Ripple price nears pivotal area that could trigger 20% uptrend

- Ripple price is in the last stage before ending this fade.

- XRP is looking for a level to bounce off higher.

- Expect to see a gradual move higher with variable gains between 10% to 20%.

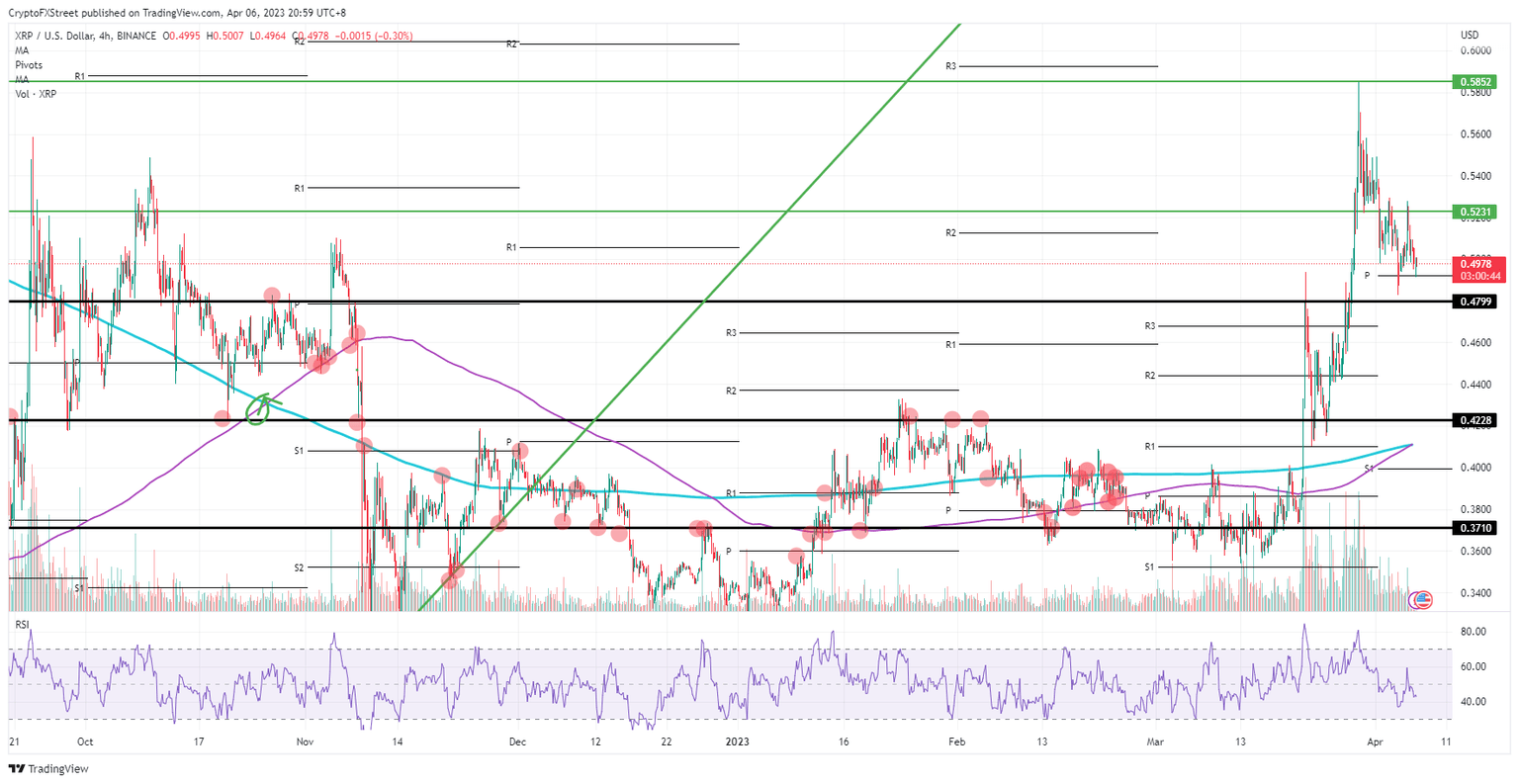

Ripple (XRP) price is nearing its endgame in this fade. As Ripple price peaked at the end of March at $0.5852, price action has been trending down with lower highs and lower lows. The Relative Strength Index (RSI) as well bears some more downside space, although there is room for a turnaround soon once this fade has reached the end of the line.

Ripple price sees turnaround ahead

Ripple price has roughly another 5% to go in its fade before bears run into a brick wall defending against any further downside move. Bulls will be more than happy to defend that $0.48 level as it bears a substantial importance as a historic pivot level with multiple tests. It already triggered a bounce in April, which pushed XRP price back above $0.52 briefly but was short-lived, unfortunately.

XRP will see bulls coming in quite soon to scoop up the pieces at a firm reduction as the RSI is set to take another leg lower once XRP finds support near $0.48. A bounce back up to $0.52 means a mere 10% gain. If bulls can see this rally through, even a 20% gain could happen when hitting $0.5852 on the topside.

XRP/USD 4H-chart

In case $0.48 breaks down, another area opens up that contains nearly a 10% loss. Ripple price would slide quite quickly toward $0.42 as there are no pivot or support levels nearby. A falling knife scenario could be at hand here with XRP crash landing into $0.40 for a 20% decline.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.