Shiba Inu whales mindful of price cap on SHIB

- Shiba Inu price action recovers back to key levels.

- SHIB price tries to refrain from printing new lows for October at the weekly close.

- Expect a possible short-term recovery, but the long-term outlook remains bearish.

Shiba Inu (SHIB) price action is, at the time of writing, still down 21% against 34% at the lowest point this week. Cryptocurrencies saw bulls storming out of the gate in the US trading session on Thursday as a lower inflation print sparked a buying wave in all asset classes except for safe havens. SHIB price action is enjoying a double whammy with a weaker dollar and the tailwinds from the rallying equities.

SHIB price doubles down on dollar weakness

Shiba Inu price action has been hanging against the ropes for most of 2022 as the stronger dollar kept pressing and squeezing bulls out of their positions. Whales were keen to pick up SHIB at lower levels than $0.00001000 and look to book some gains as price action recovers. There are certainly gains to be booked, although traders must be aware of the forces hanging over SHIB’s price.

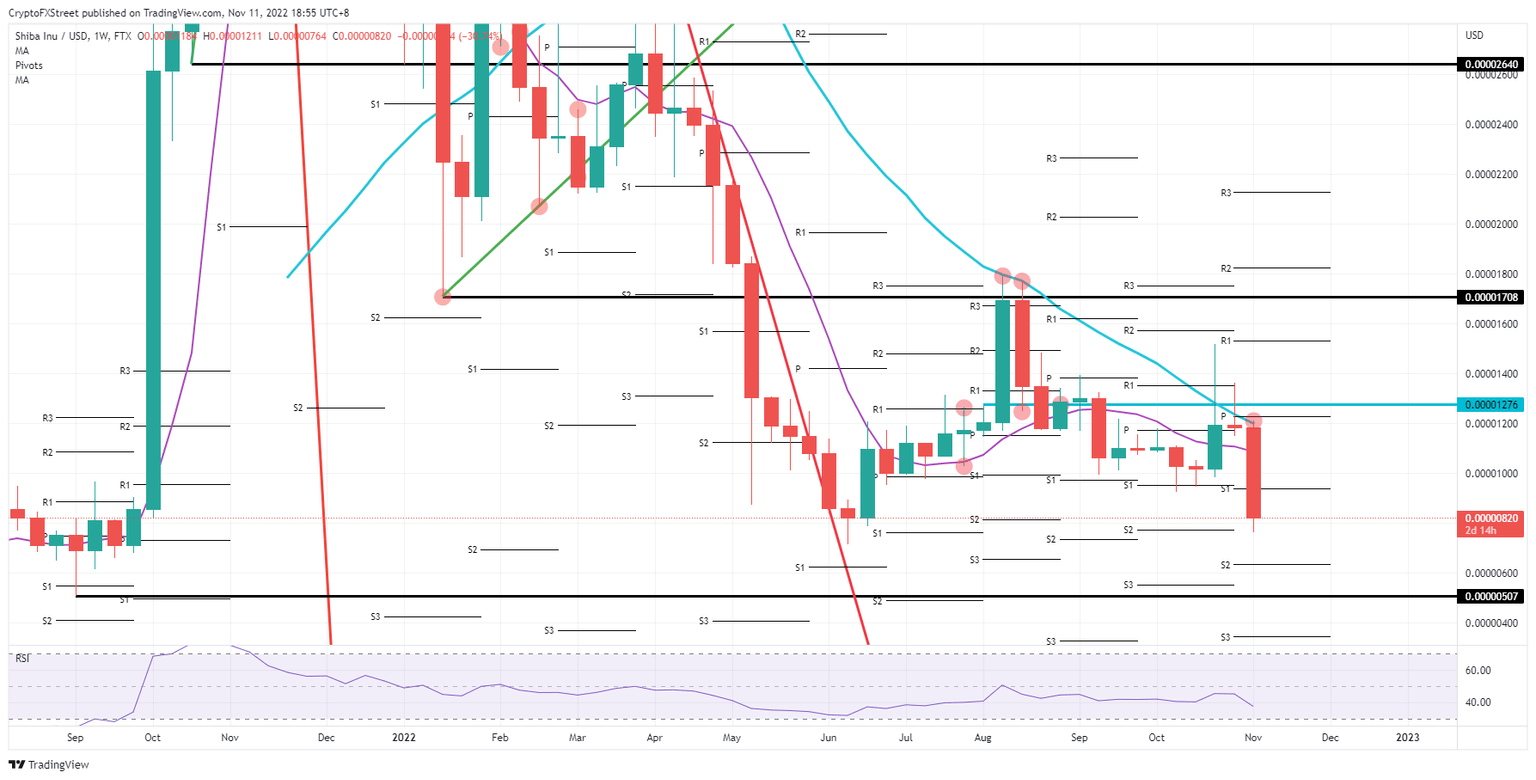

SHIB price has the 200-day Simple Moving Average (SMA) as its biggest threat from making more gains to the upside. Looking earlier on the chart, traders will spot the double top in August, which got rejected two weeks from breaking to the upside. The fact that SHIB closed below the 200-day SMA after breaking through it two weeks ago and again last week means that it is a force to be reckoned with. Expect the current rejection to be overdone, but the 200-day SMA will not be passed that easily.

SHIB/USD weekly chart

The key to unlocking the 200-day SMA comes from the dollar, which has been the driving force for most of 2022. The dollar should weaken further and continuously as more data shows that the Fed is nearing or at its pivot level. Expect more buyers and investors returning to cryptocurrencies, triggering a massive demand on the buy-side and watch as SHIB price action quickly breaks the 200-day SMA to the upside. The level to watch will be $0.00001708, the low from January

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.