Shiba Inu price is under pressure as bears solidify their intentions

- Shiba Inu price witnessed a bearish death cross on the daily time frame on December 13.

- SHIB trades range bound within a 10% fluctuating zone on the week.

- The bulls will need to flip the 0.00000932 barrier into support to justify a bullish outlook.

Shiba Inu price could be setting up for a downtrend surge. At the time of writing, the bulls show early signs of failure. If market conditions persist, a sweep-the-lows event will be imminent.

Shiba Inu price under pressure

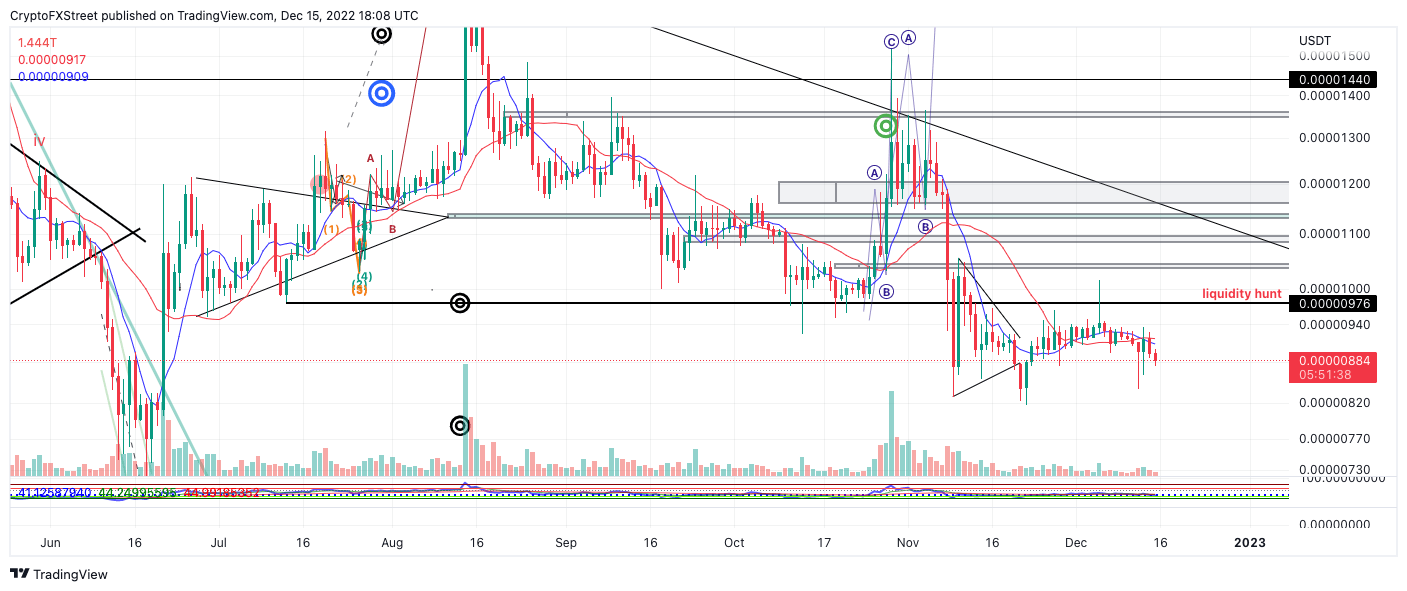

Shiba Inu price is witnessing an ongoing consolidation as the notorious meme coin coils within a 10% range on the week. On December 13, a bearish cross was spotted on the daily chart as the 21-day simple moving average treaded over the 8-day exponential moving average while SHIB remained submerged.

Since the signal, the bulls have been rejected near the $0.00000900 barrier on smaller time frames. Bearish crosses are often referred to as a “death cross” amongst traders as the crossing of the slower moving average into the faster one usually results in sharp liquidations.

Shiba Inu currently trades at $0.00000885. A second retest of the intersected indicators will be unnecessary if the market is genuinely bearish. A piercing of the December 13 low at $0.00000861 could prompt a bear rally targeting the November swing low at $0.00000817 for a 7% decline. If bulls remain sidelined near the November bottom, then SHIB will likely print new yearly lows in the coming weeks.

SHIB/USDT 1-day chart

As mentioned in the previous outlook, a bullish attempt at the December 13 swing high at $0.00000932 is required to consider aiming for higher targets. If the bulls can flip the barrier into support, SHIB could rally as high as the November 10 swing high at $0.00001055. The Shiba Inu price would rise by 19% under the bullish scenario.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.