Solana price bleeds despite launch of Seoul Hacker House event

- The Solana Foundation has powered a four-day offline event, offering in-person guidance from Solana Labs engineers.

- Solana price continued to bleed, posting 14% losses over the past two weeks.

- Crypto Twitter speculates OpenSea’s integration with Solana, fueling a bullish sentiment among investors.

Solana, considered an Ethereum-killer, continues to decline despite the launch of a hacker event in Seoul. Analysts continue to remain bearish on Solana price.

Solana Labs powers Seoul Hacker event

The Solana Foundation powered a four-day offline event with in-person guidance from the core Solana Labs engineers. Solana has offered mentorship for attendees and during the event, engineers offer informative educational programming around DeFi, NFTs and how to get started on Solana.

Advice and support from core Solana Lab engineers could help projects get started on the blockchain. Despite kicking off the event, Solana price failed to recover from the slump.

What will you build?

— Solana Hacker House | London June 14-18th (@hackerhouses) June 10, 2022

Register now for the @solana x @jump_ Hacker House in Seoul this summer!

August 3-7th, 2022https://t.co/xFrYFeVS9B

Before the Seoul event, there was a Web3 coding camp awards ceremony that Solana powered in Vietnam. Events have fueled a positive outlook in the Solana community.

Solana continues to bleed, posts losses

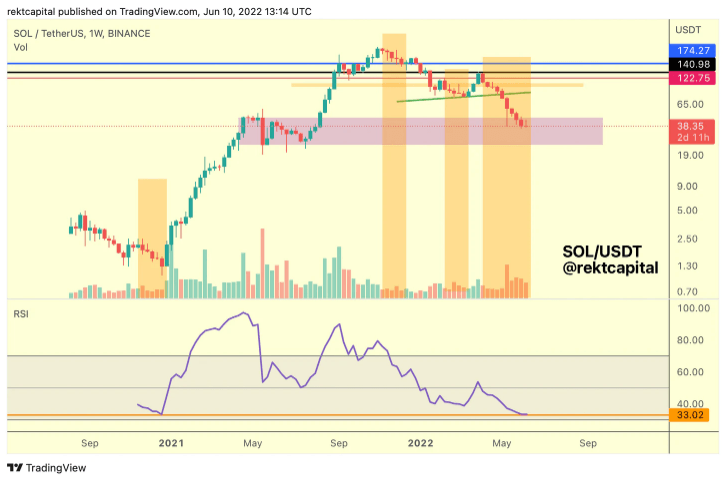

Analysts have evaluated the Solana price chart and believe the altcoin is one slide away from a 40% decline. Solana’s breakdown could result from the descending triangle pattern in the altcoin’s chart. Solana price has consolidated inside the triangle and the bearish trend could continue.

Azeez Mustafa, a crypto analyst argued Solana price is moving sideways and the altcoin remains below the 9-day and 21-day moving averages and SOL could continue to plummet below $34.

SOL-USD price chart

Solana price reached its all time lows on the RSI recently. The last time Solana was at this RSI level, it witnessed prolonged selling pressure and was followed by a trend reversal. However, Solana price has hit a historical demand area and is going through a period of prolonged sell-side pressure on volume.

Solana is approaching the demand area and the altcoin could witness high levels of seller volume. Analysts believe Solana price could flip to the top of the purple box into new resistance and promote further consolidation.

SOL-USDT chart

FXStreet analysts believe Solana price has lost its bullish potential due to network outages. For more information, check this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.