Solana meme coin Popcat surges over 20% following Binance futures and KuCoin listings

- Binance has launched perpetual contracts for the Solana-based meme coin POPCAT.

- KuCoin also listed a POPCAT/USDT trading pair on its spot market.

- POPCAT jumped more than 20% following the listings on both exchanges.

- The meme coin could see a correction, with technical indicators suggesting its price is entering the overbought region.

Binance exchange announced it had listed perpetual contracts for Solana meme coin POPCAT on Thursday with up to 75x leverage. The listing means Binance's wide user base can now gain leveraged exposure to the price of POPCAT. Such listings often translate to significant price growth for a cryptocurrency.

Shortly after Binance's announcement, KuCoin exchange listed a POPCAT/USDT trading pair on its platform, allowing users to deposit and trade their tokens on its spot market.

Following these announcements, a whale withdrew $5.73 million worth of SOL from Binance to purchase POPCAT, according to Lookonchain's data.

POPCAT rallies, but risks going into a correction

The positive updates caused a spike in POPCAT's price, which soared more than 22% in the past 24 hours. The move indicates increased POPCAT buying pressure across exchanges.

The social volume of the meme coin also surged, increasing from a mere 7% to over 53% on Thursday. While the spike in social volume amid rising prices indicates positive investors' sentiment, a correction sometimes ensues when the crowd is overly bullish.

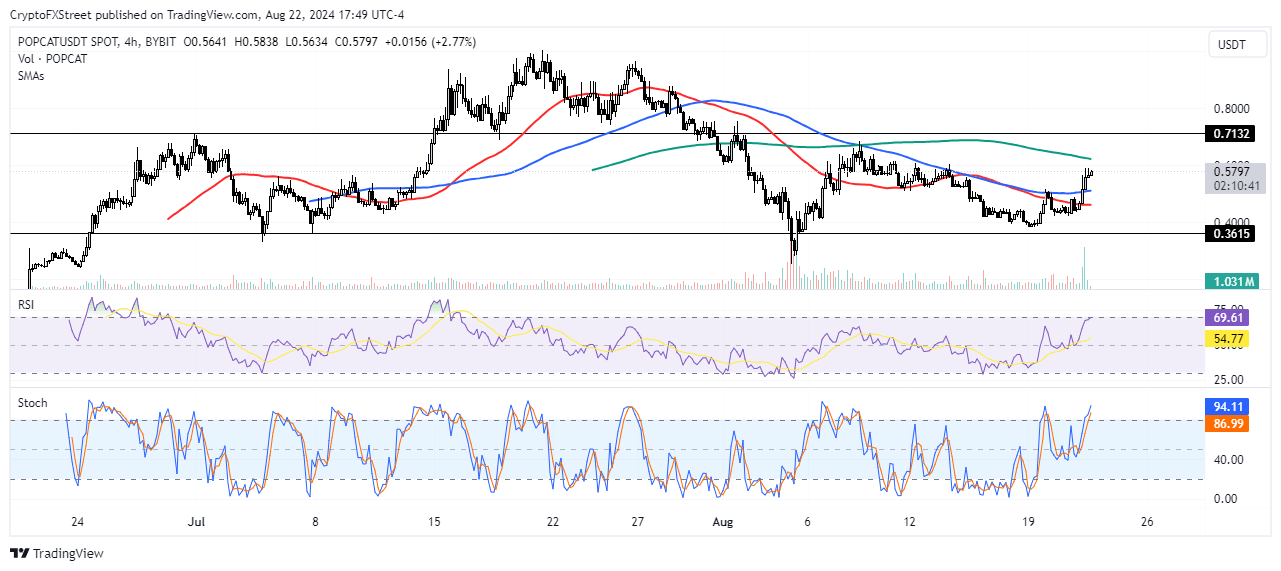

On the 4-hour chart, POPCAT could face resistance around the $0.7132 key resistance. The 100-day Simple Moving Average (SMA) could prevent a further price rise for the meme coin.

POPCAT/USDT 4-hour chart

The Relative Strength Index (RSI) is at 69.7, moving into the overbought region. Such a move indicates prices may see a correction soon. The Stochastic Oscillator (Stoch) also paints a similar picture, with the %K and %D lines now above 80 in the overbought region.

A price correction could see POPCAT decline by over 30% to find support around $0.3615.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi