Shiba Inu Price Prediction: How many burned tokens does it take to trap a bull?

- Talks of burned tokens and their impact on the Shiba Inu price persist throughout social media and media outlets.

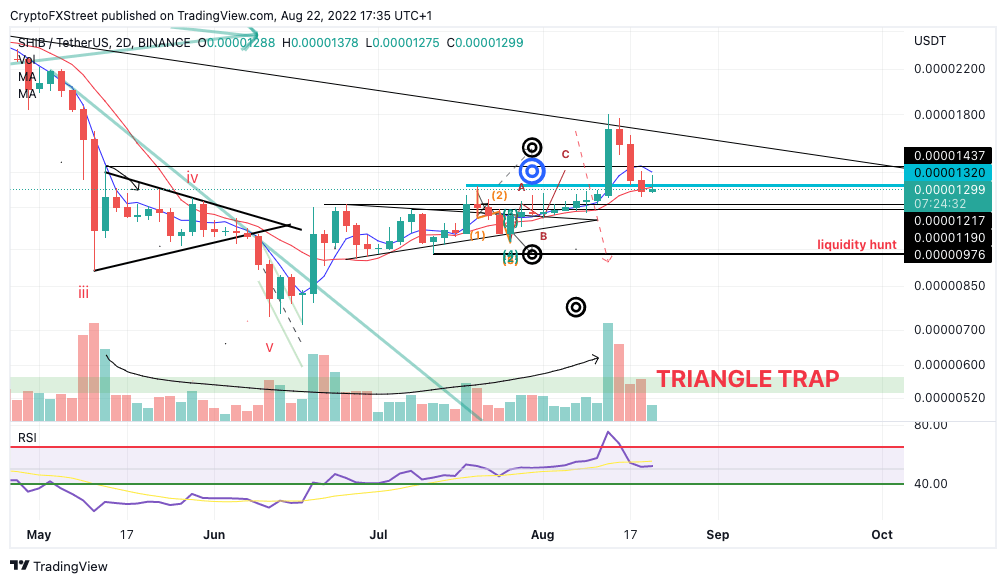

- SHIB price shows a massive uptick in bearish volume accompanied by severe bearish divergence.

- Invalidation of the bearish thesis is a breach and close above $0.00001700.

Shiba Inu price market sentiment remains optimistic despite the penny-from-Eiffel style decline.

Shiba Inu price de-correlates

Shiba Inu price shows extremely bearish technicals, confounding that a sweep of the lows event could be underway. The technicals suggested that an immediate liquidation could occur after a five-wave impulse into the bullish targets occurred.

On August 15, both bullish targets were breached as the Shiba Inu price saw a 35% hike in just one day. As a result of the buyer’s surge, the Relative Strength Index (RSI) measured the Shiba Inu price as more overbought than when the notorious dog coin price traded nearly 150% higher at $0.00003261 back in February of 2022. Accompanied with the RSI bearish divergence was an influx of bearish volume near the top of the price hike and a classical bearish ramping pattern.

SHIB/USDT 2-Day Chart

Shiba Inu price currently trades at $0.00001304. Despite the extreme bearish signals, an influx of headline news persists in the media about Shiba Inu tokens being burned from the total supply. According to the Economic Times, 400 trillion tokens were recently burned in the summer of 2022.

Twitter accounts have contributed to the discussion with theoretical models of what the impact burning SHIB tokens could have on the Shiba Inu price and overall ecosystem. According to a popular Twitter account and SHIB advocate @SHIBBPP, 111 trillion tokens could be burned within months.

Despite the optimistic market sentiment, the Shiba Inu price has not correlated well with the burned-token theory. From a technical standpoint, the SHIB price has struggled to make persistent gains, and the recent 35% upswing may have been too steep for the bulls to sustain. What was once a profit-taking consolidation near the $0.00001500 levels has morphed into a “penny-from-Eiffel” style decline as the SHIB price is currently down 27% since the new monthly high at $.00001800 high was established.

The recent pump and dump confound the previous technical outlooks forecasting a further 25% decline. Bearish targets of interest are near $0.00000970 liquidity levels in the short term.

Invalidation of the bearish thesis is a breach and close above $0.00001700. If the bulls can breach this level, they may be able to prompt a bullish scenario targeting $0.00001978, resulting in a 52% increase from the current Shiba Inu price.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.