Shiba Inu price is lagging, unable to make significant highs

- Shiba Inu price sees profit taking after mild gains this morning.

- SHIB price could start to lag as major equity indices and the top 3 in cryptocurrencies advance firmly.

- Expect to see a possible risk of a drop by the end of the week as investors pull out preemptively.

Shiba Inu (SHIB) price action is at risk of falling into negative territory as an early fade gets underway, with profit taking after the positive close on Monday. With equities in the green and major cryptocurrencies like Bitcoin and Ethereum making gains, a clear sign on the wall is that investors are only in SHIB price action for the very short-term. The messages overnight of another rocket launch from North Korea towards Japan has triggered some small profit-taking and could see follow-through into the US session, with the risk of a broader fade and new lows for the week.

SHIB price sees some profit taking after North Korea does it again

Shiba Inu price action is going nowhere this morning while the Nasdaq futures are pointing to over 1.75% of gains for the US opening bell, and major cryptocurrencies like Bitcoin are printing over 2% gains for the trading day. The fact that Monday’s rally is seeing some casualties makes a great analogy with the Tour de France, where on the climb to Alpes D’Heuz, saw several cyclists fall behind. Similar to this, SHIB price needs to drop out of the peloton and is at risk of turning negative as the other majors advance.

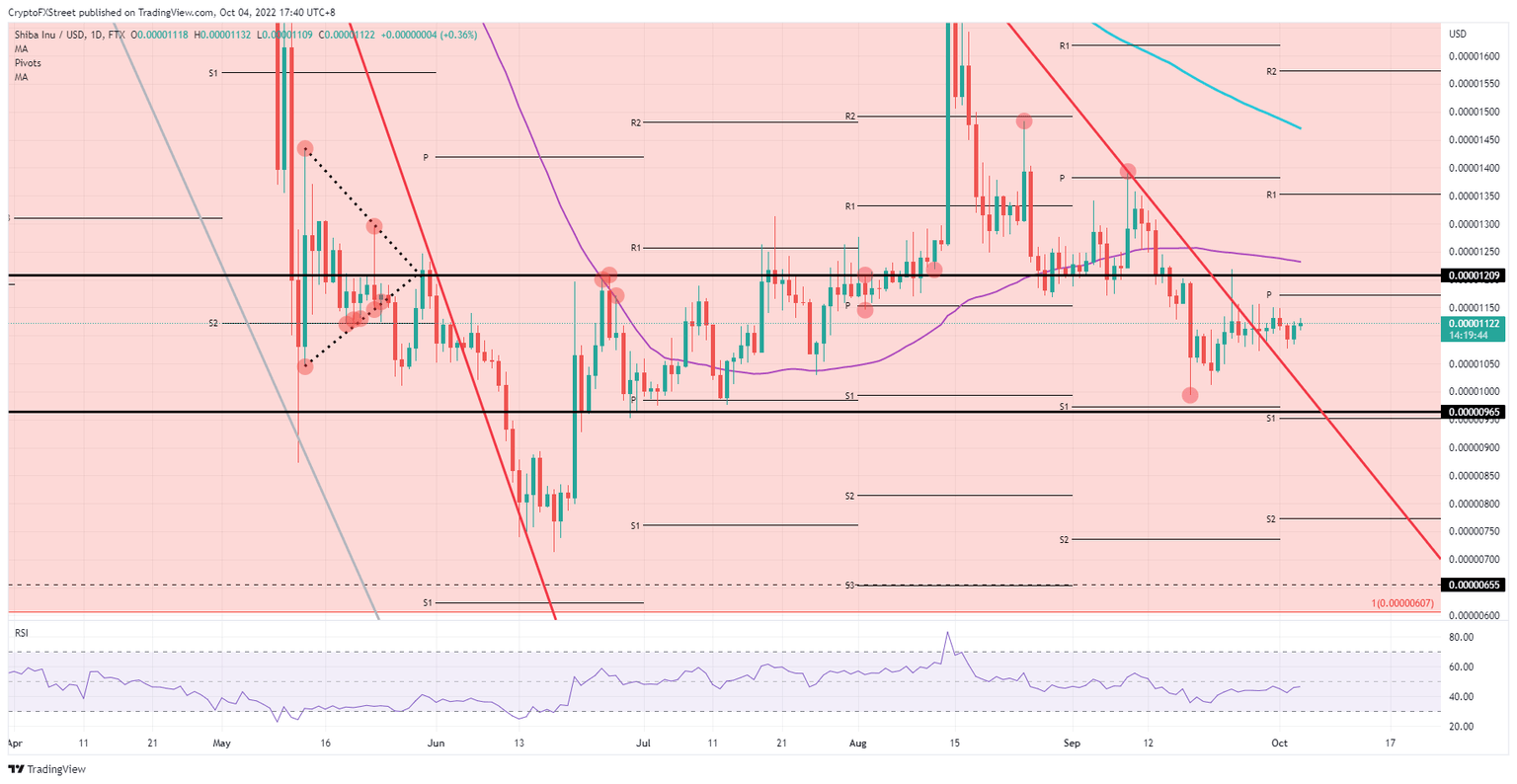

SHIB price could be setting the scene for some divergence as investors and traders were only in SHIB price action for the very short-term and started to sell their profit from Monday’s rally. Expect price action at max trade near $0.00001150 and look for the low end at $0.00001078. Should that last level, the low of Sunday, give way, expect a drop towards $0.00001000 as the fade broadens and turns into a sell-off.

SHIB/USD Daily chart

Should equities break out of bear market territory and rally back towards significantly higher levels, that would create a massive tailwind for cryptocurrencies as a whole. In such a scenario, expect to see SHIB price action benefit from an inflow of investors with demand side volume exploding and SHIB price nearing $0.00001209. A break above might even see price reach $0.00001350, near the monthly R1 printing roughly 20% of gains in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.