Shiba Inu price has one-way ticket toward $0.00003500

- Shiba Inu price action is still in a bull run since the end of September.

- After a bullish spike in SHIB price, some profit-taking occurred, and the price started to fade.

- Bulls kept their cards close to their chest and saw their bull run restored in full with $0.00003535 as target.

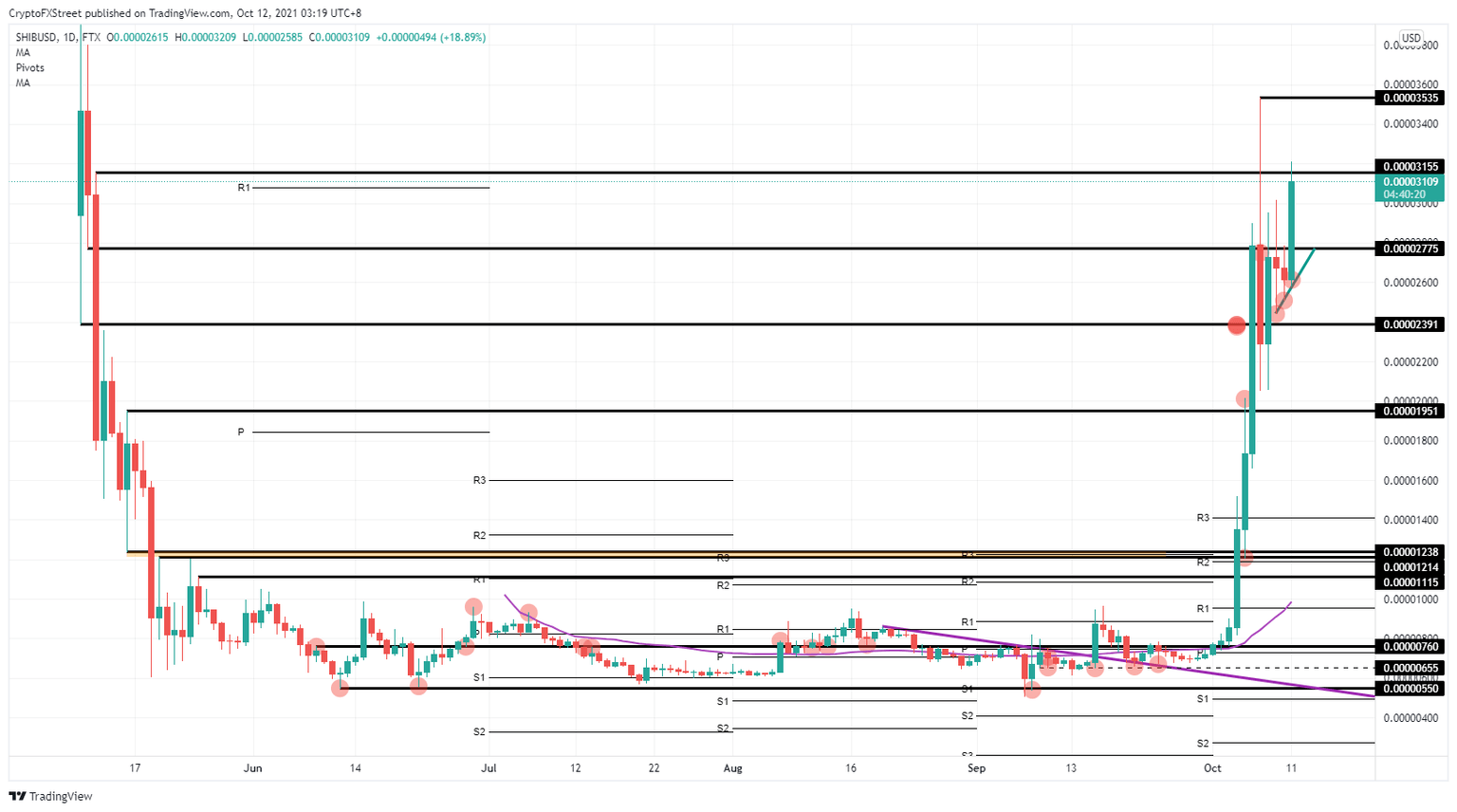

Since September, Shiba Inu price (SHIB) has been on a winning streak, with price action fading on October 7. Bulls have been very controlled and patient for another entry and are now shifting back into gear for a new attempt to claim $0.00003535. From there, $0.00004000 will be in the cards as a completion of this rally.

Shiba Inu bulls target $0.00004000, as long as the supporting trend line stays intact

Shiba Inu price action saw bulls denying bears a rally, with the latter having an opportunity to reverse the bull run since late September completely. With the formation of a green ascending trend line on October 9, SHIB price action has resupplied the bull rally. Bulls are reclaiming levels they lost control of in the profit-taking fade on October 7.

By reclaiming $0.00002775, bulls entered or added long positions in their books, and SHIB price saw a substantial breakthrough of $0.00002775 and, maybe a bit too eagerly, attempted to attack $0.00003115. Expect first to see SHIB price action settle down a bit, seek support at $0.00002775, and then add more buyers in the bull run to convincingly break $0.00003115. The next level in their rally would be $0.00003535, the high from October 7, which would form a double top.

SHIB/USD daily chart

Shiba Inu price action could go for the total swing trade and see bulls push to $0.00004000. For that, however, buyers will need to add more volume, and some more favorable tailwinds need to join the bull run. Otherwise, the rally would hit $0.00003535 and start to fade again.

When SHIB price faces some headwinds and buyers start to take their profits without respecting the target levels, expect a quick and violent reversal in Shiba Inu price action back toward $0.00002000. That level will certainly hold quite a lot of importance with bulls defending this area, because otherwise they will certainly not see $0.00003535 for a long time.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.