Here’s what to expect from LUNC after Luna Classic community failed to meet burn target

- Luna Classic successfully completed its upgrade to v1.0.5 on February 15, however the community failed to meet the burn targets.

- In the absence of Binance’s monthly LUNC burn, nearly 10 million tokens were burnt by the community members, LUNC DAO and the Cremation Coin project.

- LUNC yielded 8% losses for holders over the past week, after the blockchain upgrade and failure to reduce the token’s circulating supply.

Luna Classic went through a successful blockchain upgrade on February 15. While developers were busy with a smooth transition to the updated version of the project, the community failed to meet the LUNC burn target.

Burn is key to Luna Classic’s community since the reduction in the token’s circulating supply fuels a bullish sentiment among LUNC holders.

Also read: What do institutional giants know about GMX: Do Amber Group and Arca expect a 20% rally?

Luna Classic successfully transitions to v1.0.5

Luna Classic (LUNC), formerly LUNA successfully upgraded to v1.0.5 at block height 11,543,150 on February 15. Developers were busy with the blockchain upgrade, and the LUNC community failed to meet burn targets.

LUNC’s burn mechanism helps reduce the circulating supply of the token and fuels a bullish narrative among holders. Initially, Binance burned trade fees collected for LUNC pairs on the spot exchange. However, this week Binance did not execute its monthly LUNC burn, and in the absence of the exchange’s token burn, the community burned nearly 10 million Luna Classic tokens.

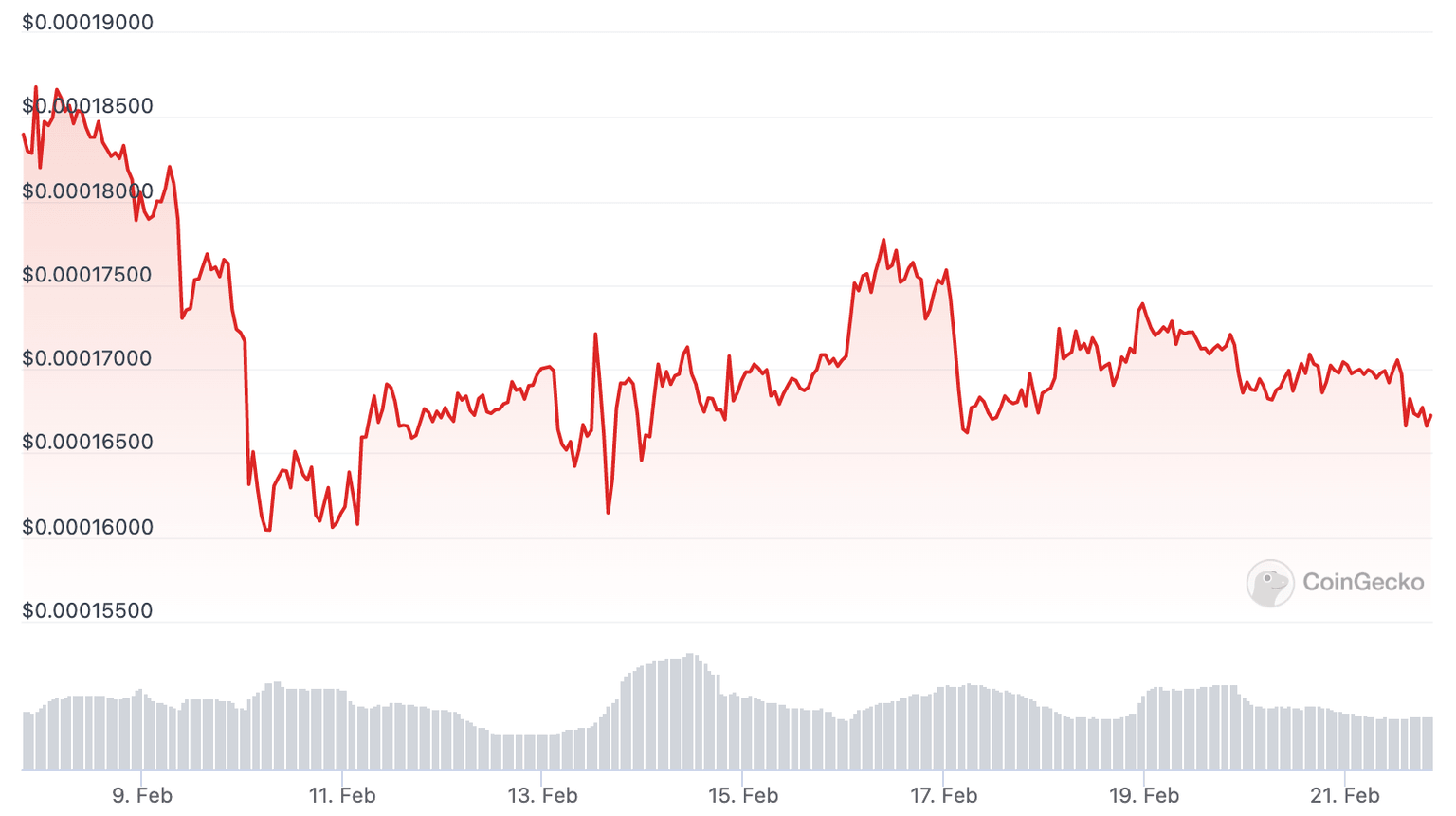

The Terra Classic community therefore missed the burn target, in the absence of significant burn in the LUNA ecosystem. This fueled a bearish sentiment in crypto market participants, with LUNC price nosediving to $0.000167.

LUNC price chart

Despite market-wide crypto recovery, Terra Classic is under selling pressure and it is likely that LUNC’s short-term uptrend may reverse soon. LUNC has yielded nearly 8% losses for holders since February 7.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.