Sandbox price set for breakout as bulls target some low-hanging fruit

- Since December, sandbox has been trying to break the downtrend.

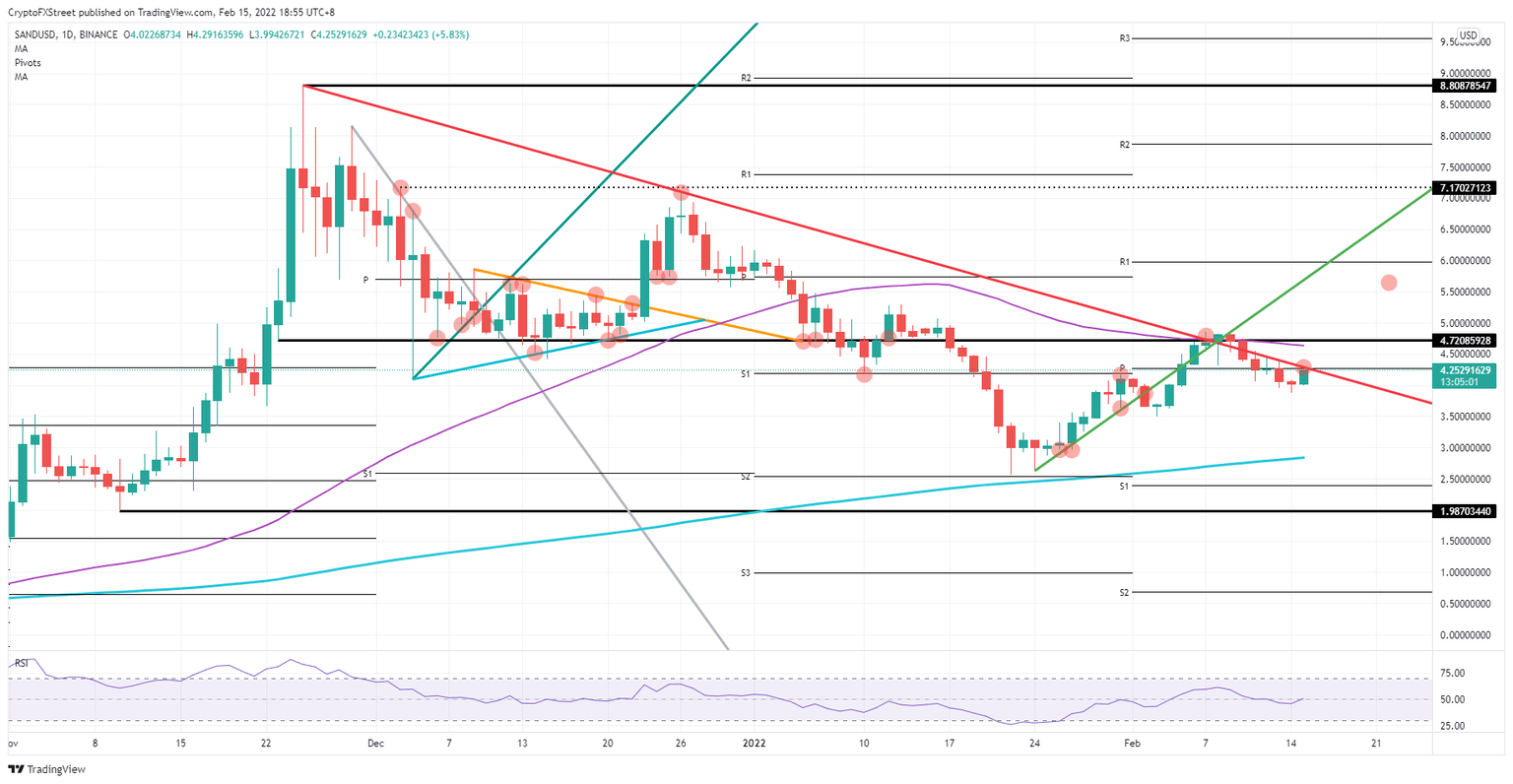

- As bulls attempt to break through, expect some profits to be booked as some targets lie nearby.

- Once above $4.72, expect $5.00 and $6.00 to be the following targets in the relief rally.

Sandbox (SAND) price action is surfing on a wave of relief this morning as tensions between Russia, and the West start to ease on positive news. With that, investors have been falling over each other to get back into cryptocurrencies, and Sandbox price is set to break the longer-term red descending trendline, and downtrend since December last year. Some low-hanging fruit will be targeted in the breakthrough and could provide enough incentive for bulls to book partial profits and go for the ultimate goal of $6.00, holding 47% of gains.

Sandbox bulls are in for 47% gains in the relief rally

Sandbox price action is again hammering on the red descending trend line that originates from December last year and has been dictating the downtrend ever since. The renewed push comes from tailwinds that emerged overnight on some positive news around de-escalation in the situation between Russia and Ukraine. As the scene is set for a solid relief rally, expect to see some excellent returns, beginning with some nice profits nearby as a good start.

SAND bulls will have their eyes on $4.72 with the 55-day Simple Moving Average and an overall pivotal level falling in line around the same area. Although this level is not far from the red descending trendline, it will still return around 16% of gains intraday. Bulls will have a good incentive to book profits midway but stay in the trade with more considerable profits gained when the price rises towards $5.00 and $6.00 – the next targets in this week’s relief rally. The trade has an excellent risk-return ratio and is the most viable as we advance.

SAND/USD daily chart

Should German chancellor Scholz come out with some negative comments and ramp up the rhetoric of full-scale escalation of the tensions, expect a knee jerk reaction with a firm rejection or false break of the red descending trend line, trapping bulls and pushing them out of their positions as SAND price action collapses back towards $3.50. From there, another leg lower could follow towards $3.00, with the 200-day SMA coming in at around $2.85 and playing its part as a supportive element in the belief that a recovery is still possible. If the 200-day SMA is no match for the downward pressure, expect a break and further push towards $2.50 or $2.00.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.