Solana bears get burned if SOL fails to break down

- Solana price faces sixth consecutive day of lower closes.

- Late bear traders may get burned if they are short at $150.

- Final daily Ichimoku support is coming up.

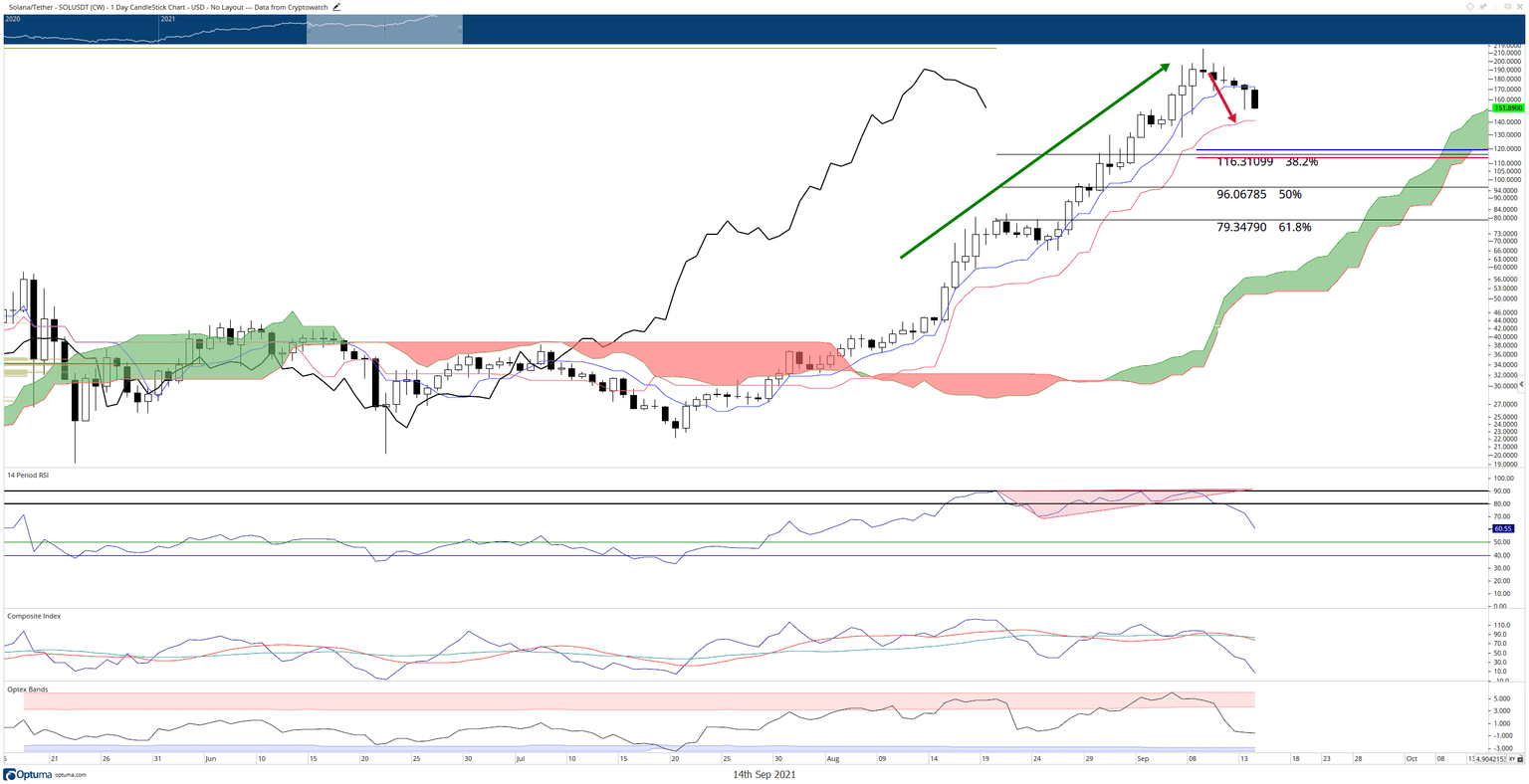

Solana price has moved lower by as much as -30% over the past six trading days. As the pullback from new all-time highs continues, Solana is entering into established median pullback ranges in cryptocurrencies. As a result, shorts attempting to enter the market near the $150 may find themselves on the losing side of a runaway market.

Solana price closes in on the final daily Ichimoku support level

Solana price is getting close to the final support level in the Ichimoku system: the Kijun-Sen. The Kijun-Sen is currently at $141.25 and is in a position to trap any late short-sellers who decide to short if Solana fails to hold $150. The Kijun-Sen is the primary 'day trader' indicator in the Ichimoku system. It represents medium-term movement and is easily thought of as a dynamic 50% Fibonacci retracement level. Support and resistance are often found against the Kijun-Sen. It is for that reason any new short positions may be under threat. A factor contributing to the Kijun-Sen holing as support is the extreme low in the Composite Index - it is approaching historical support levels.

SOL/USDT Daily Chart

Bulls should not be overly confident, though. The Relative Strenght Index has yet to hit the first oversold condition in a bull market (50) and given the current Solana price action, a move below the Kijun-Sen may be necessary. The weekly Tenkan-Sen and Kijun-Sen fall share a price range between $115 and $120. Solana will likely need to push beyond the daily Kijun-Sen for the Relative Strenght Index to test 50 or 40. A move to the $115 - $120 value area will put the Optex Bands into an oversold condition, helping to confirm a bottom.

Any daily close above $175 will invalidate any further bearish momentum.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.