Shiba Inu defends $0.000024 as SHIB aims for further gains

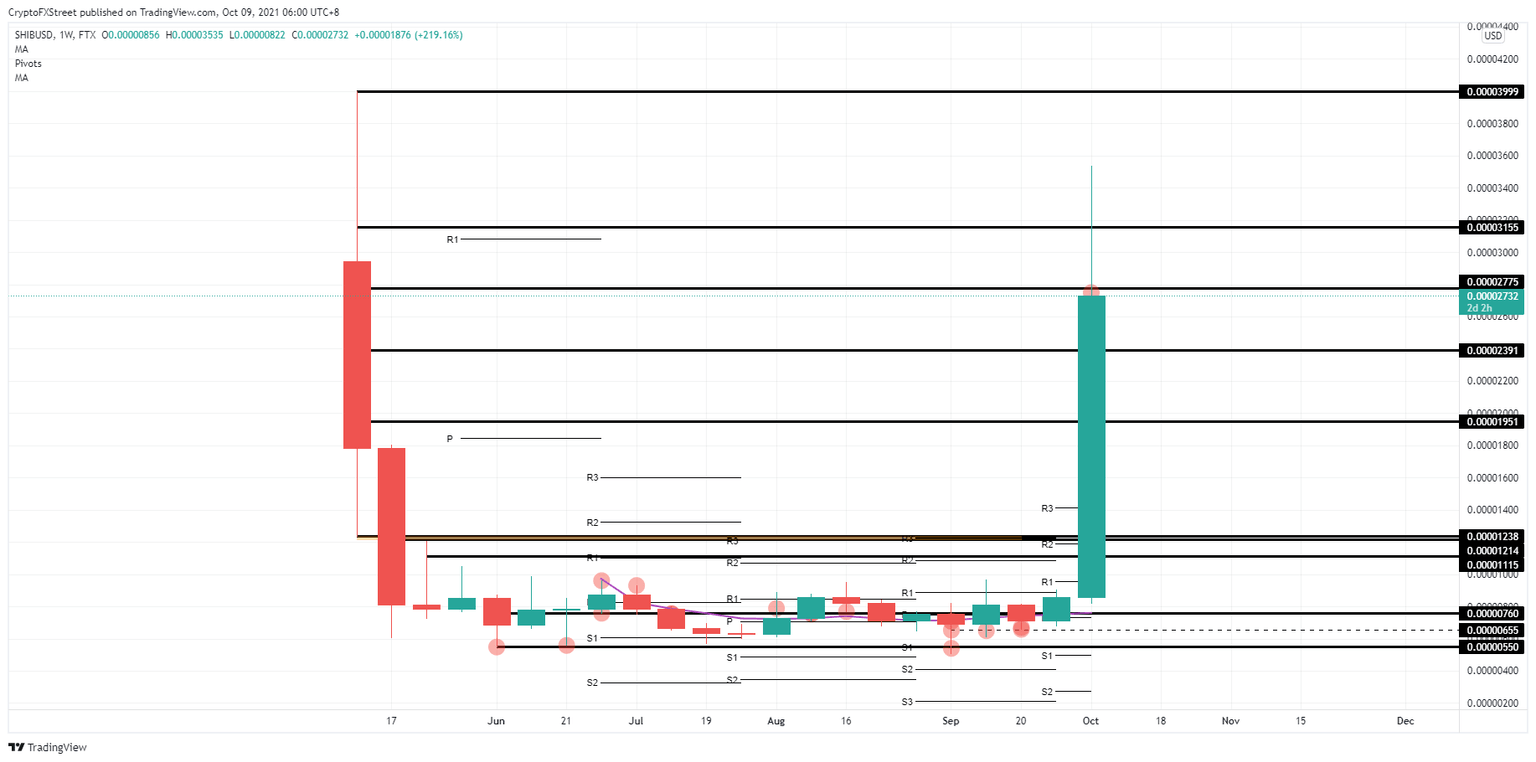

- Shiba Inu price action gained a staggering 330% return this week before fading a bit towards the close of this week.

- SHIB price still has more room to the upside as bulls now target $0.00004000

- Expect bulls to rejoin the rally at $0.00002391 and sit tight for another leg higher, as long as favorable tailwinds underpin SHIB price action.

Shiba Inu (SHIB) price action has formed a historical bullish candle this week with a 330% appreciation. As SHIB price comes off the high near the end of this week, expect bulls to wait for the first support level to offer itself as an entry point for another rally to $0.00004000.

Shiba Inu price offers entry levels for patient buyers

Shiba Inu price action is not out of steam yet after the bullish rally this week. Although price action in SHIB looks a bit exaggerated and almost looks impossible to get in, it still shows a few attractable entry levels for buyers who missed the boat. One of those levels can be identified at around $0.00002391. Although not clear on a weekly chart, the daily chart shows this level has held a few medium turn tops. As resistance turns into support, expect bulls to seize this opportunity to get in for a long.

As cryptocurrencies are on the front foot, expect that a rally in Bitcoin towards $60.000 will go hand in hand with SHIB price action to rally towards $0.00004000. That tailwind would make both cryptocurrencies hit quite a critical high, for SHIB even an all-time high for that matter. The rally would have even more room to trade higher, as making a new high will attract more buyers.

SHIB/USD weekly chart

SHIB price action could still correct the downside towards $0.00002000 if bulls do not want to risk getting stopped out in the middle of the rally and look for a lower entry-level to get involved. Should Bitcoin sentiment, which for now acts as a favorable tailwind in the spillover effect for SHIB price action, turn negative. Then SHIB might even see an almost complete reversal of the gains and pare back towards $0.00001240.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.