Shiba Inu Price Prediction: SHIB might fall to new lows this year

- Shiba Inu price is currently down 33% for November.

- SHIB price is submerged below several areas of broken support.

- Invalidation of the bullish thesis is a breach above $0.00001100.

Shiba Inu price could be in the beginning stages of a much larger decline. If the bulls step in soon, a sweep-the-lows event will likely occur. Key levels have been defined to assess SHIB's next potential target.

Shiba Inu price looks troublesome

Shiba Inu price shows concerning signals going into the third trading week of November as the bears have forged a 33% decline. As the crypto market persists with negative returns, the world's favorite dog coin has bearish technicals that are hard to avoid. If market conditions persist, SHIB may eliminate all of the summer's gains and print a new yearly low.

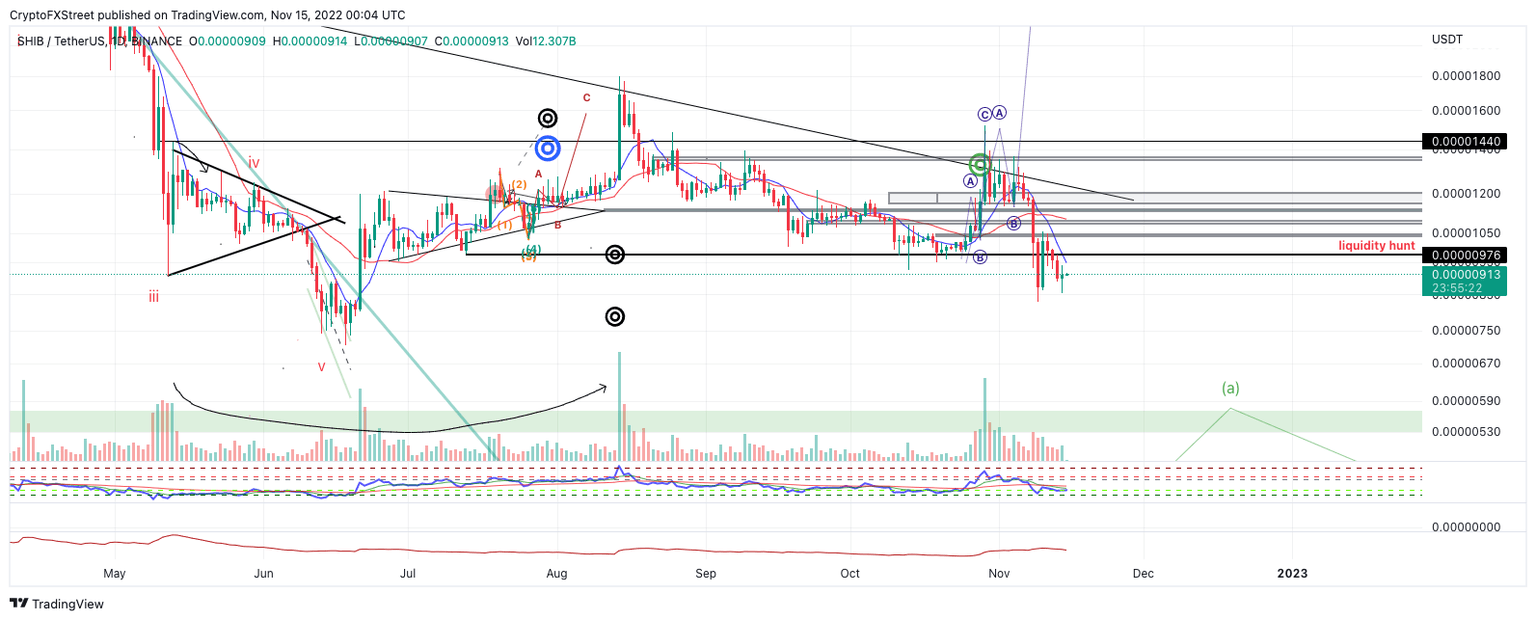

Shiba Inu price currently auctions at $0.00000900 as the bears have broken previous supports at $0.00001200 and $0.00001000 this month. The 8-day exponential moving average rejected the bulls' first attempt to retaliate against the bearish onslaught. The same indicator produced a bearish death cross just a few days earlier. The new monthly low at $0.00000861 shows an oversold reading on the Relative Strength Index. The indicator suggests the bearish move is genuine and could, if read correctly, be just half way to the intended bearish target.

SHIBUSDT 1-Day Chart

Considering these factors, the SHIB price will be oriented to find strength soon, or the sweep-the-lows event will be imminent. Bearish targets lie at $0.00000550, while bullish capitulation could reach as far down as $0.00000360.

Invalidation of the bearish outlook is possible if the bulls take the liquidity above the 21-day simple moving average of $0.00001100. Conquering the invalidation level could induce a bear-trap rally targeting $0.00001300. The price of Shiba Inu would rise by 40% if the bulls were to succeed.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.