Solana Price Prediction: Signs of a steeper correction underway

- Solana price lost 6% of market value last week.

- Retesting the monthly low at $19.68 would result in a 12% decline and could catalyze a much larger downswing.

- Invalidation of the bearish thesis would come from a break above $23.87.

Solano price is displaying bearish cues during the final week of February. Traders should keep the centralized smart contract on their watch list for a potential bearish trade.

Solana price could retest the lows

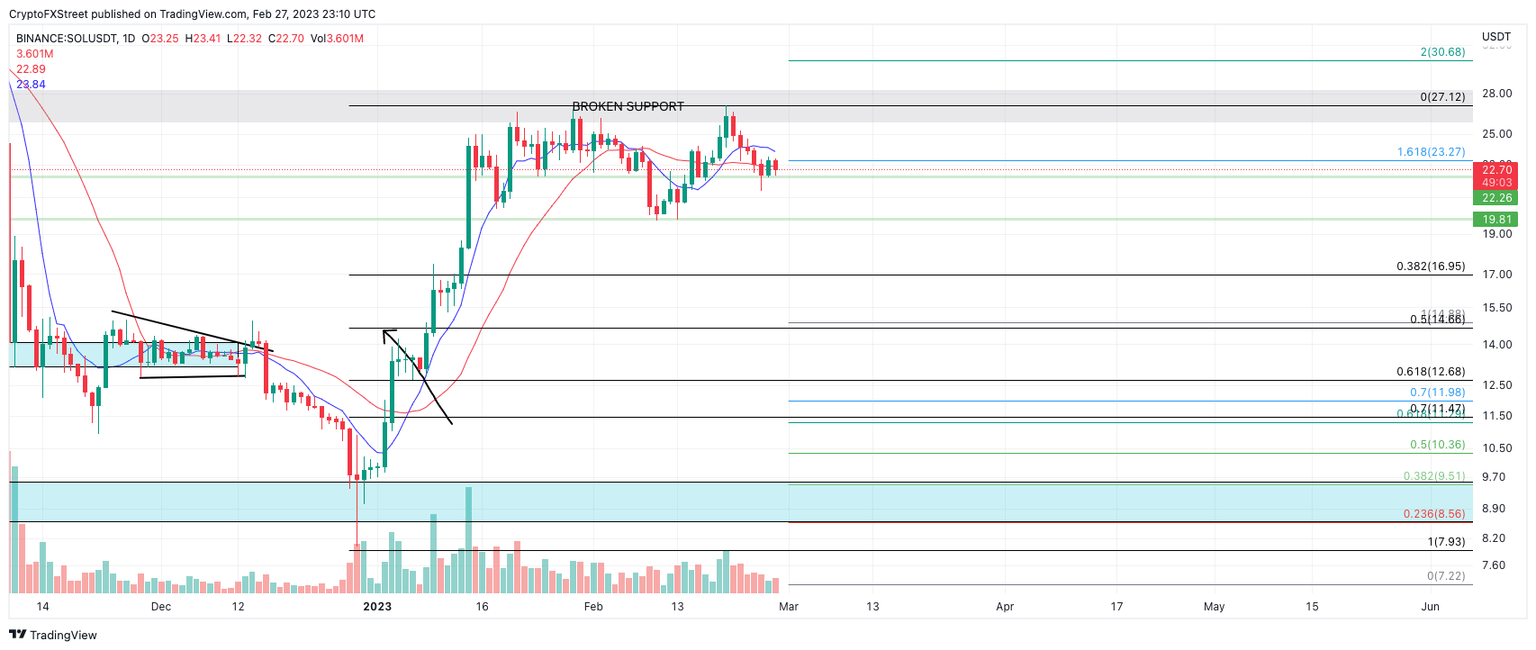

Solana price hints at an upcoming downswing as the technicals consolidate near the mid-22 dollar zone. Last week, the SOL price witnessed a 6% decline as the bears established a weekly close beneath the 8-day exponential moving average. On February 27th, the Solanaprice continued to find resistance as the 21-Day SMA rejected the retaliation bounce from last week's low at $21.41.

Solano price currently auctions at $22.60. The moving average indicators suggest that shorter-term traders are building momentum to the downside. A Fibonacci retracement tool surrounding Solana's winter rally from the low at $8 into the high at $27.12 shows a substantial amount of cushion space below. It is common for strong impulses to retrace between 50 and 61.8% of a move. The Solana price could decline as low as the $10.30 zone before the winter rally continues its next leg up. This leaves the potential for a 55% decline in Solana's price from the current market value.

Still, traders should take one step at a time before calling an end to Solana's Impressive 2.5x rally since December 30. The first stopping grounds for the bears would be February's monthly low at $19.68. Such a move would result in a 12% decline from SOL's current market value. A sweep of this low would confirm the bias that a much steeper pullback is underway.

SOL/USDT 1-Day Chart

Invalidation of the bearish thesis would arrive from a break above February's monthly opening price at $23.87. if the bulls reconquer this level, the winter rally could continue heading north, leading to a breach of February's high at $27.12. A retest of the monthly high would result in a 20% increase from Solanas current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.