Solana price to tag $50 following upgrade to prevent network outages

- Solana developers set to release upgrade v1.9.28/ v1.10.23 to prevent the blockchain from halting if durable nonce transactions fail.

- Ethereum and Solana networks are being actively drained as institutions pull out of ETH and SOL to pour capital into the Cardano network.

- Analysts have identified a reversal pattern in Solana, alongside bullish divergence and predict a rally to $50-$52 level.

Solana blockchain is protected against halts and outages with an upcoming upgrade for durable nonce transactions. Institutional capital is flowing out of Solana to the Ethereum-killer Cardano network. Analysts remain bullish on the Solana price rally.

Also read: Solana price dives below $40 after second network outage in a month

Solana blockchain to witness upgrade, protection against outages

The Solana blockchain was halted at least seven times over the past twelve months as the network suffered outages that lasted several hours. The latest event when Solana blockchain went offline was a result of failure to process durable nonce transactions correctly.

Developers have come up with release v1.9.28/ v1.10.23 that prevents the Solana blockchain from halting if the same issue [durable nonce transaction processing error] occurs again.

Solana utilizes parallel processing for non-overlapping transactions to increase its throughput. Durable nonce transactions do not expire and require a different mechanism than normal transactions to prevent double processing. Such transactions use an on-chain value specific to each account that is rotated every time a transaction is processed. Therefore, after value rotation, the same transaction should not be processed again.

However, during the last outage, a durable nonce transaction was processed while its blockhash was recent enough for it to be treated as a normal transaction on the Solana blockchain.

Transaction processing failed, transaction fees were paid, and the user resubmitted the failed transaction to the blockchain. The “resubmission” of the durable nonce transaction activated a bug in the runtime environment. This is addressed in the next release by Solana developers.

Cardano drains institutional capital from the Solana network

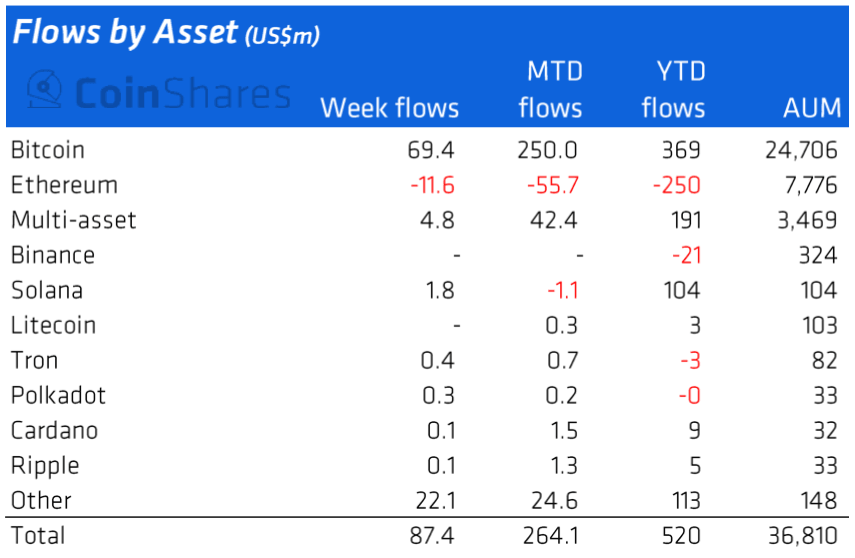

Based on data from a Digital Asset Bi-Monthly Fund Manager report by CoinShares, there is an increase in institutional capital inflow to Polkadot, Cardano and XRP at the expense of Ethereum and Solana.

There is a significant reduction in positions in Solana, falling from 4% weightage to 1%, despite a "low caution" rating from CoinShares. The report highlights that institutions are reallocating their funds to Cardano, moving out of Ethereum and Solana.

The key theme is reallocation and not inflow of funds to the altcoin. CoinShare’s weekly Digital Asset Funds Flows revealed a $1.8 million weekly inflow to the Solana blockchain. Therefore, the concern is capital rotation by institutions and not an overall dearth of inflows to Solana.

Capital flows by asset from CoinShares weekly fund flow report

Solana price targets $50 in new uptrend

Analysts have evaluated the Solana price trend and noted that the devaluation from the $85 mark indicated a bear run and a 62.5% weekly decline. Solana price hit its nine-month low, approaching support at $38 with mounting selling pressure. As Solana price recovers from the slump, analysts predict a potential bounce-back alongside the reversal pattern.

A key indicator, the basis line of Bollinger Bands, looks south and affirms the bearish edge. Analysts believe the falling wedge setup could be followed closely by a breakout to the $50-$52 range.

Indicators on Solana price chart

@Pentosh1, a pseudonymous cryptocurrency analyst, believes probabilities and historical trends predict a rally in Solana price. The analyst has set a target of $58 to $60 for Solana price.

$SOL

— Pentoshi (@Pentosh1) June 6, 2022

It is time imo

Probabilities and history say this likely rallies harder than people think too

Think we see $58-60 https://t.co/Yb9Ftsj2ew pic.twitter.com/d59WJA8M51

FXStreet analysts evaluated whether Solana price can recover from the recent network outage. For more information watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.