SHIB Price Forecast: Chinese PPI spurs hope for lower US CPI as Shiba Inu price to break above $0.00001000

- Shiba Inu price dropped in some nervous trading on Wednesday.

- SHIB jumped higher on Thursday morning in the ASIA PAC session after Chinese PPI numbers.

- Traders and markets are holding their breath ahead of of US CPI numbers later this Thursday.

Shiba Inu (SHIB) price action tanked 1.5% in late trading on Wednesday after markets got shaken by several comments from both ECB and Fed members. It has become clear that division is creeping into the US Federal Reserve's decision-making, which could spell trouble and bite its credibility. Markets recovered quite quickly, and SHIB jumped 5% after Chinese Producer Price numbers showed a firm cooldown in the economy with a negative print, propping up expectations of a lower US inflation number on Thursday.

Shiba Inu price set to hit $0.00001000?

Shiba Inu price action is showing mixed signals as markets are starting to get nervous about positioning themselves due to several types of information coming out. Just an oversight of what traders already had to digest: Fed hawks are demanding more hikes and a terminal level above 5% throughout 2023; Fed minutes showed a vote split with three in favor of no hike at the next meeting; equities are continuing their recovery; and the US Dollar continues to weaken. These are just a few elements traders are trying to price in. Together they explain why markets are shaky when new comments could break the current recovery rally at any moment.

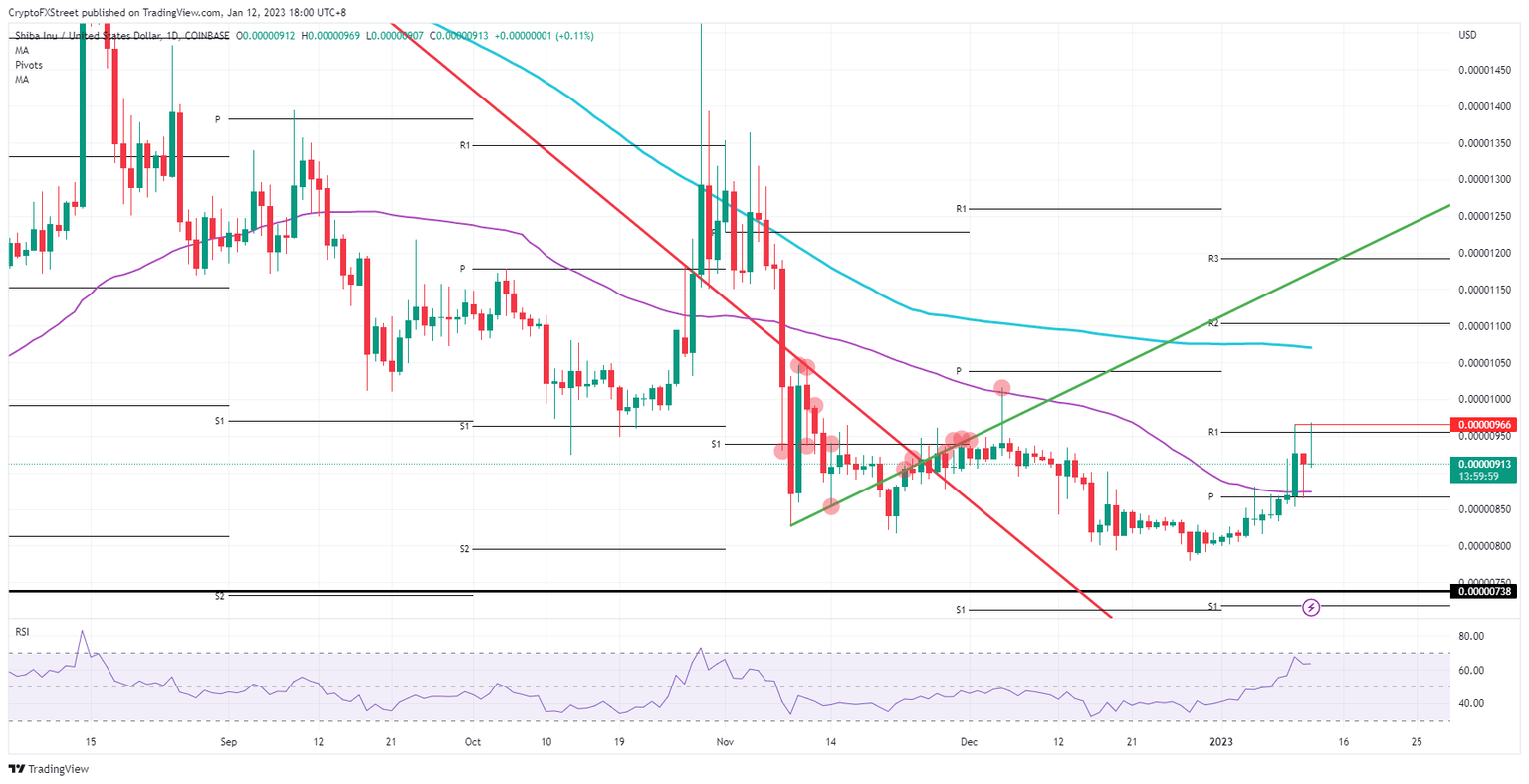

SHIB is thus a simple print of those elements mentioned above and a great example of proof that technical levels work. On Wednesday, the monthly pivot acted as support for a bounce back up intraday, and this morning the top of Tuesday got tested near $0.00000966. Expect the US inflation print on Thursday afternoon to be the best possible catalyst to break the current double top and ideally close above $0.00001000.

SHIB/USD daily chart

The rally has been a bit quick, and the last couple of days have triggered quite a lot of volatility. That has triggered a substantial spike in the Relative Strength Index (RSI), which has been hitting the overbought barrier. This could scare off traders from entering right now. Should US inflation this afternoon fall in line or even jump higher, expect to see a sharp decline back to $0.00000800.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.