Shiba Inu price prepares for major boost as SHIB gets listed on top Brazilian crypto exchange

- Shiba Inu price is set to get a boost as a major crypto exchange will soon list the canine-themed token.

- The governing technical pattern projects a 14% climb for SHIB.

- However, Shiba Inu may face a major obstacle at $0.00003550.

Shiba Inu price has projected a 14% move following a slice above a critical resistance barrier. The Dogecoin rival is expected to be listed on a major Brazilian cryptocurrency exchange on February 16, which could further boost the token’s price.

Shiba Inu price targets $0.00003708

Shiba Inu is expected to be listed on major Brazilian crypto exchange Foxbit on February 16. The exchange was launched in 2014 and is one of the oldest digital asset exchanges in Latin America. With over 950,000 registered customers on the exchange, SHIB price could get a further boost.

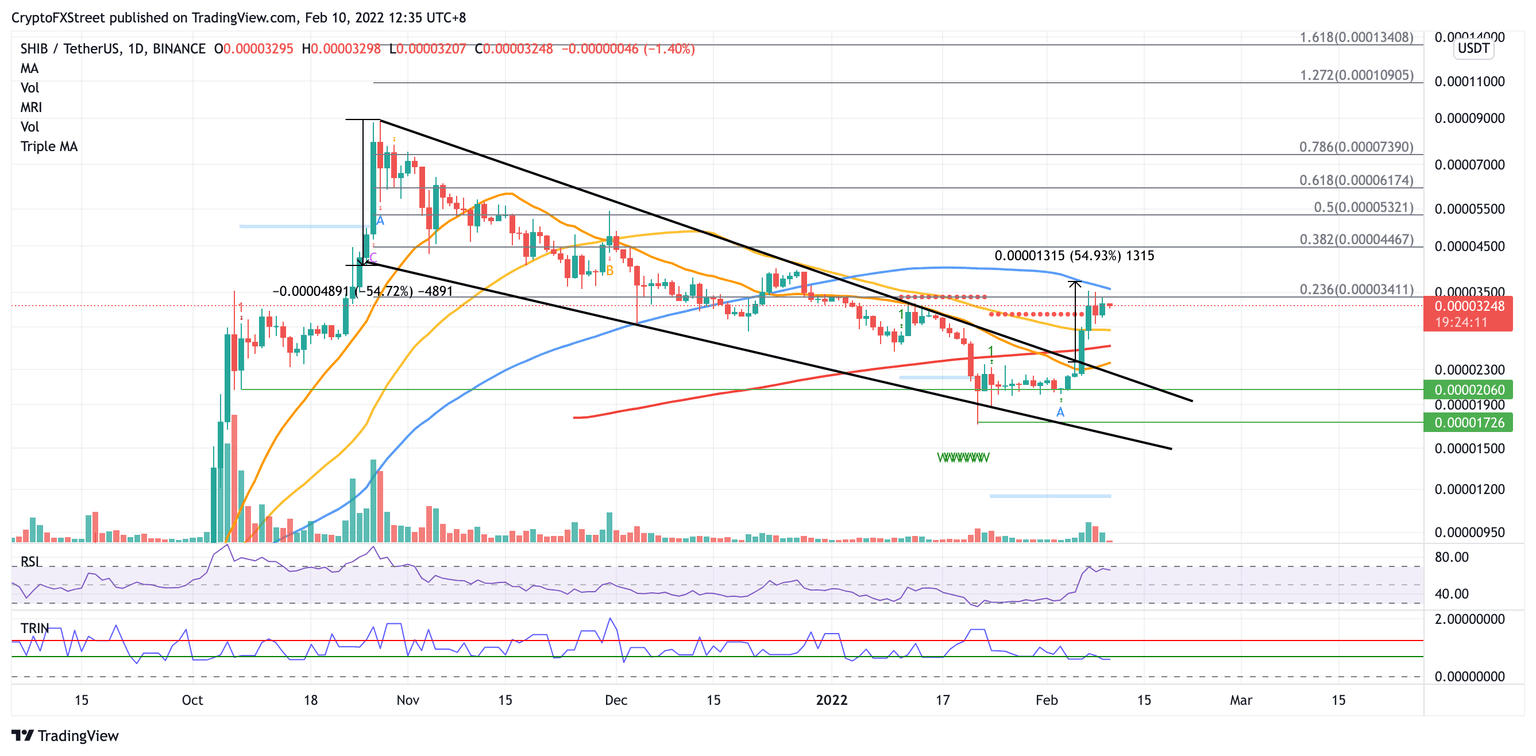

Shiba Inu price recently sliced above the upper boundary of the falling wedge pattern, putting a 54% climb on the radar toward $0.00003708. SHIB bulls are aiming for a 14% ascent to reach the optimistic target.

The first line of resistance may emerge at the 23.6% Fibonacci retracement level at $0.00003411 before facing another obstacle at the 100-day Simple Moving Average (SMA) at $0.00003550.

SHIB/USDT daily chart

If the bulls manage to tag the aforementioned bullish target at $0.0003708, the buyers may aim to reach the 38.2% Fibonacci retracement level at $0.00004467 next. Even bigger aspirations, paired with a spike in buy orders may see Shiba Inu price target $0.00006174 at the 50% retracement level.

However, if selling pressure increases, Shiba Inu price may fall toward the 50-day SMA at $0.00002854, as immediate support. If this level fails to hold, SHIB may drop further toward the 200-day SMA at $0.00002599.

An additional spike in sell orders may see Shiba Inu price descend toward the 21-day SMA at $0.00002381, near the upper boundary of the governing technical pattern. A further increase in bearish sentiment may push SHIB lower toward the October 8 low at $0.00002060.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.