Swipe Price Analysis: SXP draws nigh to 50% technical upswing

- Swipe is moving closer to an ascending triangle breakout likely to bolster it toward $6.

- The MACD has flipped bullish, reinforcing the uptrend.

- Declining network growth is a bearish signal that could hamper the expected upswing.

Swipe is among the crypto assets in the green during the European session on Tuesday. It has incurred almost 10% gains over the previous 24 hours, and the bullish outlook seems intact. SXP is teetering at $3.4 at the time of writing, while technical levels align for an ultimate liftoff to new all-time highs.

Swipe looks forward to a triangle breakout

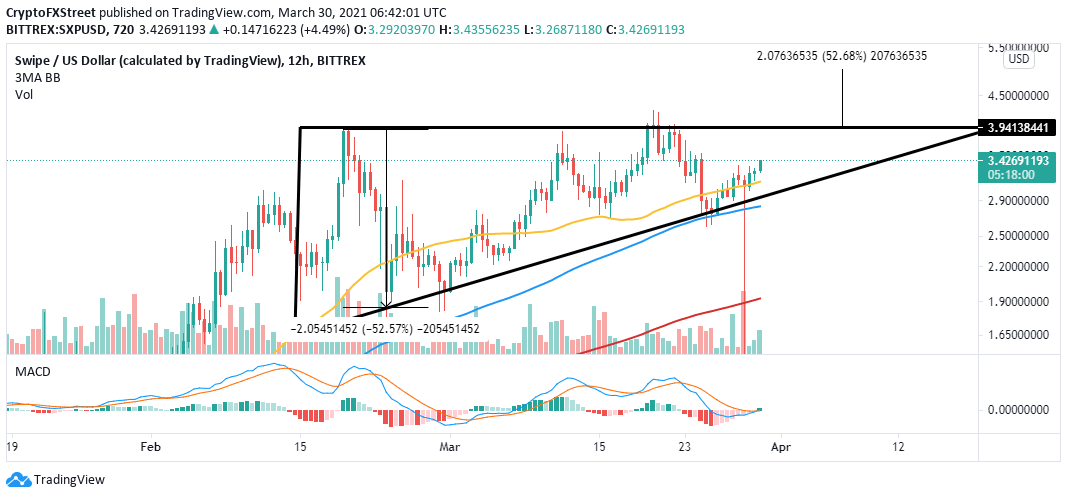

Swipe is dancing within the confines of an ascending triangle pattern. Besides, the token is getting close to a breakout as it closes the gap toward the x-axis. An ascending triangle is a bullish pattern that results in a significant upswing.

The pattern usually forms after an asset has witnessed considerable growth in value, followed by a retreat. Once a support level has been established, a recovery leads to a consolidation period, succeeded by a technical breakout.

For instance, Swipe is likely to lift 55% higher if the resistance on the x-axis cracks. Triangles are known to have exact breakout targets, measured from the highest to the lowest points.

SXP/USD four-hour chart

The Moving Average Convergence Divergence (MACD) indicator has turned bullish on crossing into the positive region. Swipe's positive outlook has also been validated by the MACD line (blue) lifting above the signal line.

Looking at the other side of the picture

Swipe is dealing with declining network growth, as highlighted by Santiment's on-chain metric model. The number of new addresses joining the network topped out at 298 on March 13 over a 30-day trailing average. However, at the time of writing, the newly-created addresses stand at 114, representing a 50% slump.

Swipe network growth

It is worth noting that low or declining network growth dramatically impacts the community's level of interaction. It also reduces investor speculation while interfering with the inflow and outflow of tokens on the network. Therefore, it is usually a bearish signal when an asset's network growth slows or falls appreciably.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B10.32.04%2C%252030%2520Mar%2C%25202021%5D-637526881996234429.png&w=1536&q=95)