Solana price dives below $40 after second network outage in a month

- Solana price tumbles as the blockchain is hit by a software glitch, resulting in a second network outage over the past month.

- The Solana network has shut down more than seven times over the past year, staying offline for several hours.

- Analysts predict another leg down in Solana price before the Ethereum-killer begins its recovery.

Solana price suffered a drop as a software glitch hit the blockchain and led to an outage for the eighth time over the past year. Analysts believe Solana price could plummet lower before it recovers from the slump.

Also read: Solana price will outperform once it overcomes this resistance level

Solana price nosedives as glitch hits network blockchain

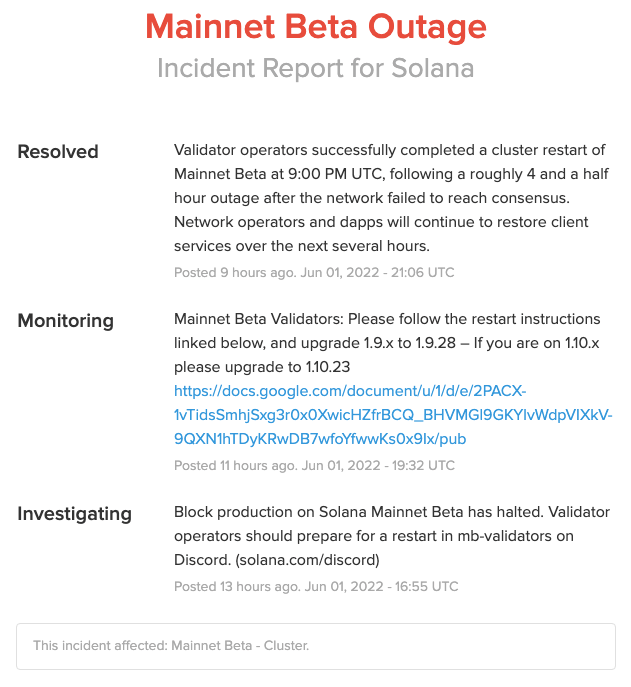

After suffering a full outage, the Solana price has plummeted below the $40 level. Block production on the Ethereum-killer blockchain was halted at 16:55 UTC on June 1. The outage lasted four and a half hours as validators restarted the mainnet around 21:00 UTC.

Reportedly, a software glitch or a bug triggered the outage and halted the Solana blockchain. The outage has been resolved based on the incident report, and network operators and dApps will continue to restore client services over several hours. The bug was identified in a niche type of transactions designed for offline use cases, and validators began disabling the “durable nonce transactions” until developers identified and patched it.

While the Solana blockchain was offline, there may have been ramifications for custodians whose transactions fall under the “offline-use case” category. The outage could have frozen their ability to move funds until the patch is in.

Incident report by Solana

The incident on June 1 was a failure in Solana’s network ability to handle durable nonces. Instead of treating them as a single transaction, validators double-counted them at two different block heights, breaking the blockchain’s consensus mechanism.

Stakewiz.com, a firm that operates validators on the Solana blockchain, offered insight into the issue. After observing an incidence of this error over the weekend, the validator reported it to the Solana blockchain. However, the bug didn’t affect a broader cluster at the time.

Solana halt today, what happened?

— Laine | stakewiz.com (@laine_sa_) June 1, 2022

A bug relating to durable nonces was triggered on a majority of validators, leading to a block hash mismatch & validators stalling.

This was actually a known bug that was being fixed and hadn't been triggered in this form previously.

This is not an isolated incident, and the Solana blockchain has suffered at least seven full or partial outages over the past twelve months. The Ethereum-killer’s blockchain has been plagued with outages and suffers service disruptions on the regular, which have degraded Solana’s performance. The blockchain was hit nine days in the month of January 2022. Duplicate transactions triggered a second outage, in less than thirty days, a third in late April and a fourth in early May. The Solana network was down for nearly eight hours as NFT minting activity overwhelmed the Ethereum-killer’s blockchain.

Solana’s blockchain clock is slow and is running 30 minutes behind in real-time. The Solana status page reads,

On-chain time continues to run behind that of wall clocks due to longer-than-normal block times.

Analysts predict a continuation of Solana downtrend

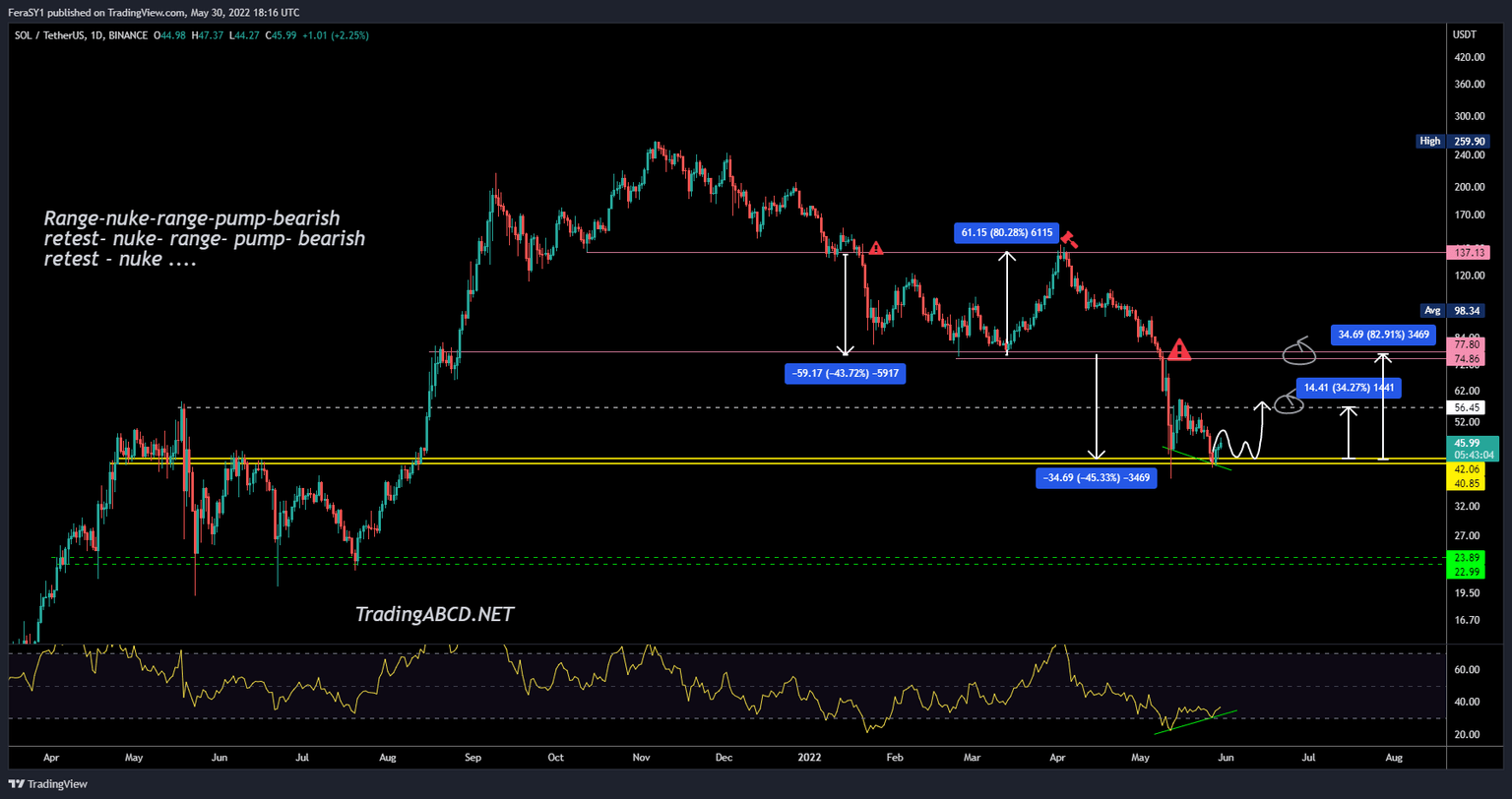

@FeraSY1, a YouTuber and leading cryptocurrency analyst, evaluated the Solana price chart and identified a downward trend. The analyst describes it as “nuke-chop-pump-bearish retest-nuke again.” According to Feras, Solana price drop below $40 is a confirmation of the altcoin plummeting to the $22 downside target.

SOL/USDT price chart

@SmartContracter, a technical analyst and trader, also has a bearish outlook on Solana. The analyst argues Solana price could range between $25 and $27 level. The analyst applies Elliott Wave Theory, considered a form of technical analysis that looks for recurrent long-term price patterns.

The analyst is looking for a drop to complete significant wave C so that Solana can complete its corrective pattern.

between 25-27 is where i'd be looking to accumulate $sol for long term bags, the macro still looks like it needs to put in another 5th wave down to complete a major wave C

— Bluntz (@SmartContracter) May 31, 2022

alot of major alts also look like this, so i wouldnt be surprised to see one more leg down across the board pic.twitter.com/ENoGdzi4Vw

Analysts at FXStreet believe Solana price will outperform once it overcomes its resistance level. For more information watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.