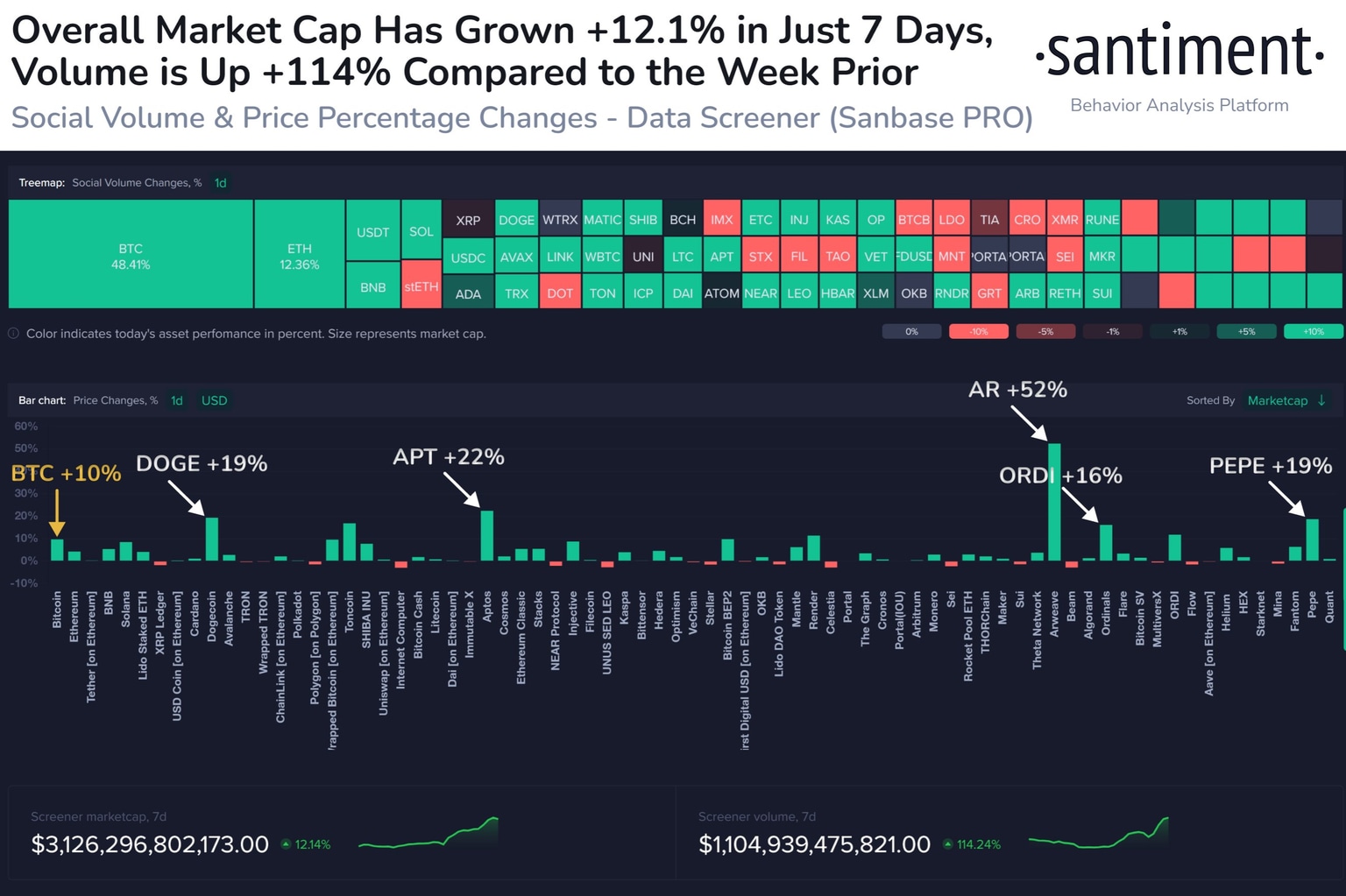

Crypto trading volume more than doubled this week: PEPE, DOGE, APT, ORDI are top gainers

- Bitcoin price climbed to a peak of $64,000 on Wednesday, catalyzing gains in altcoins and pushing the overall market cap higher.

- PEPE, Dogecoin, Aptos and Ordinals observed double-digit gains in their prices over the past 24 hours.

- The overall crypto market added 114% in trade volume and 12% in market capitalization in the past week.

Bitcoin price rallied to its new yearly high, at $64,000 on Binance, pushed the overall crypto market capitalization higher. On-chain data from crypto intelligence tracker Santiment shows that the crypto market has added 12% in its capitalization in the past week.

Several altcoins observed double-digit gains as BTC price rally resulted in likely capital rotation into alternative assets. The biggest winners according to Santiment data were PEPE, Dogecoin (DOGE), Aptos (APT), Ordinals (ORDI) and Arweave (AR).

Also read: Arbitrum price resumes rally with Web3 gameathon plan for March

Top gainers from crypto price rally this week

Santiment data identifies DOGE, AR, APT, PEPE and ORDI as top winners, holders of these assets likely made double-digit gains in the past week. While Bitcoin price climbed over 10%, these assets rallied 19%, 52%, 22%, 19%, and 16% respectively.

The rallies in these altcoins are likely supported by the spillover effect of Bitcoin’s gains rotating into smaller market capitalization assets and the overall sentiment among market participants, that has likely improved with Bitcoin’s rally to $64,000 peak.

The overall transaction volume in cryptocurrencies climbed 114% this week, as noted by Santiment. This supports the recent gains in altcoins and Bitcoin.

Crypto market capitalization and top gainers in altcoins. Source: Santiment

On-chain intelligence trackers reveal that other altcoins in the ecosystem, meme coins like Shiba Inu, could benefit front traders’ recent activities. PEPE price rally led to a whale realizing gains and changing positions to SHIB. Lookonchain data reveals that the whale withdrew 75.9 billion SHIB worth $893,000 from Binance.

A smart whale deposited all 1.97T $PEPE($6.07M) to #Binance and made a profit of $3.49M.

— Lookonchain (@lookonchain) February 29, 2024

Then he changed his position from $PEPE to $SHIB, withdrawing 75.9B $SHIB($893K) from #Binance 3 hours ago.https://t.co/X67O2VjR1y pic.twitter.com/nL7rRDZCXT

With their recent gains, traders need to keep an eye out for price rallies or capital rotation from Solana (SOL), Fetch (FET), Bonk Inu (BONK), among other tokens. Whale wallet activities could indicate where capital is headed next and which altcoin could pop in the ongoing bull run.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.