Solana price must regain $100 to recover from market volatility

- Solana price sees bulls trying to support monthly S2 support at $89.

- Although SOL price broke below it yesterday, bulls are re-defending the level.

- Expect a last test to the downside as the RSI is firmly oversold and holds limited potential for further losses.

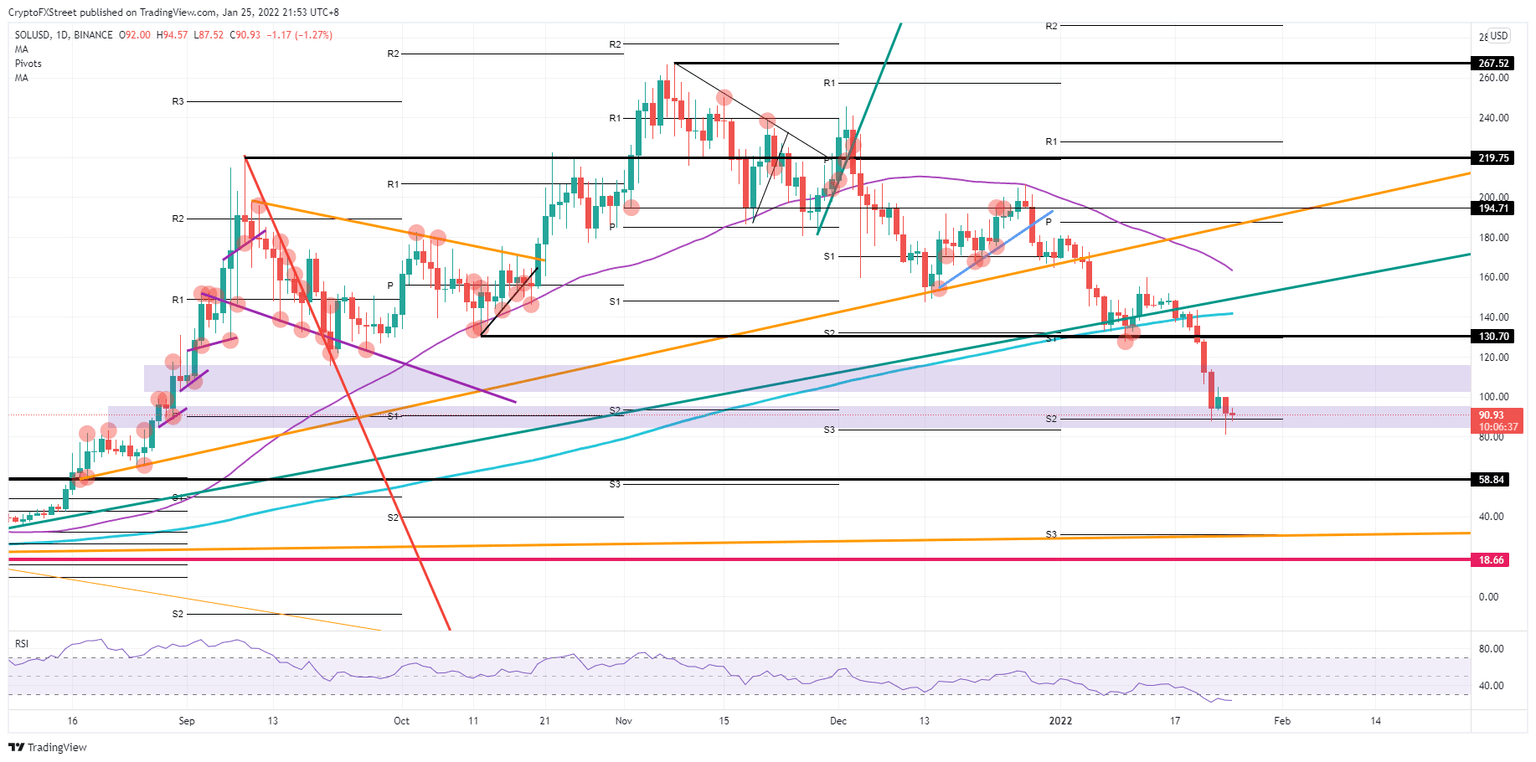

Solana (SOL) price broke below the monthly S2 support at $89 and targeted $59 to the downside. The entrance of bulls could push price action in SOL back above S2 and keep it there going into today's session. If bulls can hold the support, expect a possible bullish knee-jerk reaction that could spark a return towards $130 by the end of the week.

Solana set for a baby step recovery

Solana price got slaughtered the past few days as it lost 34% of price valuation in just four trading days. Although the monthly S2 support level proved to be very important, it was no match for selling pressure yesterday when SOL price slipped below $89 but got stopped in its tracks and sent back above the S2, with bulls engaging in price action late into the US session. Bulls see a case for a turnaround, and temporary halt of selling pressure as bears will want to book gains and the Relative Strength Index (RSI) is deeply in the oversold area, limiting any further outlook on gains near-term.

SOL bulls could have another go again today and could hit $100 in their small bullish candle, trading away from the S2 support. Although US indices futures look in the red again, the selloff is not as large as seen yesterday and Friday, which points to bulls eating up and halting further downside pressure. If bears flee the scene, SOL could return to $130 by the end of the week, paring back the losses for 2022.

SOL/USD daily chart

That being said, some weak earnings from tech stocks could further weigh on the Nasdaq and see another spillover effect into cryptocurrencies, further mounting pressure to the downside. The bulls would get stopped out from their attempt to run price action up to and see their attempts being tested back to yesterday's lows. A break, however, in SOL would see a sharp nose dive towards $59 with the low of August 2021 in place.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.