Why the Shiba Inu price could spike higher before the bears flex their power again

- Shiba Inu price has printed a new monthly low after a weekend decline.

- The newfound low has produced a bullish divergence on the Relative Strength Index.

- Invalidation of the bullish idea is a breach below $0.00000816.

As the crypto market continues to decline, discussions of sparse liquidity are being had amongst top key players. The liquidity crisis is forcing traders only to consider short-term intraday trade setups. Shiba Inu price shows potential for an ideal countertrend spike. Key levels have been defined to gauge SHIB’s next potential move.

Shiba Inu price could challenge retail bears

Shiba Inu price has succumbed to the crypto market's unfortunate demise as the notorious meme coin has produced a new low for November. As a result of the drop, there are subtle signals suggesting retail bulls are uninterested, which could provoke a smart money spike to wipe out retail bears in the market.

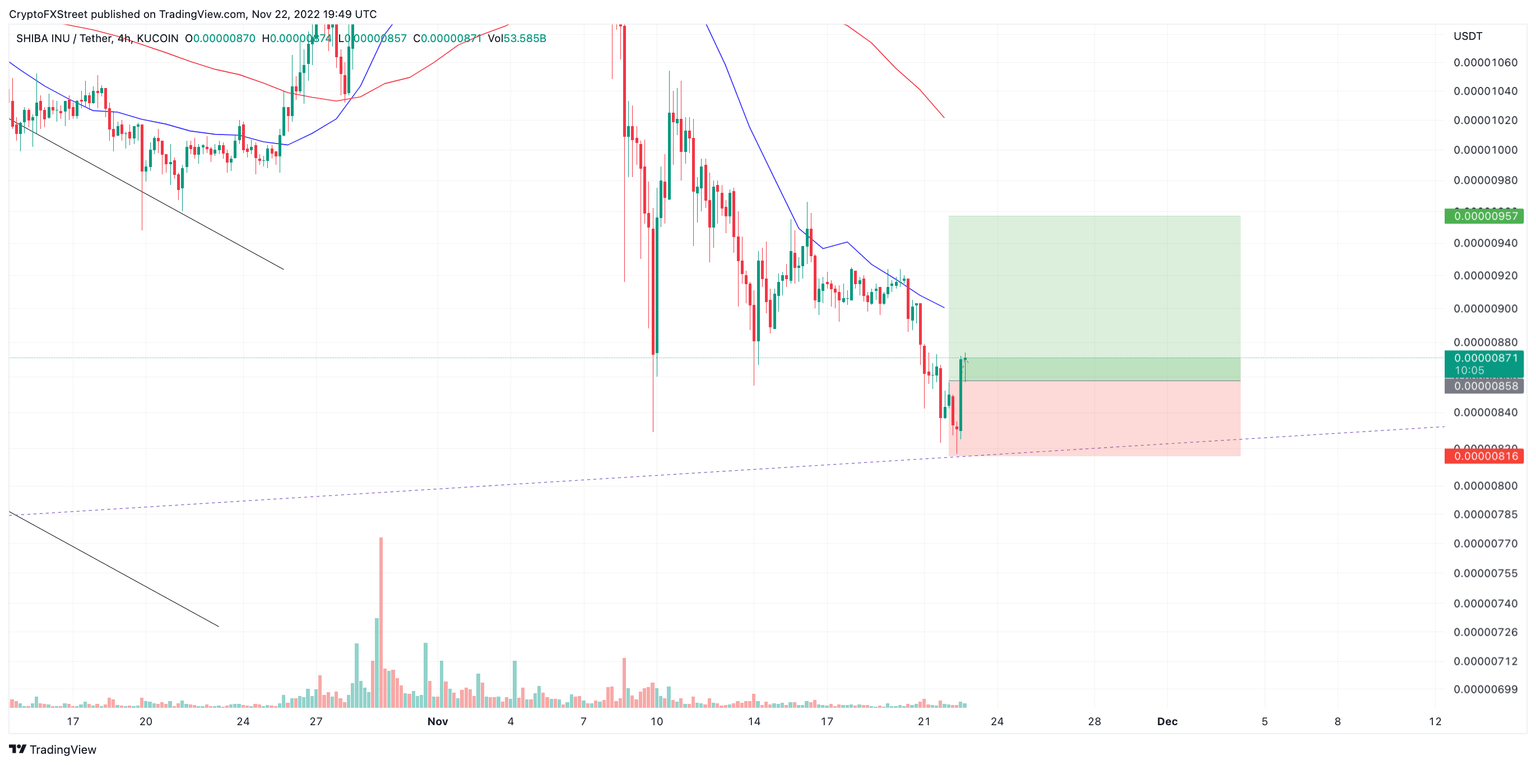

Shiba Inu currently auctions at $0.00000865. The Relative Strength Index (RSI) displays a bullish divergence between the newfound low and the previous monthly low established on November 9. Using auction market theory techniques, the SHIB token may be able to rise 10% towards the $0.00000950 barrier to offset the bullish divergence. The Volume Profile Indicator compounds the idea that a countertrend spike could occur, as the newfound low shows extremely low volume. The indicator may be suggesting retail traders are completely uninterested in opening a long position.

SHIB/USDT 4-hour chart

Invalidation of the bullish outlook could arise if the bears tag the newfound low at $0.00000816. A breach of the low could induce a slump toward the summer lows at $0.00000715. Shiba Inu's price would decrease by 17% due to said price action.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.