Solana fails to outperform competitors Ethereum and Cardano as on-chain activity declines

- Solana network’s on-chain activity falls despite a rise in the number of new addresses on the blockchain.

- The Ethereum-killer gears up to compete with rival blockchains with its update release for mainnet beta validators.

- Solana price decreased nearly 8% over the past week.

Solana (SOL), one of the largest smart contract competitors of the Ethereum network, witnessed a significant increase in the number of new addresses added in the month of May. The blockchain’s on-chain activity in terms of value moved lower and active addresses declined, despite the rise in overall number of new addresses joining the SOL network.

Also read: Solana captures new users as Bitcoin and Ethereum struggle

Solana new user address growth fails to fuel recovery in price

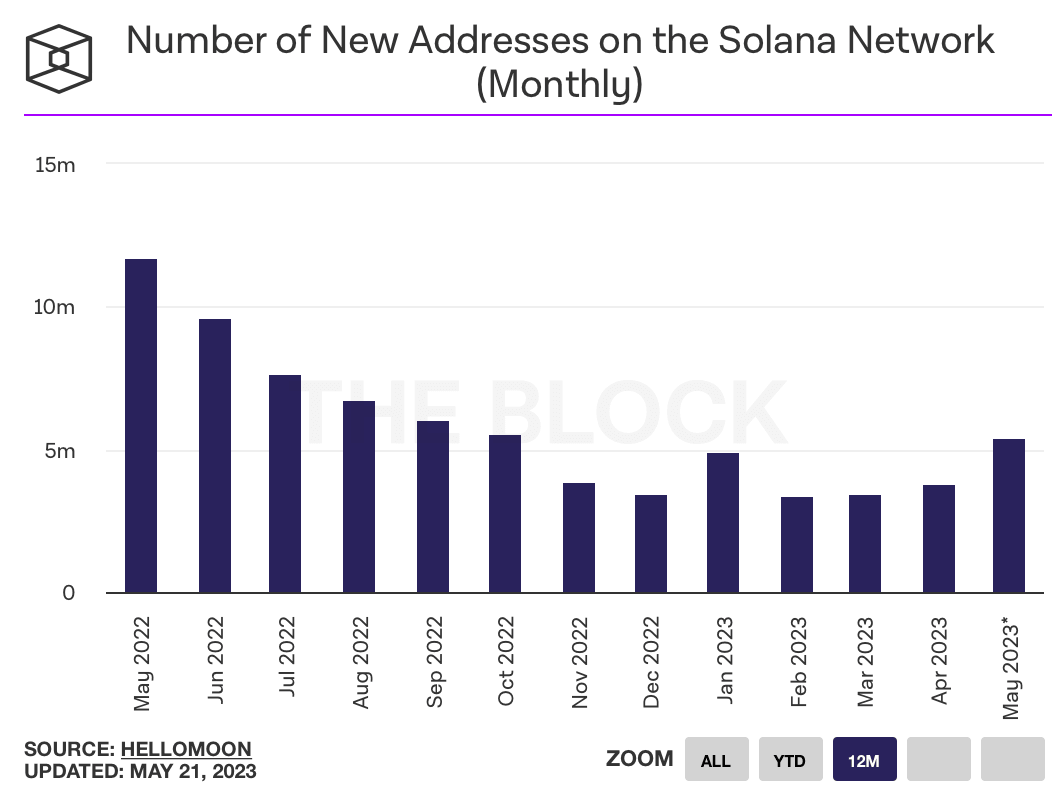

Solana blockchain added a large number of new user addresses in May 2023. Based on data from The Block, the number of new addresses added on a monthly basis is much higher than February, March and April of this year.

Number of new addresses added to the Solana network

The number of new addresses is a key metric in assessing the adoption of SOL among crypto market participants as it represents interest and utility of the asset for users. Combined with the significant rise in new addresses on a monthly basis, this month Solana positioned itself as a competitor to Ethereum and Cardano.

The on-chain activity and adoption of SOL failed to fuel a bullish thesis for the asset among users and the altcoin’s price declined nearly 8% since May 15.

To tackle the key issues facing the Solana blockchain, like outages and challenges faced by validators, developers shared an update for mainnet beta validators.

Mainnet Beta Validators: Please upgrade to https://t.co/M9PjgQS0Kp

— Solana Status (@SolanaStatus) May 22, 2023

Solana blockchain’s value moved and active addresses fail to catch up

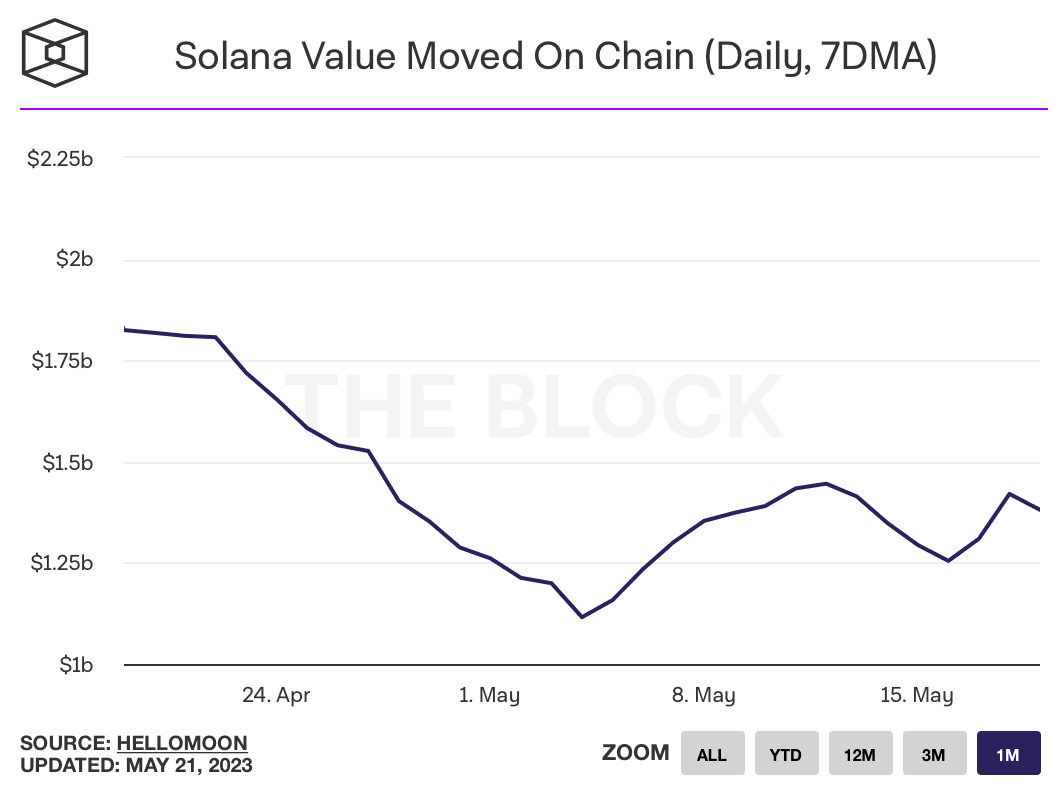

Value moved on-chain is the transaction volume or measure of economic throughput of Solana’s blockchain. The below chart from The Block demonstrates that the seven-day moving average of value moved on-chain has decreased for Solana.

Solana value moved on-chain 7-day moving average

Transaction volume declined from $1.82 billion (7-day Moving Average) to $1.38 billion between April and May 19.

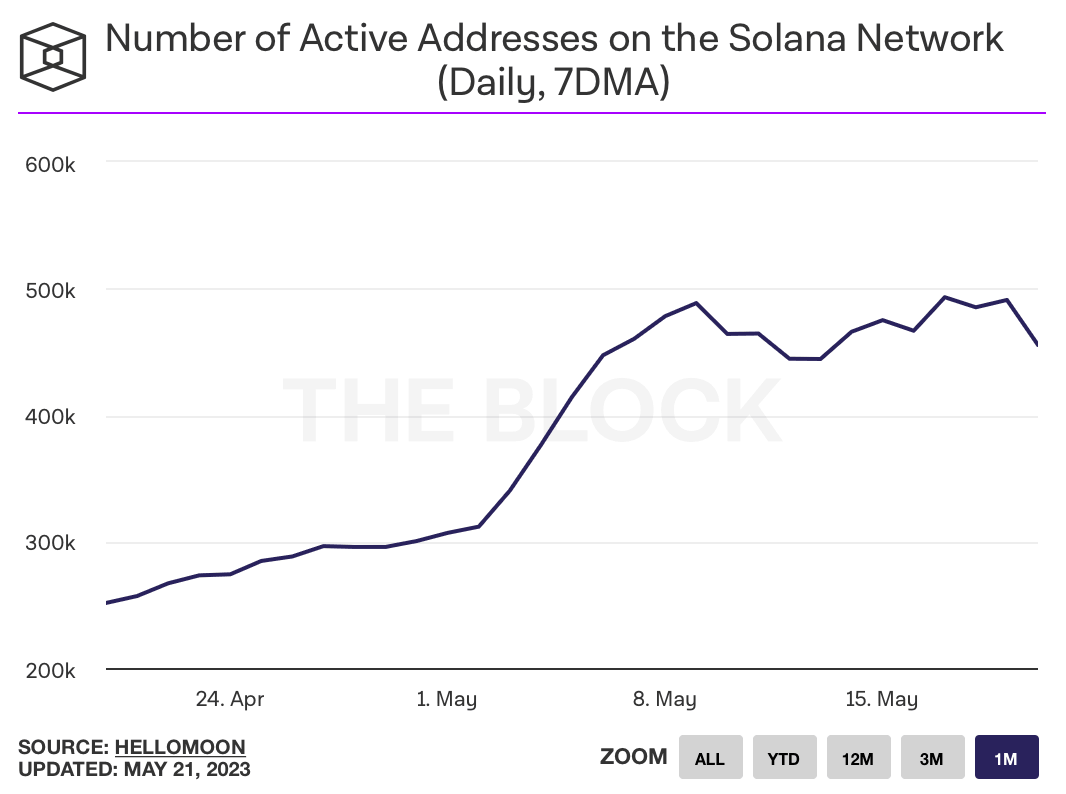

The 7-day moving average of active addresses on the SOL blockchain followed a similar trend, nosediving from its peak of 490.95K on May 19 to 455.37K on May 21.

Number of active addresses on SOL 7-day moving average

Solana blockchain’s native token SOL failed to recover from its April 2023 decline from $23.71 to $19.46 on Monday. SOL is struggling to begin its recovery, while Ethereum and Cardano prices were largely unchanged over the past week. It remains to be seen whether the mainnet beta validator upgrade fuels a recovery in Solana price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.