SafeMoon Price Prediction: SAFEMOON bulls target $0.00000395

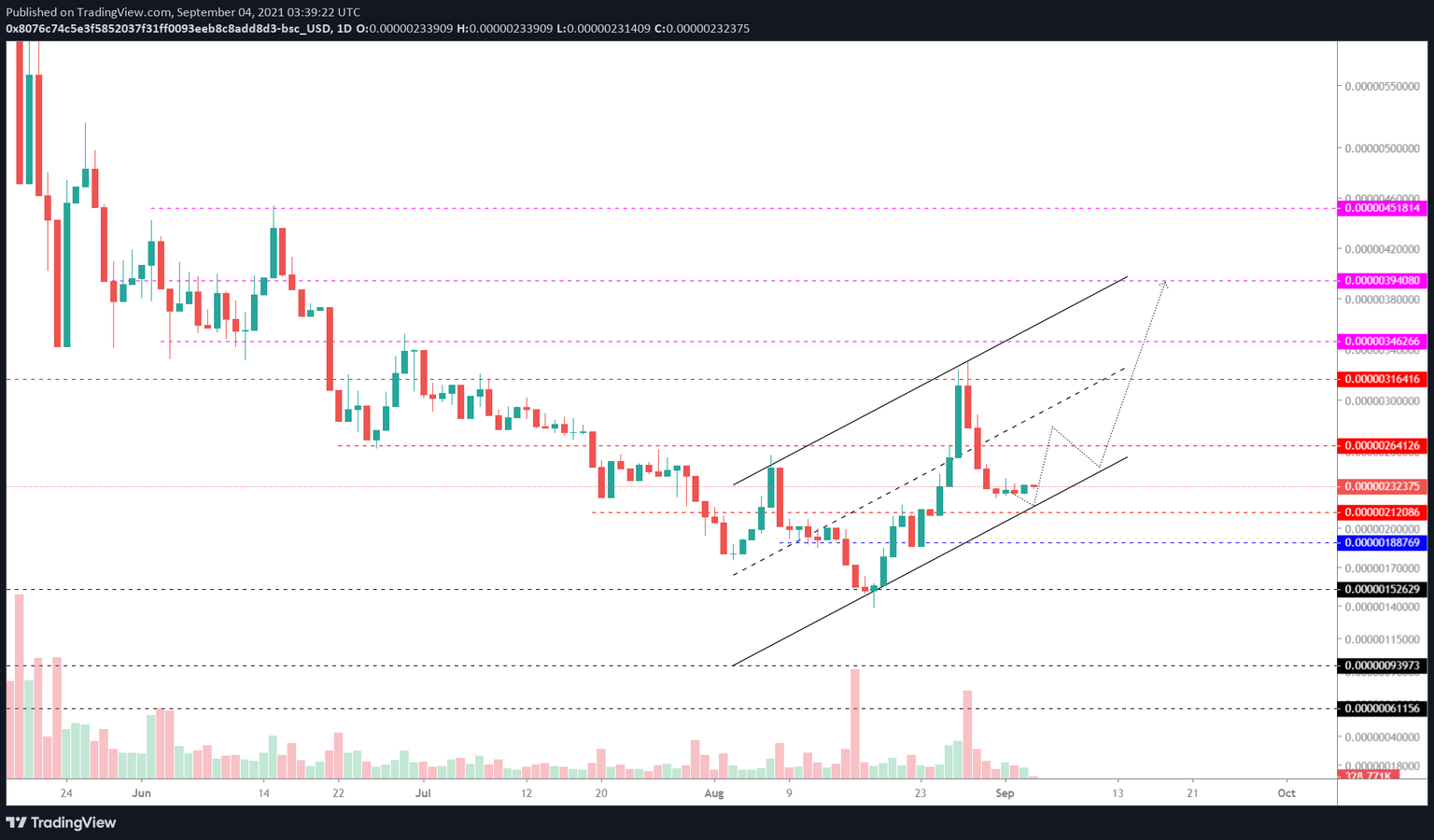

- SafeMoon price is traversing a potential ascending parallel channel.

- A bounce off the lower boundary of this setup could lead to a 68% ascent.

- If SAFEMOON creates a lower low below $0.00000156, it will invalidate the bullish thesis.

SafeMoon price appears to be building steam as it prepares for a quick upswing. A resurgence of buying pressure could trigger this run-up and propel it to set up a higher.

SafeMoon price reversal is on its way

SafeMoon price dropped roughly 31% after setting up the second swing high at $0.00000330 on August 28. However, the inability of buyers to sustain this climb led to a drop that breached immediate support levels, creating a second swing low.

Drawing trend lines joining the swing points shows the formation of a potential ascending channel.

Now, SAFEMOON price is bouncing off the lower trend line of the technical setup at $0.00000212. A resurgence of buying pressure will kick-start a new uptrend. However, SafeMoon price needs to breach the $0.00000264 and $0.00000316 to set up a higher high.

If the bulls make this swing high happen, another 25% ascent is likely around the corner that retests $0.00000394.

Such a move will tag the upper trend line and create a third higher high.

SAFEMOON/USDT 1-day chart

While an upswing around the $0.00000212 support floors seems likely, investors need to be aware of an increased selling pressure that breaches it. If this move occurs, it will indicate that the bullish momentum is far lower and is likely to trigger a retracement.

The support floor at $0.00000189 will be the immediate shelter where bulls can give a shot at an uptrend.

However, a decisive close below $0.00000153 will invalidate the bullish thesis and, in some cases, catalyze further crashes.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.