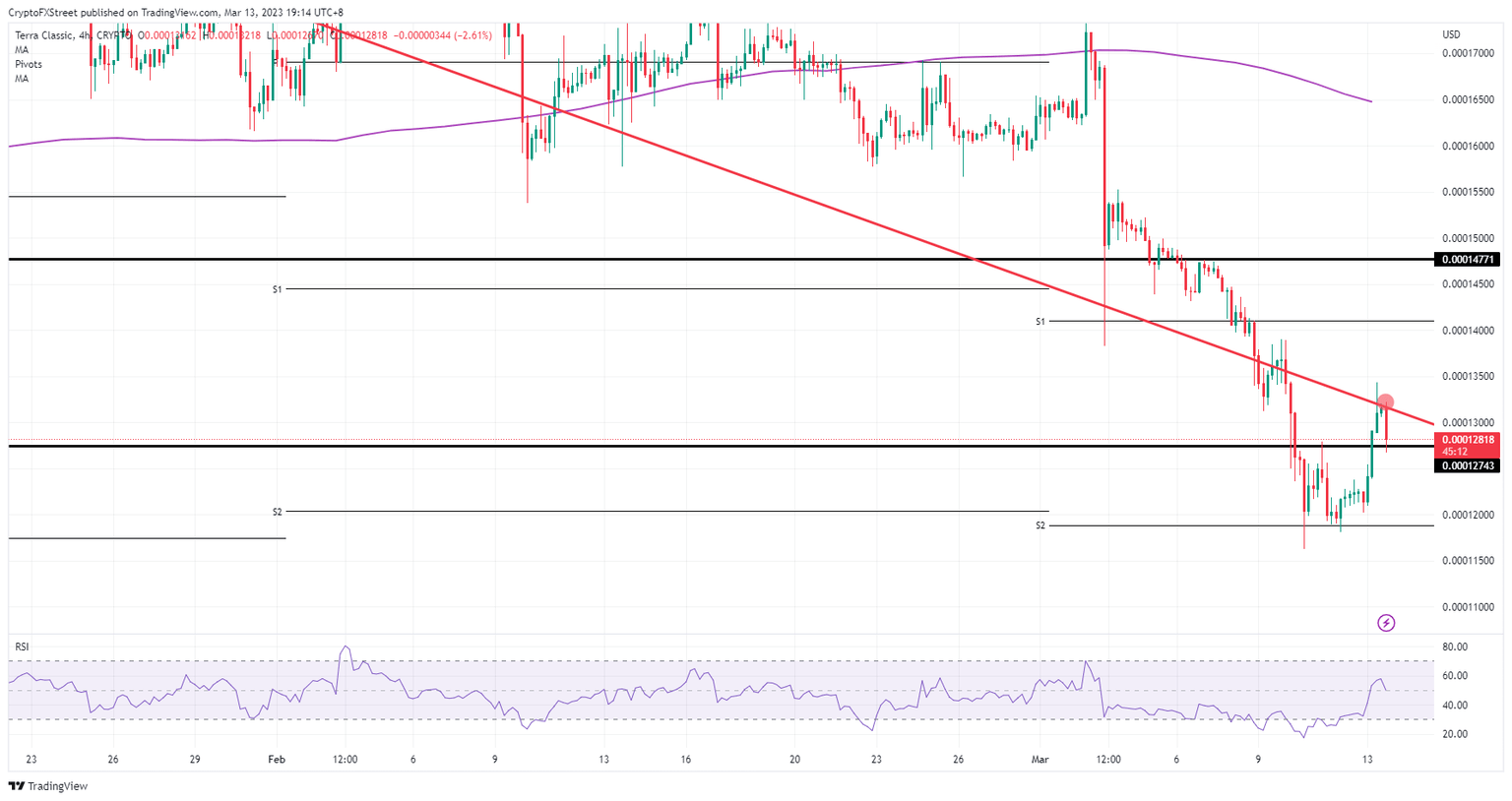

LUNC sees bulls taking a step back after hitting that red descending trend line just around the time the ASIA-PAC session was going to sleep and handed over the trading stick to the European trading session. A fade over 2% occurred with support at $0.000012743. Expect to see more volatility with at risk a leg lower toward $0.000012000 and price action to head back to the low of this weekend.

LUNC/USD 4H-chart

If support at $0.000012743 holds, a squeeze to the upside could happen with a breakout above the red descending trend line. That means that a break above the red descending trend line would trigger a bear trap for short-sellers at that same red descending trend line this early Monday morning. A clean breakout above the red descending trend line could see a sprint by the bulls toward $0.000014771 and make 12% for this Monday.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.