Solana Price Prediction: With negativity priced in, SOL could jump 80% in just three months

- Solana price takes a step back as Solana stays the favourite altcoin.

- SOL as a decentralized blockchain platform is set to outperform Ethereum.

- WIth the US regulatory crackdown around the corner, SOL is set to become the next best thing.

Solana (SOL) price is set to rip roughly 80% higher in the coming months as a massive tailwind heads its way. A big dispersion is set to happen in cryptocurrencies as the US regulatory crackdown is just around the corner. Several people close to the matter have already reported that decentralised tokens and coins are safer as centralised cryptos are set to get slaughtered.

Solana price set to see Ethereum clients choose sides in favor of SOL

Solana price is taking another step back this week and is currently caught between a rock and a hard place. Positive news will soon kick in as decentralized cryptocurrencies will gain renewed focus with Solana as the frontrunner. Several people close to the US regulatory crackdown on cryptocurrencies have mentioned that decentralized coins fall outside the scope of any rules.

SOL can see a major inflow of investors that are fleeing several centralised cryptocurrencies such as XRP and Ethereum just to name a few. Although ETH is nearly 50% decentralized, it will be in the crosshairs of the new US regulatory package. Expect a massive inflow into SOL that will see its price spiral higher toward $40.

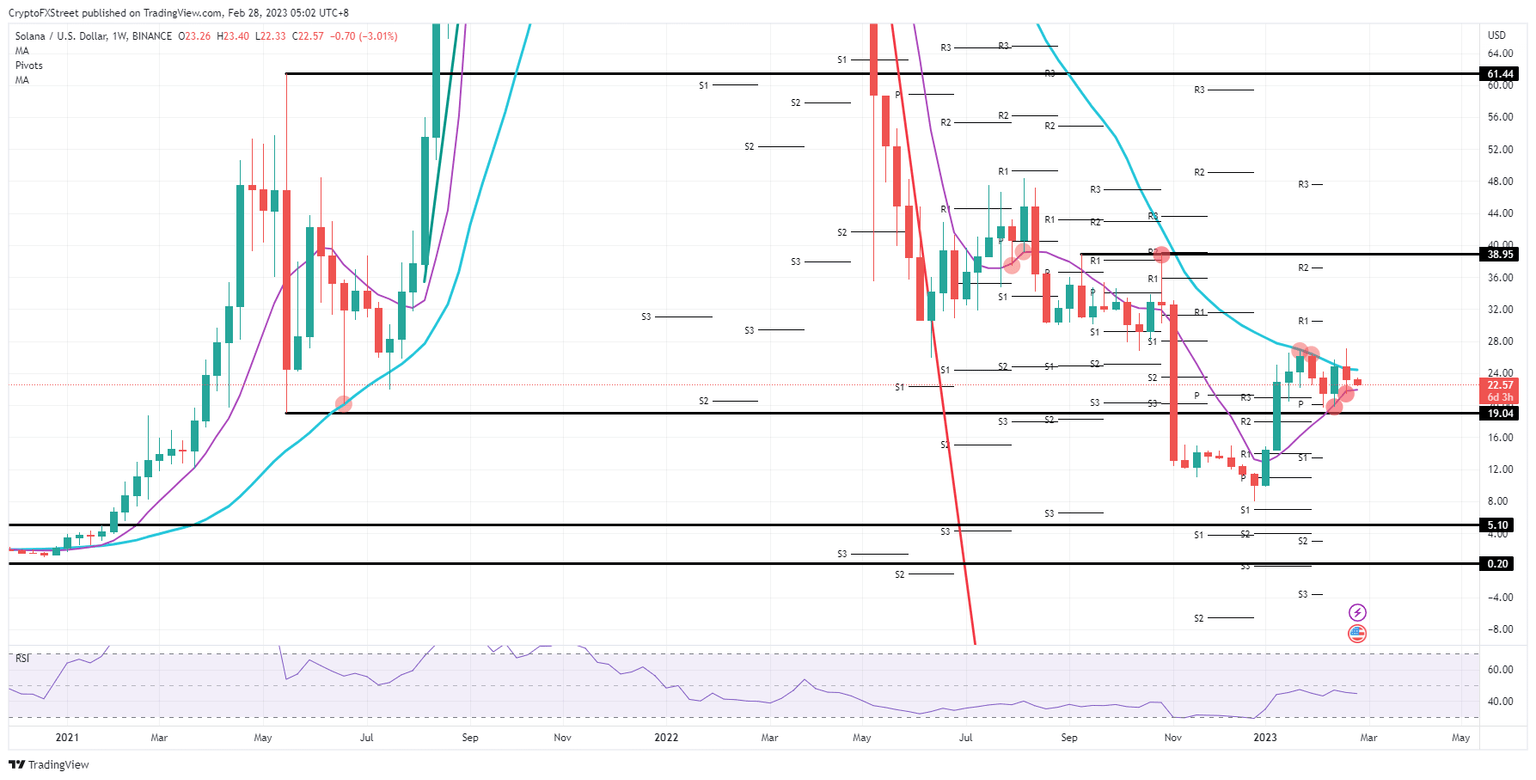

SOL/USD weekly chart

Big risk is present that a breakdown of support could see the rally of 2023 be fully unwouned. The writing on the wall would be a break below $19. Once that happens, warning signals will be issued and might see Solana price decline near 60% toward $9.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.