Stellar Price: Here are the levels to watch as XLM prepares for a weekend rally

- Stellar price holds firmly to support at $0.0880 while consolidating weekly losses.

- Fonbnk and the Stellar Organization collaborate to assist more than two billion people join the digital financial world.

- Increasing buying pressure may trigger a buy signal from the TD Sequential indicator.

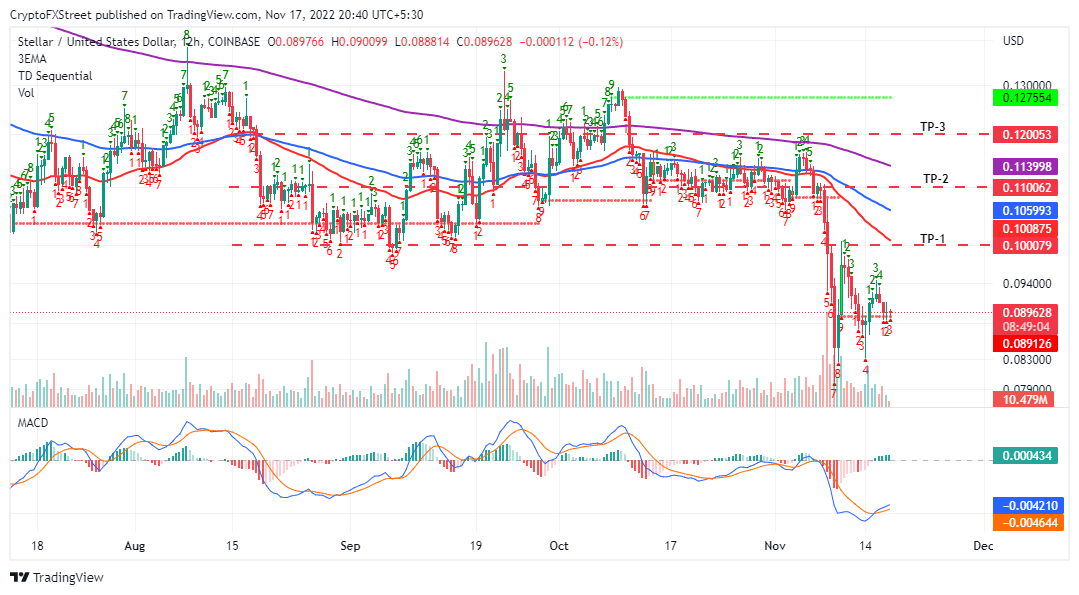

Stellar price consolidates losses slightly above crucial support at $0.0880. Earlier this week, the cross-border money remittance token attempted to recoup losses incurred during the events that led to the untimely collapse of FTX, but it only made it as far as $0.1000. XLM now trades at $0.0897 ahead of another northbound move that could see it tag $0.1200.

Stellar and Fonbnk turn sim cards into virtual debit cards

The Stellar Organization has partnered with Fonbnk, a platform that enables frictionless movement of value for unbanked people globally. Approximately 350 million people on the African continent have no access to bank accounts, while only 20% of families have formal accounts with banks.

The Stellar Organization believes this collaboration with Fonbnk offers “a real-world solution to this problem,” with the potential to turn eight billion active prepaid SIM cards into virtual debit cards supported by the Stellar blockchain.

“Once users load prepaid airtime credits onto Fonbnk wallets, those credits are on-ramped onto the Stellar network, digitized into tokens named MIN which can then be turned into USD Coin (USDC),” the Stellar Organization explained via a Twitter post.

If seen through to completion, this opportunity could onboard more than two million people onto the digital financial world.

Stellar price on the cusp of a bullish breakout

Stellar price was forced to abandon the push for a 61.8% retracement north of support at $0.0800. Higher support at $0.0880 ensured that declines emanating from XLM’s rejection at $0.1000 did not revisit the primary support level.

A buy signal presented by the Moving Average Convergence Divergence (MACD) indicator encouraged buyers to be patient, which kept the bullish outlook in XLM intact. A 12-hour to a daily candlestick close above the support mentioned earlier at $0.0880 is necessary for Stellar price to start closing the gap to $0.1000 (TP-1).

XLMUSD 12-hour chart

A little push by the bulls to the upside could trigger a buy signal from the TD Sequential indicator. A red nine candlestick will represent the buy signal, with traders encouraged to buy when the low of the sixth and seventh candles in the count closes below the low of the eighth or the ninth candlesticks.

Conversely, sell orders could turn profitable immediately Stellar price breaks support at $0.0880. Declines that follow could stretch to its primary support at $0.0800 and $0.0760 if push comes to shove.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren