Solana price explodes as Ethereum-killer network powers a Web3 mobile phone

- Solana price witnessed a massive rally after the Etehreum-killer announced the launch of a Web3 mobile phone, Saga.

- The modified mobile handset will have a specialty crypto wallet function and a software development kit for Web3 programs.

- Analysts remain bullish on Solana price, eye return to $45 level.

Solana network announced the launch of its mobile phone, Saga, an Android. The phone marks Solana’s foray into mobile-focused growth in the Web3 ecosystem. The Ethereum-killer’s announcement has fueled a bullish sentiment among holders.

Solana Labs announces development of Web3 mobile phone

The Solana network, considered one of the leading competitors of the largest altcoin Ethereum, is launching its own mobile phone called “Saga.” The Android handset’s key blockchain stakeholder is Solana Labs.

Solana Labs is modifying an OSOM handset with specialty crypto wallet functions and adding a Solana Mobile Stack (SMS) development kit for decentralized applications, Web3 programs. Solana Labs announced the launch of the phone in a conference last week, and it triggered a bullish sentiment among holders.

Anatoly Yakovenko, CEO of Solana Labs said that the mobile phone would cost about $1,000 and will be available for delivery in early 2023. Solana has moved on to mobile-focused growth and “Solana Pay” will be integrated to enable on-chain payments.

Analysts believe Solana price uptrend could continue

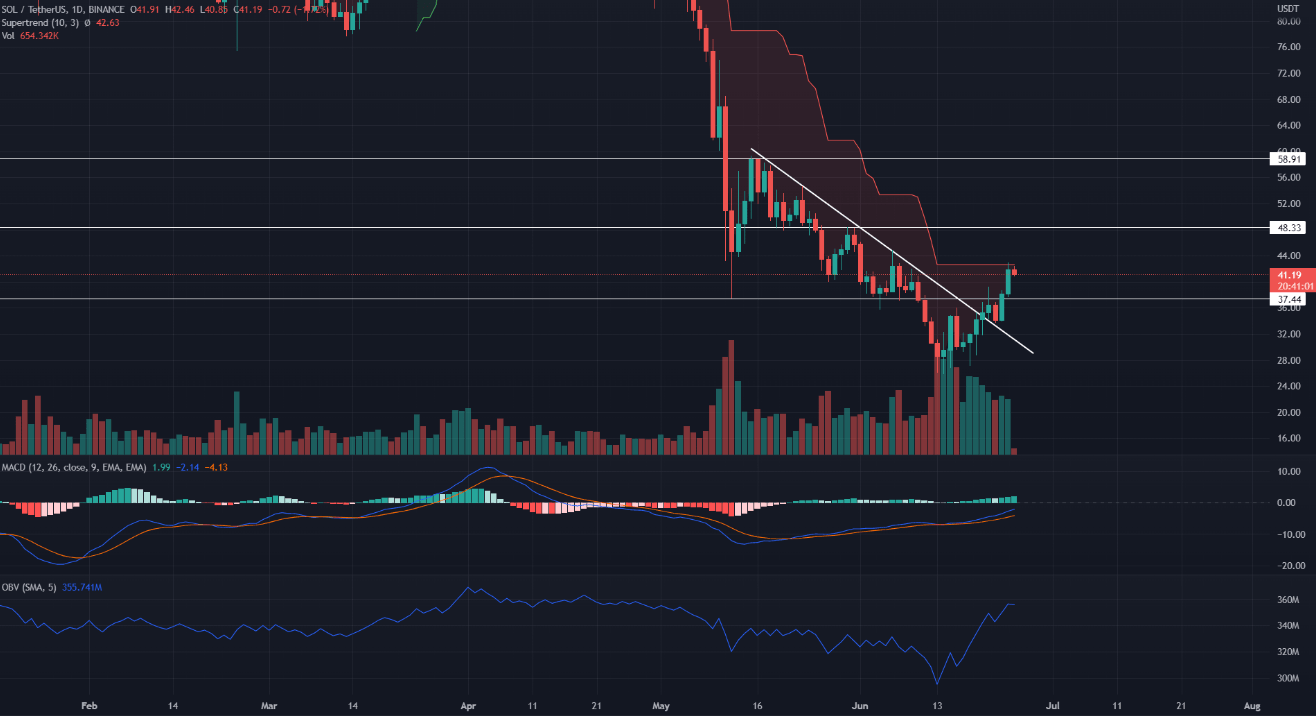

Analysts have evaluated the Solana price chart and predicted a continuation of the Ethereum-killer’s uptrend. Brian Bollinger, a crypto analyst argues that MACD indicator slope is rising and this indicates growth in underlying bullishness. There is an increase in interest in long positions in Solana and the altcoin could continue its uptrend. The next resistance for Solana price is at $48 level.

SOL-USDT price chart

FXStreet analysts believe Solana price presents an excellent opportunity for traders. For more information and price targets for the Ethereum-killer Solana, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.