Why Shiba Inu price will rise 17% next month

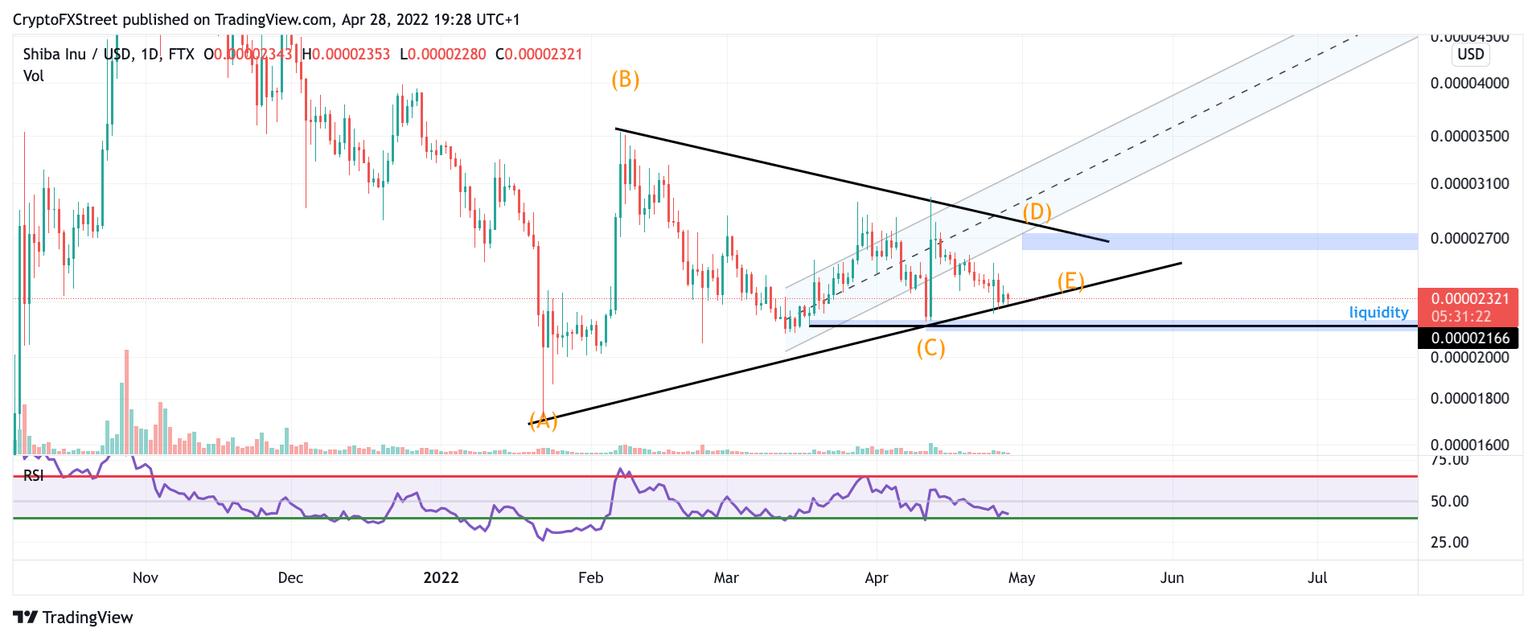

- SHIB price is coiling into a triangle pattern.

- Shiba Inu price is showing support signals on the RSI.

- Invalidation for the bullish case is a breach below $0.00002217.

Shiba Inu price displays evidence of a triangle formation underway. If the technicals are correct, SHIB price will rise 17-20% in May.

Shiba Inu price downtrend looks weak

Shiba Inu price has given reasons to believe in a 17% uptrend rally in the coming days. The SHIBA price appears to be coiling into a triangle pattern, having printed 3 of the 5 necessary swings. Analyzing the technicals, waves A, B, fit textbook triangle criteria as they display choppy and sometimes unpredictable directional changes.

Shiba Inu price currently trades at $0.00002308. The present downtrend looks relatively weak in terms of volume, which is a confluence signal for the prospective triangle idea. Additionally, the candlesticks within the downtrend are also relatively weak compared to the massive bull rally that occurred on April 12th to end wave C. It is worth noting that wave C has a strong buy signal on the Relative Strength Index.

SHIB/USD 1-Day Chart

Shiba Inu price has a 17% bullish target at $0.00002621, which should be the last wave to mark wave D. The invalidation for the bullish idea is a breach below wave C at $0.00002217. If the bears can breach this level, then the triangle idea would not be invalid, but liquidity levels under $0.00001850 would be an ideal target for the bears resulting in a 20% decrease in the current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.