Runes likely to have massive support after BRC-20 and Ordinals frenzy

- PUPS, WZRD, and PEPE are gaining liquidity through Bitcoin Ordinals.

- Creator of Bitcoin’s Ordinals protocol is debuting a new fungible token standard to rival BRC-20, Runes.

- BRC20 was basically pumped-and-dumped in a week. This type of energy going into Runes shows we’ll have massive support.

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds (ETFs), the recent all-time high of $73,777, and now the halving. Amid the euphoria, there has been a rising demand for Ordinals, and soon, a recent innovation called Runes is now in the works.

Also Read: Bitcoin price reacts as IMF endorses BTC in published report two days to halving

BRC-20 tokens and Ordinals create a frenzy

BRC-20 tokens, comprising ORDI (ORDI), PePe (PEPE), PUPS (Ordinals) (PUPS), and Bitcoin Wizards (WZRD), among other tokens created on the Bitcoin blockchain via the Ordinals protocol, are gaining popularity, seen with the surge in liquidity into the ecosystems.

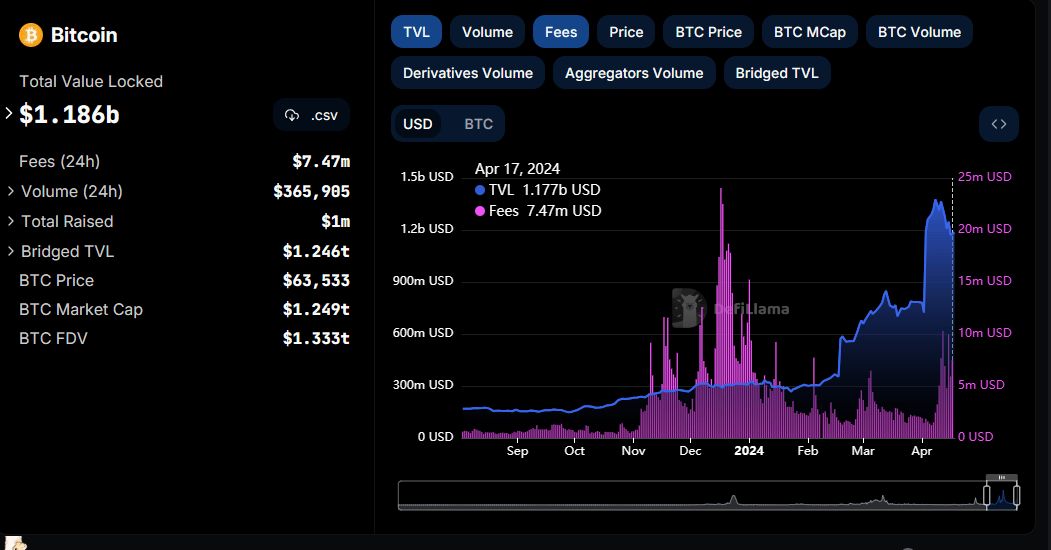

The frenzy around BRC-20 tokens and Ordinals has caused a surge in transaction fees amid soaring network congestion.

BTC transaction fees

Why BRC-20 tokens impact Bitcoin fees and transactions

BRC-20 tokens and ordinals have stirred some controversy, first because of the clogging up of the network and second because of the raising of fees. Relative to simple P2P transactions, the creation and transfer of BRC-20 tokens is complex, oftentimes requiring more space on the blockchain.

#Bitcoin developers opting to censor #Ordinals as they consider just Spam. Maybe the live of #BRC20 #ORC20 and #OrdinalsNFTs become so short? DYOR and don’t take unacceptable risks when you can’t afford to loose your money. pic.twitter.com/Xn5JvZCcL6

— Emanuele Vedova (@vedova) May 10, 2023

Nevertheless, the fees could only go higher with the creator of Bitcoin’s Ordinals protocol debuting a new fungible token standard, Runes, which is expected to rival BRC-20. Runes are due for launching along with the Bitcoin halving, and given the hype that BRC-20 got during its debut, Runes is likely to enjoy similar if not more support, with Ordinals and Runes speculated to display the biggest transfer of wealth.

ᛤ Runes ᛤ

— Sennett Lau (@sennettlau_13) April 18, 2024

There is around a day left until the next Bitcoin halving.

A new protocol, Runes, brings another type of fungible tokens to the Bitcoin ecosystem.

Here is something you should know:

(1/15) pic.twitter.com/SIduBjMic3

BRC-20 and Runes

Runes is a new protocol and the brainchild of the creator of Ordinals, Casey Rodarmor, a Bitcoin developer. With Ordinals, Rodarmor enabled the creation of NFT-like “inscriptions” on the Bitcoin network. Speaking to a news site, the developer described his Ordinals “theory” as a lens through which you can view the Bitcoin blockchain and see the “trackable satoshis pop into view like Pokémon in the tall grass.” The innovation, Runes, represents a new lens for viewing Bitcoin, only that it does so with shitcoins. While BRC-20 is a fungible token standard that uses Ordinals protocol, Runes tries to make the process of creating fungible tokens on Bitcoin more efficient.

A recent protocol explainer shared by Rodarmor indicated that while Ordinals are inscribed, Runes are etched, with the etcher being able to optionally "premine" a certain allocation of the token for themselves ahead of the public mint. The common denominator between BRC-20 and Runes is that they both use Bitcoin and pay fees in Bitcoin to create new tokens.

Here is a thread that runs down Ordinals and Runes.

Runes launch coincides with the Bitcoin halving

Rodarmor slated the launch of Runes to happen on the same day as the Bitcoin halving. Specifically, both the Runes protocol and the various “runes” tokens being developed on the protocol will go live when Bitcoin reaches a block height of 840,000. This is currently expected to happen on April 20. Several projects are already lining up along Runes in anticipation. They include:

- RSIC, which plans to launch a token called RUNE

- Runestone

- Node Apes

- PUPS is also speculated to migrate to Runes

- Xverse Bitcoin wallet has added testnet support for Runes, also in anticipation of launch.

- Magic Eden NFT marketplace also indicated plans to support Runes.

Citing Rodarmor in an appearance on Hell Money Podcast, “If Runes are successful, they’ll drain liquidity, technology, and attention away from other cryptocurrencies, and bring it back to Bitcoin.” He added, “I'm not creating a shitcoin [but] a venue for people to create shitcoins, which is possibly worse and more dangerous. We’ll see.”

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.