Shiba Inu price consolidates after mixed sentiment from Apple

- Shiba Inu price saw gains erased yesterday after concerns from Apple and Amazon.

- SHIB price looks for support above $0.00002200.

- Expect to see a pop higher once bulls have bought in as the dust settles after tech earnings.

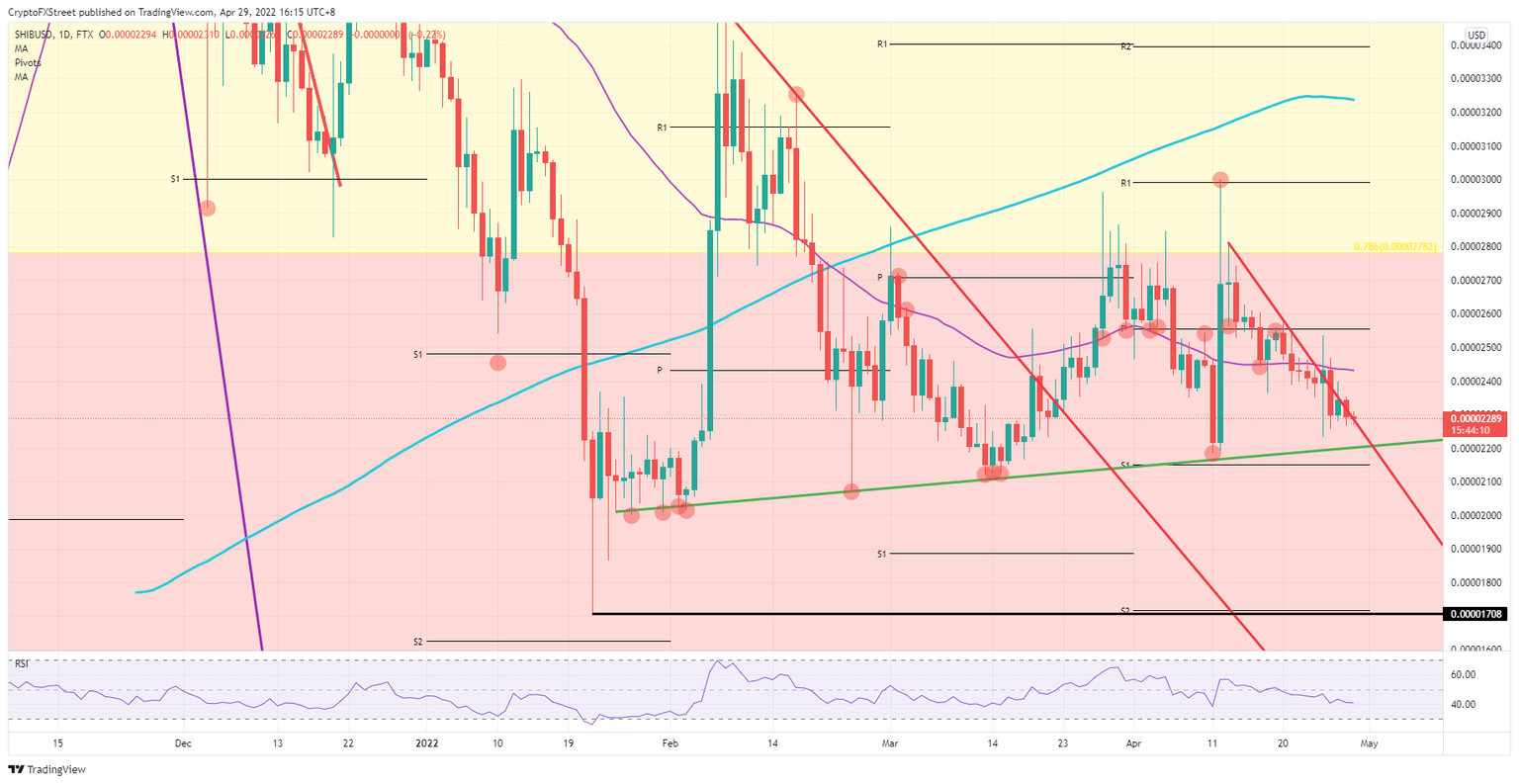

Shiba Inu (SHIB) price looks heavy in ASIA PAC as investors are again reassessing the situation after the sigh of relief following Facebook’s earnings on Thursday. Mixed earnings from Apple and Amazon over the weekend, however, are giving investors new reasons to fret. Although a slip towards $0.00002200 could be in the making, a bullish pop is also possible going into the weekend. The 55-day Simple Moving Average (SMA) has been put forward again as the first hurdle to tackle before hitting $0.00002500.

SHIB price resilient enough to withstand setbacks

Shiba Inu price is managing to keep its act together despite woes from highly correlated tech stocks. Recent earnings from Apple, for example, highlighted supply issues and less profitable margins to come for next quarter. Yet overall, the Nasdaq did not drop as much as we saw last week after Netflix released its earnings or Alphabet during this week. This has created some areas for bulls to keep buying at current levels and seen the SHIB price ramp up over the weekend.

SHIB price thus sees the Relative Strength Index (RSI) flatlining as buyers and sellers are in equilibrium around current levels, which opens the door for a pop higher as this week ends, and the dust can settle with investors ready to go long risk assets again. SHIB price would first pop to $0.00002400 before preparing to attack the 55-day SMA at $0.00002435. Once pierced through, it would be time to test the 55-day SMA for support, followed by a slingshot back up to $0.00002600, breaking the monthly pivot and setting the scene for next week.

SHIB/USD daily chart

One source of a setback for bulls could come from Russia, which expanded its military attacks again yesterday, with missile attacks on Kyiv. In case that anger spins out of control with the use of nuclear weapons, expect to see a drop below the green ascending trend line, opening the door for a nosedive move towards $0.00001708, dropping 22%. This would come as bulls get fed-up with entering trades going nowhere and wait for all the tail risks to fade or diminish before getting long SHIB again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.