Shiba Inu completes powerful bearish warning pattern, SHIBA could push new 2022 lows

- Shiba Inu price action is mostly unchanged on its Point and Figure chart.

- Surprisingly, SHIBA triggered a hypothetical long entry previously identified last week.

- Downside risks remain considerable and could be in the extremes.

Shiba Inu price action fulfilled an Ideal Bearish Ichimoku Breakout on its daily Ichimoku chart on Friday's close. This is the first time this bearish entry condition has appeared since November 22, 2021. Thus far, bears have not followed through with a continuation move in selling pressure. News regarding a temporary ceasefire in Ukraine may contribute to a return of positive risk-on sentiment very soon.

Shiba Inu price is at risk of creating new 2022 lows, pushing as low as $0.00001200

Shiba Inu price action is now overwhelmingly bearish. On Monday, there was hope that SHIBA was positioned for an Ideal Bullish Ichimoku Breakout. The threshold of completing that most bullish of Ichimoku entries dropped significantly from prior weeks, but bulls were unable or unwilling to capitalize on the new positioning.

Instead, bulls saw Shiba Inu price get rejected at the Kijun-Sen and top of the Ichimoku Cloud in the $0.00002800 to $0.00002850 value area. Friday's close confirmed an Ideal Bearish Ichimoku Breakout, putting SHIBA into the most bearish condition it's been in since November 2021. SHIBA could very easily and very quickly fall to the 161.8% Fibonacci expansion at $0.00001200.

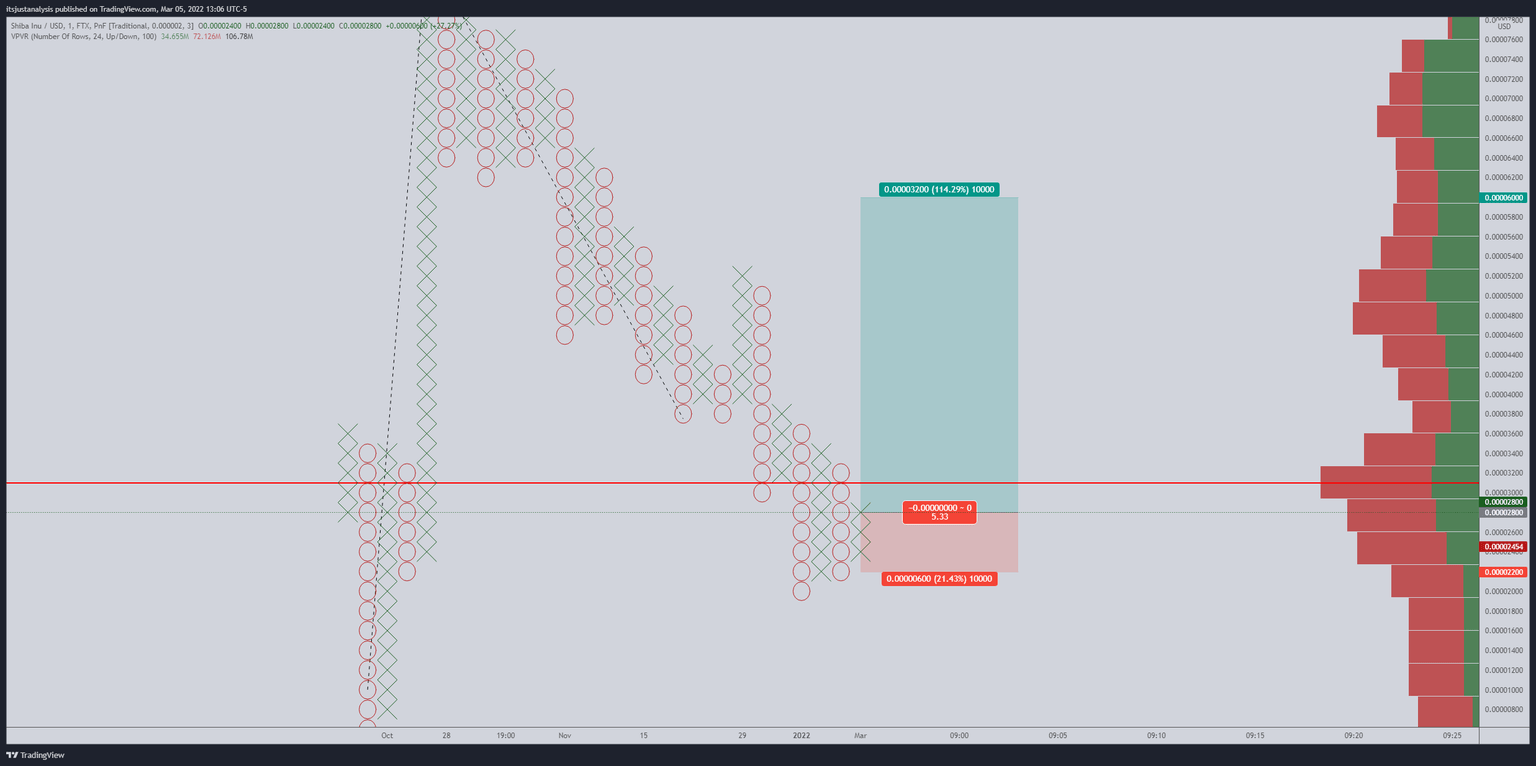

However, despite the bearish development on the Ichimoku chart, SHIBA's Point and Figure chart continues to show no change since triggering a prior long entry idea. That entry is still valid if traders missed it; it remains an appropriate entry opportunity before any positive risk-on sentiment returns to this market.

The hypothetical long entry for Shiba Inu price was a buy stop order on the three-box reversal of Xs that formed off the previous O-column. That entry was triggered at $0.00002800. The entry is still valid. The stop loss is at $0.00001200, and the profit target is at $0.0004540. The trade represents a 4.33:1 reward for the risk setup. A trailing stop of two to three boxes would help protect any profit made post entry.

SHIBA/USDT $0.000002/3-box Reversal Point and Figure Chart

The long trade idea is invalidated if Shiba Inu price falls to $0.00001400 or lower before the entry is triggered. However, if SHIBA continues to move lower, the entry and stop-loss move in tandem – but the profit target remains the same.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.